At AustralianSuper, we’re committed to delivering world-class domestic service and support for our employer partners. To help us achieve this goal, we’re excited to be offering you single log in access to the new Employer Portal1 – an integrated clearing house platform and self-service administration solution provided by Wrkr.

The new Employer Portal is more than just a software update. It provides simplified super admin tools for compliance management – designed to help you meet your super obligations so you can focus on running your business.

Key features

The new Employer Portal will offer the following features:

- available at no cost to registered AustralianSuper employers

- validates your data digitally and in real time

- provides a user-friendly interface

- is multi-factor authentication enabled

- displays and records your employee’s stapled and choice of super fund during digital onboarding – supporting compliance with super stapling requirements, and

- planned integration with Payroll and HR systems (integration may vary by provider).

In addition to the features above, you’ll also have the option of adding your logo and two brand colours to the employee digital onboarding process, providing continuity for new employees as they easily and securely supply their details.

For more details and an overview of the key features, download the Key features of the new Employer Portal fact sheet.

Overview of features at a glance

The table below shows an overview of features currently available within the existing AustralianSuper solutions as well as the features that will be available in the new Employer Portal.

It's intended to provide you with information about the new Employer Portal and shouldn't be taken as a recommendation.

| Feature | Business Portal | Current clearing house | Employer Portal |

|---|---|---|---|

| Digital onboarding for new employees with tracking and reminders | |||

| Create new member accounts for employees in real time | |||

| Tax File Number verification | |||

| Find existing member number | |||

| Super stapling search | |||

| Option to include your business branding | |||

| Super contribution data file submission | |||

| Pay super contributions for employees | |||

| BPay payment option | |||

| Reporting and contribution history search | |||

| Set up multiple ABNs |

Helpful resources

Key features of the new Employer Portal - pdf, 211KB

See an overview of the key features with the Employer Portal fact sheet.

Get ready to make your first contribution - pdf, 197KB

Use the Employer Portal checklist to assist you as you move through the steps of the registration process.

Let's get you ready

Here's some things you can do now to help you prepare.

Now:

Ensure QuickSuper2 is up to date

- Log in to QuickSuper2 and check your contact, administrator and employee details are correct. It's important to note that Employer Portal users have unique, not shared, email addresses.

Next:

Register with your Employer Portal link

- You’ll be sent an email which will give you access to the Employer Portal registration process. You’ll need to register so you can complete the Quickstart checklist in the portal. We're staggering this process to give you time to get ready.

- Once you’re all set up in the Employer Portal, you can use it for all future super contribution admin requirements if you choose to.

- After you’ve activated your new Employer Portal account, QuickSuper access will become read only. We recommend you download any reports required from QuickSuper for recordkeeping purposes.

Register for a live information session

What to expect from the new Employer Portal

Regular communication

A information session

Quickstart checklist tasks

Support

Getting started

Step 1

Watch out for an email with your Employer Portal link and register for access.

Step 2

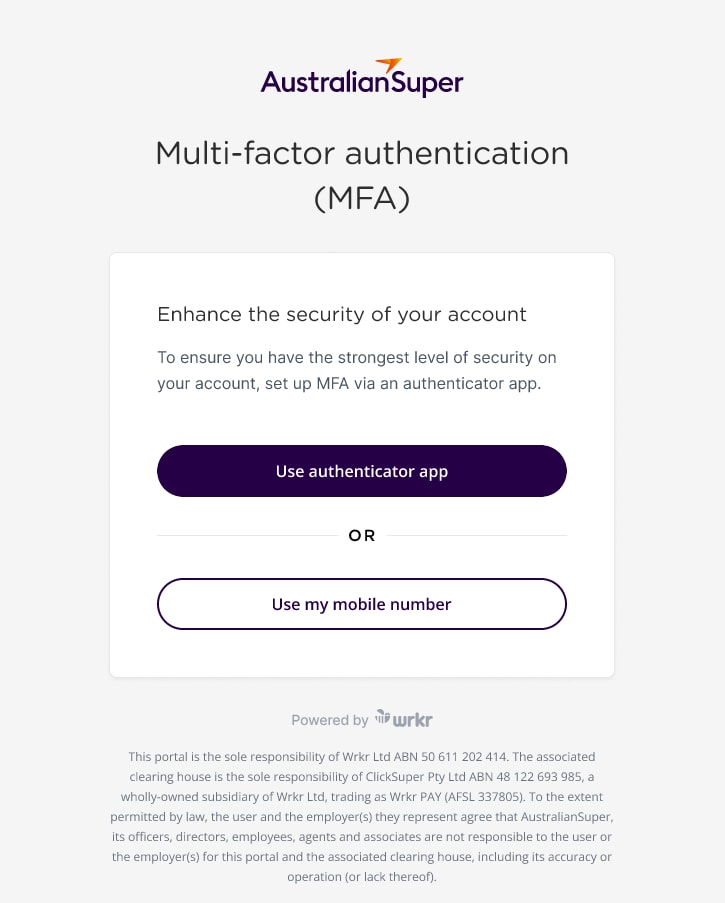

Log in to your account and set up MFA. You’ll need to download the Google authenticator app, or choose to use a one-time pin.

Step 3

Complete the action items in the Quickstart Checklist.

Frequently asked questions

Transitioning from QuickSuper to the new Employer Portal

-

When will AustralianSuper’s arrangement with QuickSuper end?

AustralianSuper will start the process in 2026 (the exact date is yet to be confirmed, and we will update the answer to this question when it is).

The first step will mean QuickSuper is placed into 'read-only' mode where your information is still available, but you will not be able to make changes or contributions.You will have 12 months from the date 'read-only' mode is activated to access, download and store historical contribution records. After the 12-month period, QuickSuper will no longer be accessible via AustralianSuper.

-

Are there any requirements leading up to the transition?

We recommend that you perform a pre-transition data check in QuickSuper for system users and employees to ensure all your company contact details are correct and your employee lists are current. The Employer Portal enforces multi-factor authentication which means each user will need to use their own unique email address when logging in. Please make sure each user in QuickSuper is set up with their own unique email address. This means no shared email addresses should be used. -

Will I need to set up my clearing house account in the Employer Portal from scratch?

AustralianSuper is working with our technology partners to pre-fill employer accounts in the Employer Portal using existing information from QuickSuper, the Business Portal and our Administrator’s core registry system.

As we manage the transition to the new Employer Portal, we will be inviting current QuickSuper administrators or the primary contact in an organisation (based on our registry records) to ‘activate’ their new account. During this process, they will just need to check and confirm that the pre-filled details are correct. They will also be asked to invite any other existing users to activate access to the Employer Portal.

Businesses who normally use the manual grid to make contributions, will have the option of importing their employee data. Those who typically use contribution files can import their next contribution file, so all employees within the file will be added to the Employees listing in the new Employer Portal.

Our aim is to simplify the transition experience and avoid data re-entry errors by transferring the information we already have.

-

Will there be downtime during the transition to the Employer Portal?

We aim to minimise any disruption, and there will be no planned downtime in your ability to access clearing house services. We’ll communicate timelines and provide support so contributions and other clearing house services can continue smoothly. -

Is consent needed - for myself and my employees?

QuickSuper and our core registry system will be used for the same purpose it was originally collected. This means you and your employees don’t need to provide additional consent, even if they’re not currently members of AustralianSuper.

By taking this approach, we’re helping you meet your super obligations with less risk and downtime.

-

Will I still be able to view my contributions in QuickSuper?

The arrangement between AustralianSuper and QuickSuper will end in 2026. You’ll need to complete your transition before the arrangement ends and you can then use the portal for all future super contributions. After you’ve activated your new Employer Portal account, QuickSuper access will become ‘read only’. This means you won’t be able to make any changes in QuickSuper but you can see your contributions history for approximately 12 months from the date it becomes ‘read only’. We recommend you download any reports required for recordkeeping purposes. -

How do I download historical contribution reports from QuickSuper?

To view or download a contribution report, sign in to QuickSuper and navigate to the Report menu.

From the drop-down menu, select ‘Yearly Contribution Report.’

You will be able to view or download your historical contribution reports. It's possible to filter by fund, contribution, and employee.

As AustralianSuper begins the transition from QuickSuper to the Employer Portal, we recommend you download and store historical reports required for recordkeeping purposes.

-

How long will I have access to QuickSuper after transitioning to the new Employer Portal?

Your access to QuickSuper will switch to 'read only' after you've successfully made a contribution through the Employer Portal. You will receive notification, including instructions on how to download historical contribution reports. We recommend downloading any reports required for recordkeeping purposes as part of your transition to the new portal. Read only access to your contribution history will be available for approximately 12 months after you've activated your Employer Portal account. -

Can I keep using QuickSuper via AustralianSuper?

AustralianSuper will start the process to end the arrangement with QuickSuper in 2026 (the exact date is yet to be confirmed and we’ll provide more information on this web page when it is). The first step will mean QuickSuper is placed into 'read-only' mode where your information is still available, but you won’t be able to make changes or contributions. You’ll have approximately 12 months from the date 'read-only' mode is activated to access, download and store historical contribution records. After the 12-month period, QuickSuper will no longer be accessible via AustralianSuper. -

Will employer and employee data be automatically transferred to the Employer Portal?

Where possible, we’ll securely use your existing details from the Business Portal and/or QuickSuper to pre-fill data in the new Employer Portal. This will help to streamline your setup so you can meet your super admin obligations.

Get to know the new Employer Portal

-

Why is AustralianSuper making this change?

We’re moving to the new Employer Portal, which is a self-service administration platform with an integrated clearing house, provided by Wrkr. It’s designed to support employers in managing their super obligations, including changes under the Payday Super legislation. AustralianSuper’s arrangement with QuickSuper will come to an end in 2026 (we’ll provide the exact date on this webpage when it’s confirmed). -

Who can use the Employer Portal?

Business owners, bookkeepers and payroll service providers acting on behalf of employers. -

Can I set up multiple users?

Yes, you can. Each user needs to be set up with a unique, individual email address (not shared mailboxes). This supports MFA, audit trails and secure user management. This security feature is required by the Australian Tax Office to enable the Employer Portal to link to the employee stapling service. -

When will the new Employer Portal be accessible?

We're working to deliver access in the most streamlined way possible. We’ll keep this page updated with key dates. -

How does the new Employer Portal simplify making super contributions?

It's a one-stop digital experience - you'll be able to create/find members, upload or enter contributions, validate data in real time, submit and track status, and export reports, all in one place, with clear prompts and alerts to keep you moving without needing to navigate multiple systems. -

What features help my business meet super obligations?

Real-time validation and clear status tracking are designed to help you resolve any entry exceptions (errors) quickly.

If your business, or the business you’re performing super admin for has many entities, multi-entity switching enables contributions to be made through a single log in.

Smart alerts and in-product guidance are provided to help you stay on track of your super obligations.

You can choose to bulk upload your contribution files for multiple employees in one go, then reuse templates next pay cycle if there have been no staff changes since the previous upload.

The portal is ready for the Payday Super legislation and is planned to evolve along with future legislative changes.

-

Are my payroll/HR systems compatible with the new Employer Portal?

The Employer Portal supports the industry standard SAFF file format, which most payroll and HR systems produce. Additionally the QuickSuper file format will be supported by the Employer Portal.

If your payroll or HR system produces a different contribution file or you use a custom file format, the Employer Portal offers a file mapping tool. To use the tool you need to save your contribution file in .csv format. It also needs to include the minimum data that SuperStream requires for contribution submissions.

The relevant fields in your files can then be translated into SAFF format. The settings will be saved so it’s simple next time you need to upload a file using the same format.

-

How will the Employer Portal reduce errors and processing effort?

As you work through the contribution process, built-in validation will highlight any issues or errors for correction before submission. This will reduce rework and processing efforts. -

When can an employee expect to see a payment reflected in their super account?

The time it takes for super contributions to appear in an employee's super account depends on the payment method used, standard banking processing times and the time it takes for the superannuation fund to allocate to the employee’s account.

Direct Debit

- Direct debit contributions made prior to 4pm (AEST/AEDT) on a business day (e.g. Monday), will take three business days to clear. They will be processed and sent to the superannuation fund (on the Thursday) and be received by the fund on Friday.

- Payments made after 4pm (AEST/AEDT) or on non-business days, will add an extra day in this process.

Funds transferred in a clearing house must remain in the account for a minimum period of three business days to ensure the debit will be honoured by your financial institution.

Electronic Funds Transfer (EFT) or BPAY

- Contribution payments made by EFT or BPAY prior to 4pm (AEST/AEDT) on a business day (e.g. Monday), will be received and processed the following day (Tuesday). Payment will be received by the fund a day later (Wednesday).

- Payments made after 4pm (AEST/AEDT) will add an extra day in this process.

-

How long can an employee expect to wait to receive a super refund?

If either EFT or BPAY are set as the preferred payment method for your contributions, a Virtual Bank Account (VBA) is set up to assist with refunds.

It works as follows:

- A notification is triggered to the employer.

- The refund is held in the clearing house for ten business days before being refunded back to the employer via the nominated bank account, payment source, or manually.

-

What if I'm currently using a different clearing house and want to use the new Employer Portal?

You’ll be able to register to use the Employer Portal via our website in early 2026. Please note you need to be an AustralianSuper participating employer to register, which can also be set up in the same join experience. -

I am a bookkeeper that manages multiple organisations. How can I add them to the new Employer Portal?

You can set up multiple profiles by completing the onboarding journey for each organisation that you manage, provided you have access to the portal with ‘admin permission.’

To get started, click ‘add organisation’ and follow the instructions.

If you are not the admin user for an organisation, they will need to invite you via the User Management module of the Employer Portal and set you up with permission to manage your organisation’s profiles. The admin can complete this step as part of the employer's activation and account set up.

-

What do you mean by user-friendly interface?

The Employer Portal uses clean screens, guided forms and clear status labels to make the platform easier to navigate, reduce errors and assist with task completion.

Transferring your data

-

How will you get the data to set up my Employer Portal account?

We’ll securely collect your information from QuickSuper, the Business Portal and our Administrator’s core registry system. This data will be sent to our new technology partner, Wrkr, to combine and store it safely in a central database. From there, we’ll use it to pre-fill your new Employer Portal account for you to activate and validate.

-

How will the data be kept secure?

We’ll use a secure database with industry-standard protections to keep your information safe.

- Only a small number of trusted team members will be able to access the database – and only when needed.

- TLS 1.3+ encryption for all data in transit.

- AES-256 encryption for all data in AWS storage services (S3, RDS, EBS)

- Data exchanges (from sources) occur via secure protocols such as HTTPS, SFTP, or Managed File Transfer.

- The database will be strictly controlled – no AI systems will be able to access or process your data.

-

What happens to my data if I don’t activate my Employer Portal account?

If you currently use QuickSuper and choose not to activate the Employer Portal, you can simply ignore1 the invitation. You can choose to make your own clearing house arrangements.

Once our data transition program ends, any data prepared for activation will be securely deleted from the database if your account hasn’t been activated2.

1 AustralianSuper will be ending the arrangement with QuickSuper in 2026. We’ll publish the exact dates on our website once they’re confirmed. If you decide not to use the Employer Portal, you’ll need to set up an alternative clearing house arrangement by the closing date.

2 If you haven’t activated your Employer Portal account by the end of the data transition program, you can set up an account in the Employer Portal at another time by visiting australiansuper.com/employers. You’ll just need to have your ABN and employer number handy. Keep in mind, your account won’t be pre-filled with data. -

What steps should I take if the data is inaccurate?

When you activate your Employer Portal account, you’ll be asked to review and confirm the pre-filled details. Most fields can be edited, so you can update anything that needs to be changed.

We realise some users set up in the Business Portal or QuickSuper may no longer be employed by your organisation. That’s why your organisations administrators will need to review pre-filled user data, send invitations to the right people, or remove outdated users. You can also update user permissions directly in the new Employer Portal.

To help prepare for the transition, we recommend current QuickSuper users review and update their organisation and user details now, so everything’s accurate and ready to go.

-

Will AustralianSuper use my employee data to approach members of other funds?

No, we won’t. This would go against the Privacy Act and other legal protections. We respect every employee’s right to choose their own super fund. Our focus is simply helping employers continue making contributions, and other super obligations.

Account security

-

What does a “single login” mean in practice?

The existing solution requires two different logins. With the new Employer Portal, access to clearing house and employer administration will be within one secure login, with MFA and role-based access. -

Is multi-factor authentication (MFA) required?

Yes, it is. The Employer Portal offers enhanced security through MFA. You can choose to authenticate your access using either the Google Authenticator app, or by receiving a one-time code via your mobile phone. If you don’t have access to a work device, you can use a personal device.

-

Can I submit a photo of a copy of my ID for the ID verification (IDV) process?

No, a photo must be taken of the physical ID itself and must be of good quality, with all wording legible. We can't accept photos of copies.

Assistance and support

-

What support, training materials and resources will you provide?

This web page will be updated with materials as they become available. The new Employer Portal has been designed to provide a user-friendly interface to guide you to take the next steps. If you choose to register to use the portal, you will have step-by-step guides that are accessible via the ‘Help’ icon within the Employer Portal. Alerts and real- time information will provide status updates as you complete your super administration tasks. -

Who can I contact for assistance or troubleshooting if there’s a problem during the transition to the Employer Portal?

AustralianSuper have dedicated resources to assist with any issues that may arise during the transition. Please contact us on 1300 300 273 8am – 8pm AEST/AEDT weekdays should you be unable to find the information you need.

- The clearing house is a financial product offered by ClickSuper Pty Ltd ABN 48 122 693 985 (‘ClickSuper’) trading as Wrkr PAY (AFSL 337805), a wholly owned subsidiary of Wrkr Ltd ABN 50 611 202 414 (‘Wrkr’). Terms and conditions of Wrkr and ClickSuper apply and a Product Disclosure Statement for the clearing house is available from ClickSuper on request. AustralianSuper Pty Ltd doesn’t receive any commissions or other benefits from ClickSuper, nor is it recommending, endorsing or providing an opinion about the products or services offered by ClickSuper or intending to influence anyone to make a decision about them. AustralianSuper Pty Ltd is not liable for any loss or damage you incur in connection with the use of products or services provided by ClickSuper or Wrkr.

- QuickSuper is a financial service provided by Westpac. AustralianSuper doesn’t accept liability for any loss or damage caused by use of the QuickSuper service and doesn’t receive any commissions from Westpac if employers use this service. Terms and conditions apply. Visit quicksuper.westpac.com.au to learn more.