In a year shaped by global uncertainty, AustralianSuper remained focused on delivering value for members. We continued to enhance our services, strengthen digital tools and security, and support members through every stage of their retirement journey. As we mark 40 years since the Fund’s beginnings, our commitment to putting members first remains as strong as ever.

Celebrating 40 years of putting members first

This year marks a milestone for your Fund – 40 years since your fund began in 1985. From our origins as one of the first industry super funds to becoming Australia’s largest fund1, our purpose has remained consistent: to help members achieve their best financial position in retirement.

Strong returns in a challenging year

Despite a year of global uncertainty, AustralianSuper delivered positive investment returns for members. The Balanced option – where most members invest – returned 9.52% for the year to 30 June 2025. For Choice Income pension members, the Balanced option returned 10.41%.

Over the past decade to 30 June 2025, the Balanced option for super members has delivered an average annual return of 7.94% and for pension members an average annual return of 8.62%, demonstrating the strength of our long-term investment approach. For a member who has been with the Fund since the beginning in August 1985, a balance of $10k back then will have grown over 40 years to over $340k at 30 June 2025, with no additional contributions2.

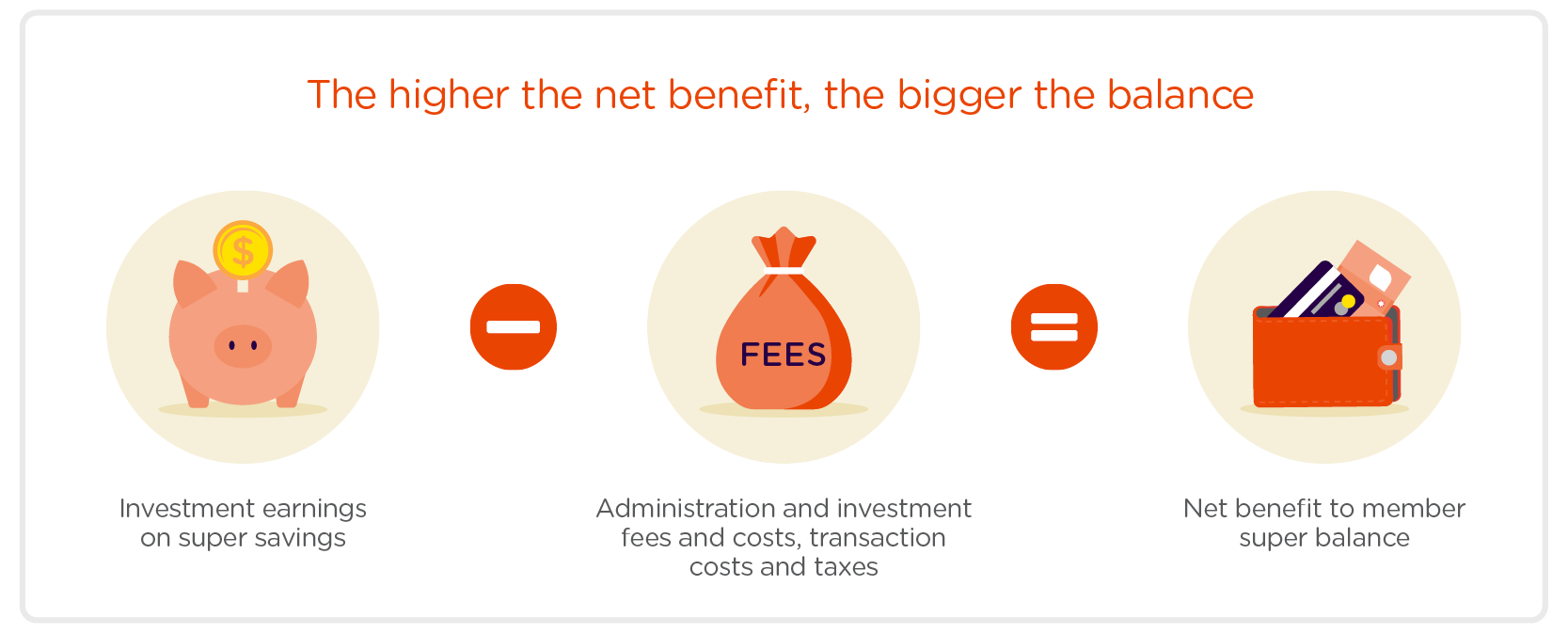

Net benefit is the number that really matters when it comes to assessing how your fund is performing. In relation to your super, net benefit is the investment return delivered to you by your super fund minus the administration and investment fees and costs, transaction costs and taxes.

Super is a long-term investment

For most, super is a long-term investment – often spanning 50 years or more. Our experienced investment team continues to manage your money with discipline and care through all market cycles.

Learn more about our investment performanceInvesting in better service

With 3.5 million members today – and five million expected within the decade – we’ve invested more than $200 million during the year to transform how we support you, including:

- Launching a new Bereavement Centre to better support members’ families navigate the death claims process with care and faster outcomes.

- Establishing an in-house Member Resolution Centre, dedicated to ensuring that members receive the right outcome based on their individual needs and circumstance.

- Expanding our mobile app and online tools, helping more members manage their super on the go.

- Strengthening cybersecurity and rolling out additional multi-factor authentication.

- Improving the insurance claims process by enabling members to lodge and track their claims online.

- Investing in our technology, data, and teams to enhance the experience for members, enable us to support growth beyond 2035, and stay agile as members’ needs evolve.

Every dollar we invest in service is designed to deliver better outcomes while keeping your administration fees low3.

Looking ahead: our 2035 Strategy

As the super system matures, we’re focused on the future. Our 2035 Strategy sets a clear direction for the decade ahead, built on five pillars:

- Market-leading net performance

- Personalised guidance at scale

- Trustworthy financial institution

- Value at a competitive cost

- Talent and culture.

We’re leveraging our size and global scale to help deliver strong returns, great service, and positive impact for members and the broader economy.

A system that works for all Australians

Australia’s super system is a global benchmark – and AustralianSuper remains committed to helping strengthen it for the benefit of all Australians. We continue to advocate for a more inclusive and equitable system, with a focus on improving outcomes for low-income earners, women, younger workers, First Nations Australians, and those in non-traditional work. We’re also championing reforms to simplify the retirement income system and better integrate super with the Age Pension.

Learn more about our policy and advocacyThank you

From humble beginnings to a fund managing the retirement savings of one in seven working Australians4, our story is your story. Whether you’re just starting out or planning your retirement, we’re here to support you – today, tomorrow, and for the long term.

Investment returns aren’t guaranteed. Past performance isn’t a reliable indicator of future returns.

- APRA Quarterly Superannuation Fund Level Statistics March 2025, Released 26 June 2025

- AustralianSuper investment returns are based on crediting rates, which are returns less investment fees and costs, transaction costs, the percentage-based administration fee deducted from returns from 1 April 2020 to 2 September 2022 and taxes. Returns don’t include all administration, insurance and other fees and costs that are deducted from account balances. Investment returns aren’t guaranteed. Past performance isn’t a reliable indicator of future returns. Returns from equivalent options of the ARF and STA super funds are used in calculating returns for periods that begin before 1 July 2006. Inception date is 1 August 1985.

- Source: Zenith CW Pty Ltd (Chant West) (ABN 20 639 121 403). Chant West Super Fund Fee Survey December 2024. Survey compares administration fees and costs for MySuper products for a $50,000 balance. AustralianSuper’s MySuper product is the Balanced option. Other fees and costs apply. Fees may change in the future which may affect the outcome of this comparison.

- Source: Australian Bureau of Statistics (Labour force) and AustralianSuper Member Data, December 2024.