1 July 2023

The Australian property market has been very buoyant in recent years, which has made it attractive for investment purposes, but it’s also made it hard for first time home buyers to get into the market. That’s where the First Home Super Saver (FHSS) scheme can step in – to help first home buyers save for a deposit using their super account. Find out how you could, subject to eligibility criteria, use your super to save for your first home.

If you’re a first home buyer, you could save through your super to buy your first home using the FHSS. If you choose to use the FHSS scheme, there are some benefits and limitations that you need to know about.

FHSS article: 5 key takeaways

- The FHSS scheme limit is $50,000 across all years.

- You could salary sacrifice1 your first home savings into super to lower your taxable income.

- You could pay less tax on your FHSS earnings – compared to keeping it in the bank.

- You could earn stronger returns2 on your FHSS contributions, compared to your bank’s interest rates.

- Suitable for residential property that you intend to occupy only.

1. First Home Super Saver scheme – here are the basics

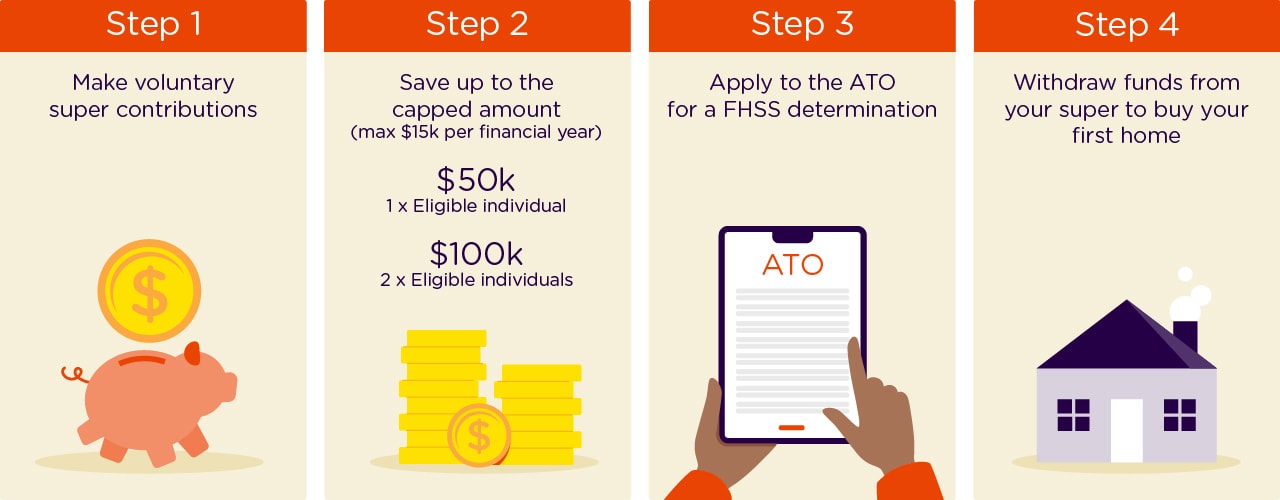

The FHSS scheme could be a good way to help save a deposit to buy your first home. Using your super fund, you can personally contribute up to $15,000 each financial year3, with the total you can withdraw across all years from 1 July 2017 limited at $50,000. Eligibility is assessed on an individual basis, meaning two people could each contribute to their super, and access their own FHSS contributions to purchase the same property. For example, 2 people purchasing the same property together could access up to $50,000 each, bringing the amount that could be withdrawn up to $100,000 plus associated deemed earnings and less applicable taxes.

Note, the previous withdrawal cap on eligible contributions was $30,000 for individuals and applies to requests made for a FHSS determination prior to 1 July 2022.

When you’re ready to purchase your first home and have made eligible contributions under the FHSS, you can apply to the Australian Tax Office (ATO) to request the release of your FHSS savings, (your contributions plus associated earnings and less applicable taxes) from your super account so it’s ready to go. It may be useful to do this when you apply for your mortgage loan, as you have 12 months from the date you requested your FHSS savings to sign a contract to buy or construct a home, or the funds need to be recontributed to the super fund. Don’t worry – there are fallback options if buying your first house doesn’t go to plan.

How the FHSS scheme works

2 How to set-up and contribute to FHSS

Just to be clear, the FHSS isn’t a new or separate account to deposit funds. It’s a scheme that allows you to use your existing super account to save money to buy your first house. Your FHSS is ‘set-up’ when you meet the necessary requirements, which we’ll provide more information on in this article.

Here’s how you could make eligible contributions up to your existing contribution caps to your FHSS:

Before-tax contribution3 – includes salary sacrifice salary sacrifice contributions and any personal after-tax contributions you claim a tax deduction for4.

After-tax contribution3 – includes any extra additional contributions you make from your take-home pay, where a tax deduction hasn’t been claimed.

READ MORE: HOW TO MAKE AN AFTER-TAX CONTRIBUTION

Contributions you can withdraw

Taking into account the yearly and total limits, you can withdraw:

- 100% of your non-concessional (after-tax) amounts, and/or

- 85% of concessional (before-tax) amounts.

There are rules about which contributions are included in your release amount, based on when they’re made and whether they’re concessional (before-tax) or non-concessional (after-tax).

Ineligible contributions

You can't include superannuation guarantee contributions made by your employer, or spouse contributions in your FHSS determination.

If you include these in your FHSS determination, your request may be cancelled or delayed.

For more information on what contributions can be classified as Eligible and Ineligible for the FHSS, please visit ato.gov.au/FHSS.

3 The benefits of FHSS

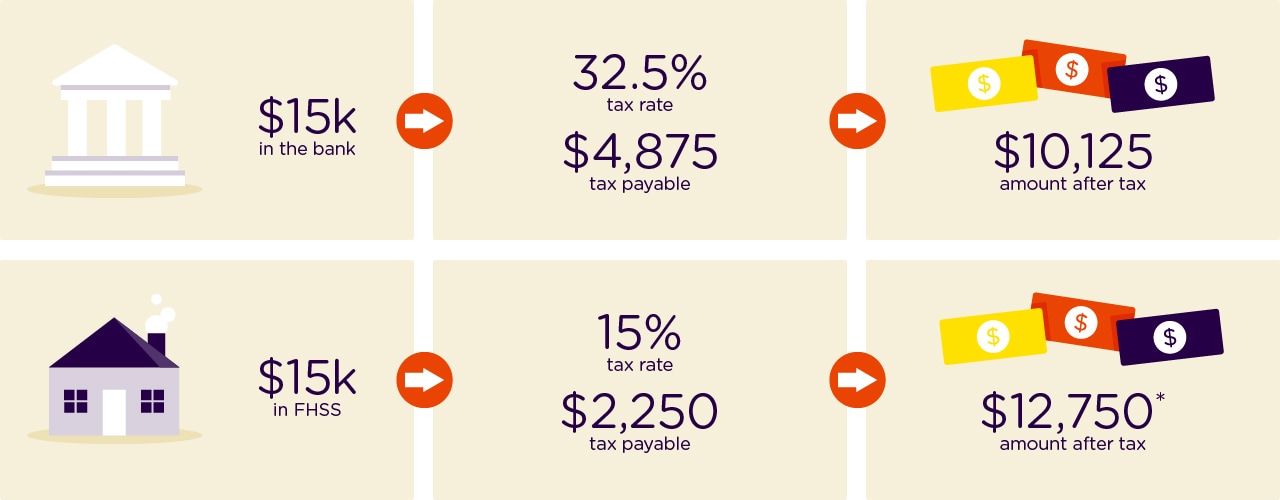

One benefit of using FHSS is the favourable tax treatment of super. For those with an income of less than $250,000 each year, you generally only pay 15% tax on your contributions, instead of:

| Your income | Your tax rate |

|---|---|

| $18,201 – $45,000 | 19% |

| $45,001 – $120,000 | 32.5% |

| $120,001 - $180,000 | 37% |

| $180,001+ | 45% |

The above tax rates are current for the 30 June 2024 income year and exclude the Medicare Levy.

If you’re in the $45k - $120k income bracket. Here is an example of the tax savings you could make when making a $15k before-tax contribution under the FHSS scheme:

As well as saving on tax, there can be other benefits to using the FHSS:

- You could also receive investment returns2 on your contributions (less applicable taxes). Depending on where you invest, these returns could be better than the interest rate you get with the banks.

- If you change your mind, your savings remain in your super account and go towards your retirement savings (before and after-tax contributions limits apply).

4 The limitations of FHSS

While FHSS allows you to use your super account to save for your first home, it also has some limitations. First and foremost, you can’t dip into it and take money out like you can with a normal savings account.

Quite the opposite, with FHSS: You only get one shot to take out one sum.

The ATO then calculates earnings on your contributions, applies any tax and relevant tax offsets.

The ATO will also apply ‘ordering rules’ to calculate the maximum FHSS release amount. For more information on eligibility and how to release funds, visit: ato.gov.au/FHSS

Also – if your income (including your before-tax contributions) is more than $250,000 per year, you may have to pay an additional 15% on some or all of your before-tax contributions (bringing the total contributions tax to 30%).

5 The rules…

Here are a few rules that you need to follow for the FHSS scheme:

- You need to be 18+ years to request a FHSS determination or a release.

- You can’t have previously owned a property in Australia5.

- You can only use FHSS once.

- You must intend to live in the premises you are buying as soon as possible for at least 6 of the first 12 months you own it or at least 6 of the first 12 months from when it is practicable to live in it.

- Once you withdraw your FHSS sum, you must sign your first home contract or home construction contract within 12 months. Otherwise, you may have to pay 20% tax on it.

- With your FHSS sum, you have to purchase or construct a residential property located in Australia. You can’t use it for a houseboat, motor home, vacant land or any other form of property where you can’t have a house.

- If you buy vacant land that you plan to build on, it is the contract to construct your house that must be entered into to access your FHSS sum.

- You are allowed to buy any size house – as long as you follow the FHSS scheme rules above.

For more information on all requirements that may apply, please visit ato.gov.au/FHSS

6 Need more time?

You have 12 months from the date you make a valid release request to the ATO to sign a contract to purchase or construct your home.

Remember that you must notify the ATO within 28 days of signing a contract to purchase or construct your home.

Otherwise, you can:

- Utilise the automatic 12-month extension from the ATO

- Return the amount to your super account as an after-tax (non-concessional) contribution (this must be at least equal to your assessable FHSS released amount, less any tax withheld).

- Keep the released funds, subject to FHSS tax of 20% of assessable released amounts.

Remember that you must notify the ATO that you have chosen to do one of the above.

7 Seek financial advice

Make sure the FHSS is right for you. With all the different things you can and can’t do with the FHSS, it’s worth speaking with a financial adviser to find out if the FHSS could be right for your personal circumstances6.

- Salary sacrifice may affect some Government benefits and employee benefits. Consider getting financial advice before deciding if a salary sacrifice arrangement is right for you.

- All investments, including super, have some risk. The returns on the amount you invest in your super towards your FHSS can go up and down over time, known as volatility. Investment returns aren’t guaranteed. Past performance is not a reliable indicator of future returns. To find out more about how super works, please read the Product Disclosure statement available at australiansuper.com/pds

- Before adding to your super, consider your financial circumstances, contribution caps that may apply, and tax issues. We recommend you consider seeking financial advice.

- Superannuation Guarantee contributions made by your employer cannot be released under the FHSS scheme. Employer contributions are included in the before-tax (concessional) contributions cap, so it’s important to consider these amounts when making before-tax personal contributions.

- If you have previously owned property in Australia, you may be eligible if the ATO determines that you have suffered a financial hardship that resulted in a loss of ownership of all property interests.

- Personal financial product advice is provided under the Australian Financial Services Licence held by a third party and not by AustralianSuper Pty Ltd. Fees may apply.

This may include general financial advice which doesn’t take into account your personal objectives, financial situation or needs. Before making a decision consider if the information is right for you and read the relevant Product Disclosure Statement, available at australiansuper.com/PDS or by calling 1300 300 273. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the TMDs at australiansuper.com/TMD. AustralianSuper Pty Ltd ABN 94 006 457 987, AFSL 233788, Trustee of AustralianSuper ABN 65 714 394 898.