What is a superannuation clearing house?

A super clearing house is a government-approved automated payment system.

With a clearing house, you can make one super payment for all employees, no matter what fund they belong to. The clearing house then sends the money to your employees’ super funds.

How does a super clearing house work?

A clearing house is an online portal that simplifies the process of making superannuation contributions. Instead of making separate payments to multiple super funds, employers can make a single payment to the clearing house, which then distributes the contributions to the respective employees’ super account.

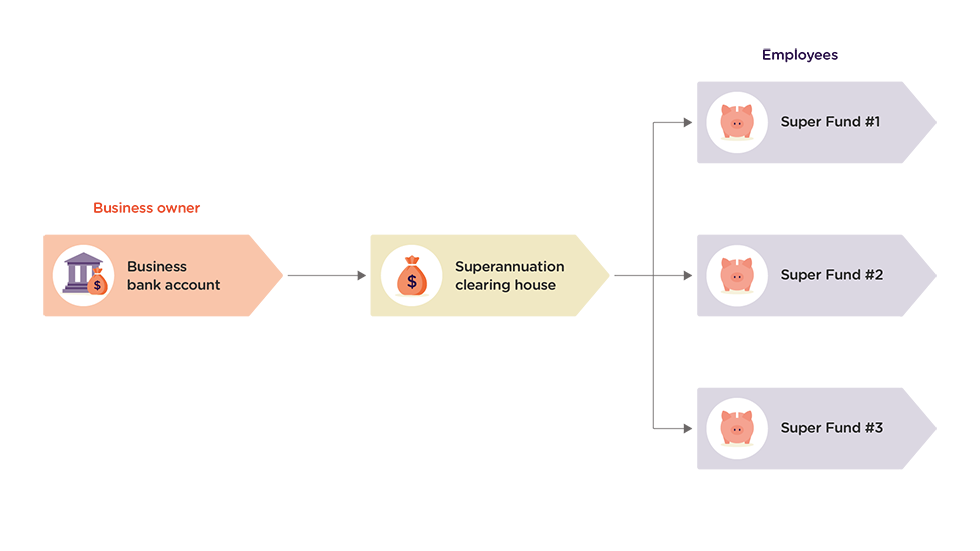

The infographic below demonstrates the clearing house process:

As an employer, you will provide both contribution details and payment into your chosen clearing house which will then send details and payment onto your employees’ separate super funds.

What clearing house should I use?

As an employer, you can use a super clearing house as long as it meets SuperStream legislation1.

When you register with AustralianSuper, you can apply to have access to QuickSuper2 to pay and track employee super. It's free, fast and supports SuperStream compliance.

With QuickSuper2, you can:

- create accounts for new employees

- make additional or voluntary contributions

- update business and employee details

- use reporting to reconcile payments

- create a detailed audit trail

- choose your super payment frequency: weekly, fortnightly, monthly or quarterly.

At AustralianSuper, we’re committed to delivering world-class service and support for our employer partners. In early 2026 we’ll launch a new Employer Portal3 with an integrated clearing house.

If you currently use AustralianSuper QuickSuper, we’ll guide you through the transition to the Employer Portal.

Do I have to use QuickSuper if AustralianSuper is my default super fund?

No. You can register with AustralianSuper without using QuickSuper1.

While we offer QuickSuper1 to employers, you might choose not to use it. You may choose to bring your own clearing house or have access through your business' accounting software.

How to register with QuickSuper

- First, you’ll need to register with AustralianSuper. Haven’t done it yet? Register now.

- Once you’ve done this, start your QuickSuper application1.

- Enter your company details.

- Confirm your details are correct and submit your application.

- Once your QuickSuper1 account is registered successfully, within approximately 24-72 hours you will be emailed your QuickSuper1 login details, which includes a temporary password, a username and a Client ID number.

- Then, it’s time to log in and set up your account.

- Need to know more about QuickSuper?1 Download the QuickSuper how-to guide.

QuickSuper how-to guide - pdf, 1.1MB

Start paying super to your employees

-

Important things to consider

- Australian Taxation Office, SuperStream for employers, ATO website, accessed 18 July 2024.

- QuickSuper is a registered trademark and a product owned and operated by Westpac Banking Corporation ABN 33 007 457 141. Westpac’s terms and conditions applicable to the QuickSuper service are available after your eligibility for the clearing house service is assessed by AustralianSuper. A Product Disclosure Statement (PDS) is available from Westpac upon request. AustralianSuper doesn’t accept liability for any loss or damage caused by use of the QuickSuper service and doesn’t receive any commissions from Westpac if employers use this service. You can choose to make your contributions using a different service, but it needs to meet the government’s minimum data standards, visit ato.gov.au

- The clearing house is a financial product offered by ClickSuper Pty Ltd ABN 48 122 693 985 (‘ClickSuper’) trading as Wrkr PAY (AFSL 337805), a wholly owned subsidiary of Wrkr Ltd ABN 50 611 202 414 (‘Wrkr’). Terms and conditions of Wrkr and ClickSuper apply and a Product Disclosure Statement for the clearing house is available from ClickSuper on request. AustralianSuper Pty Ltd doesn’t receive any commissions or other benefits from ClickSuper, nor is it recommending, endorsing or providing an opinion about the products or services offered by ClickSuper or intending to influence anyone to make a decision about them. AustralianSuper Pty Ltd is not liable for any loss or damage you incur in connection with the use of products or services provided by ClickSuper or Wrkr.