Adviser resources

- Back

- Next

- News

- FAQs

- All documents

- Products

- Portal updates

Latest news

We’re mandating multi-factor authentication to the Adviser Portal

To help keep your clients’ accounts secure, AustralianSuper will soon be implementing multi-factor authentication (MFA) to the Adviser Portal as a mandatory security measure. To prepare for this change we require advisers, Licensees and support staff to add or update their mobile number to their Adviser Portal profile to ensure uninterrupted access.

Once MFA is implemented, you’ll need to enter a one-time code sent to your mobile phone when you log in.

-

Our commitment to security

The introduction of MFA is an important step in enhancing the security of our members’ personal information. As a member-owned super fund, protecting our members is a top priority. We’re also aware that MFA can result in users having to verify their login multiple times per day. So we’re working on a new feature to improve the log on experience. Stay tuned for further updates.

-

Instructions for advisers adding a mobile number

To add a mobile number to your Adviser Portal profile, you’ll need to call us on 1300 362 453 weekdays from 9am-5pm (AEST). For privacy and security reasons, we'll need to verify your identity before changing any details.

Please note that we cannot accept email as a method of adding or updating a mobile number.

-

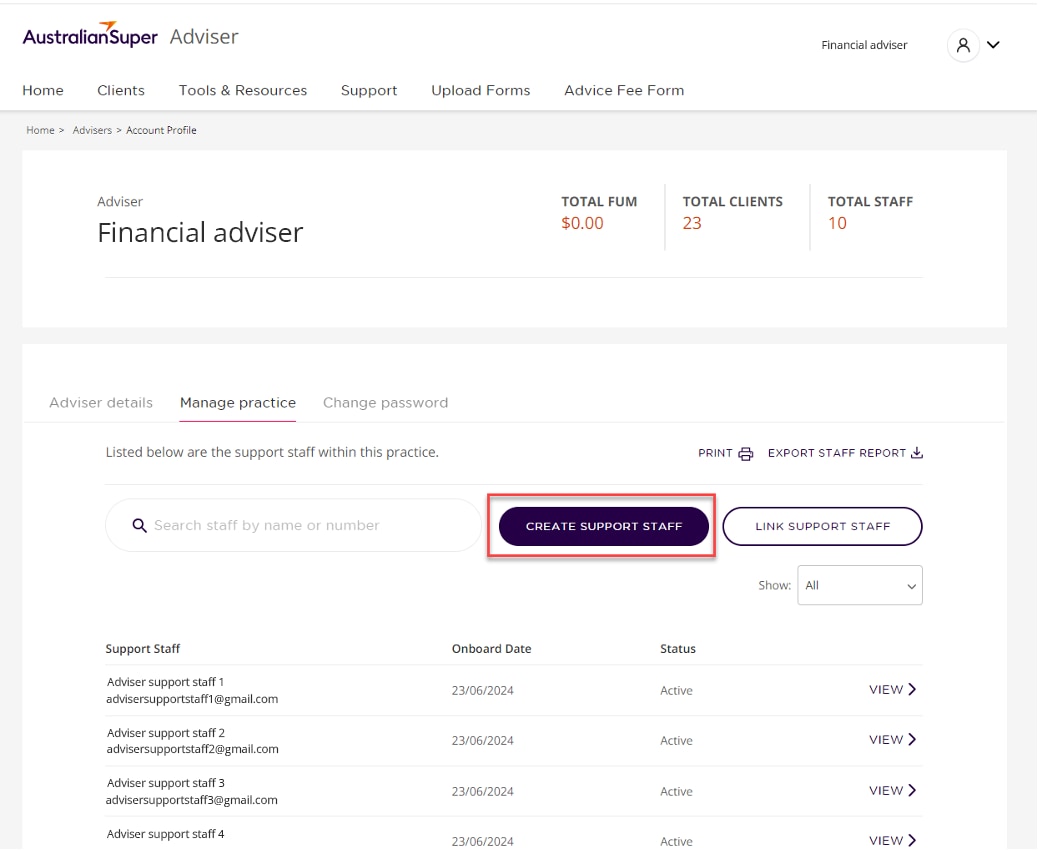

Instructions for support staff adding a mobile number

Mobile numbers can be added to a support staff account in two ways:

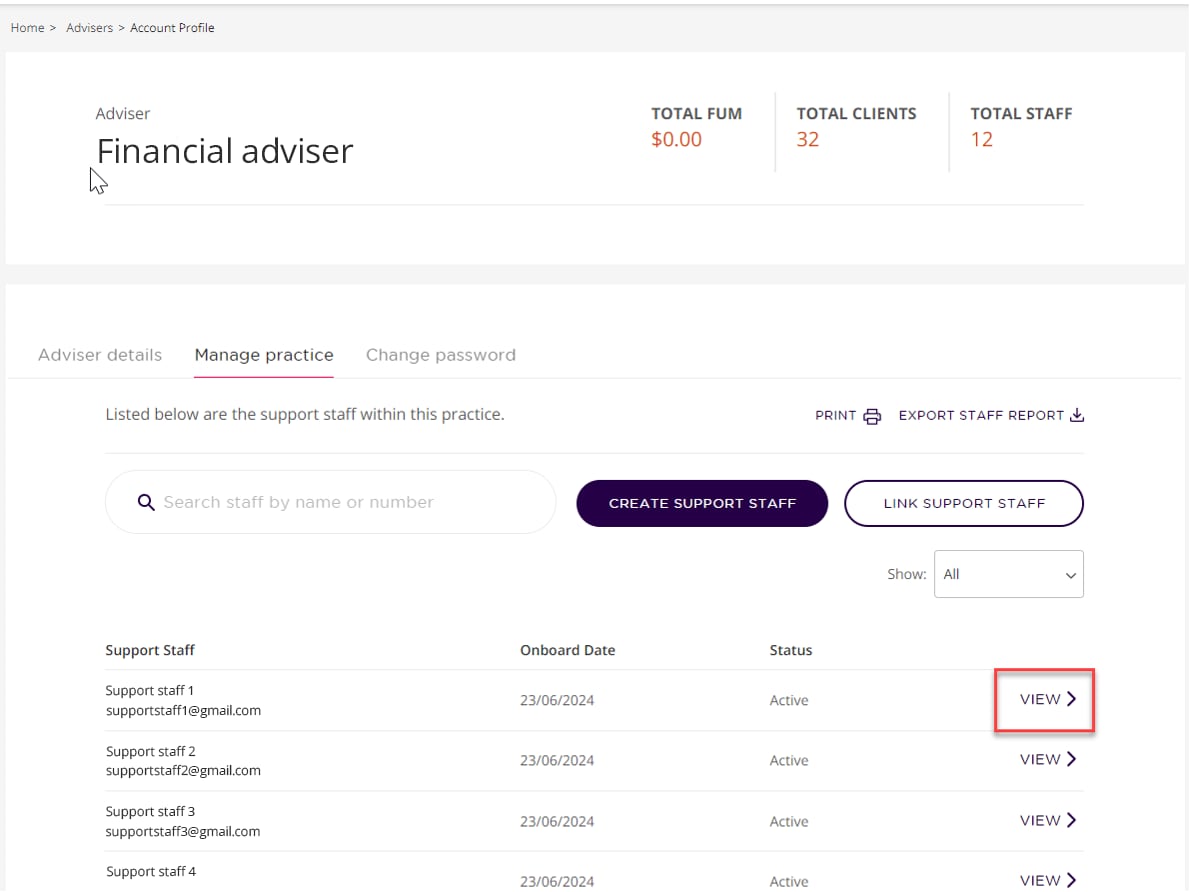

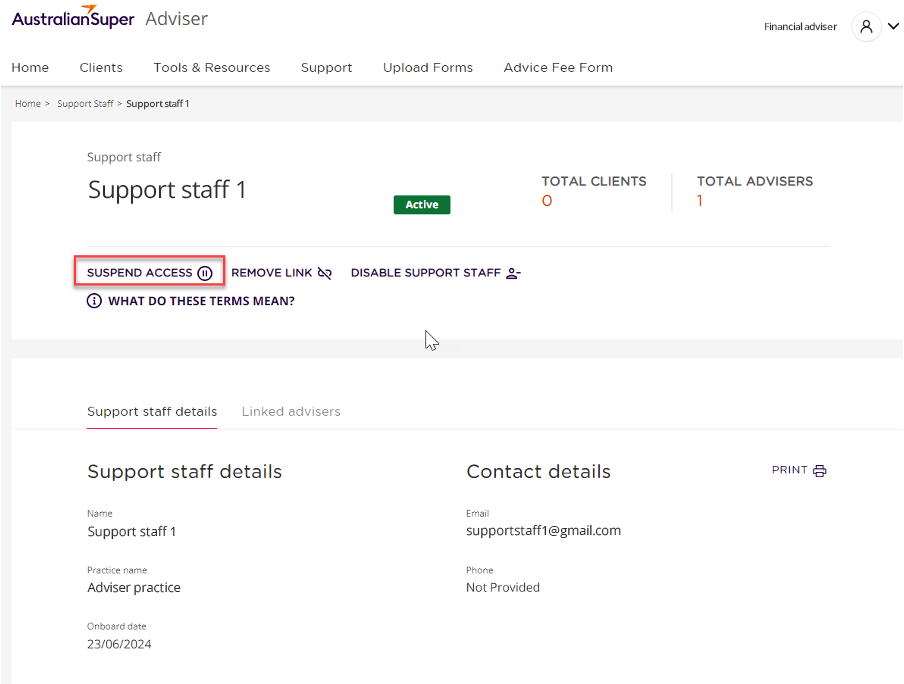

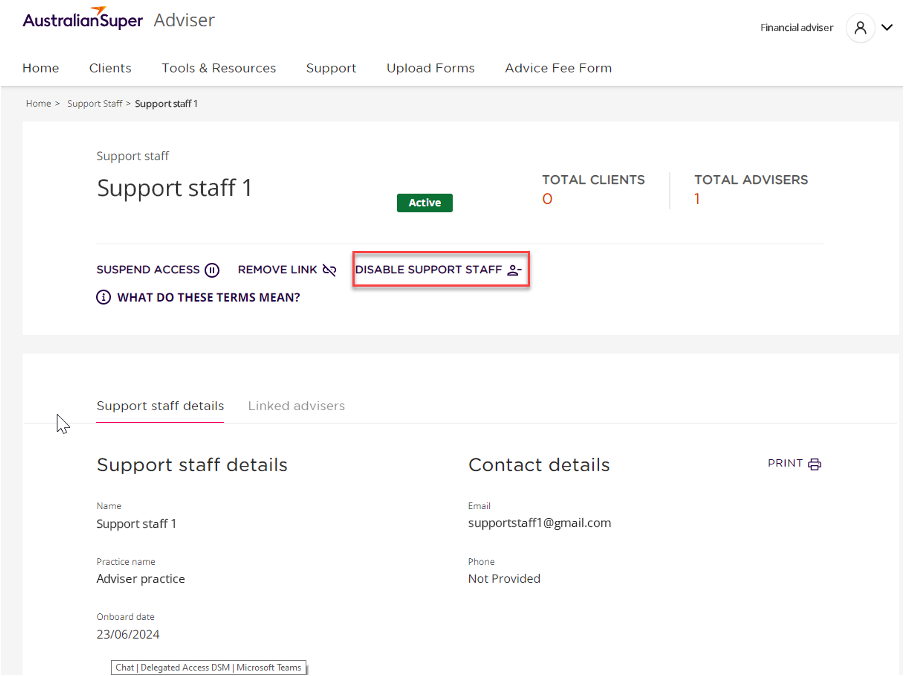

- Advisers can add it in the Adviser Portal:

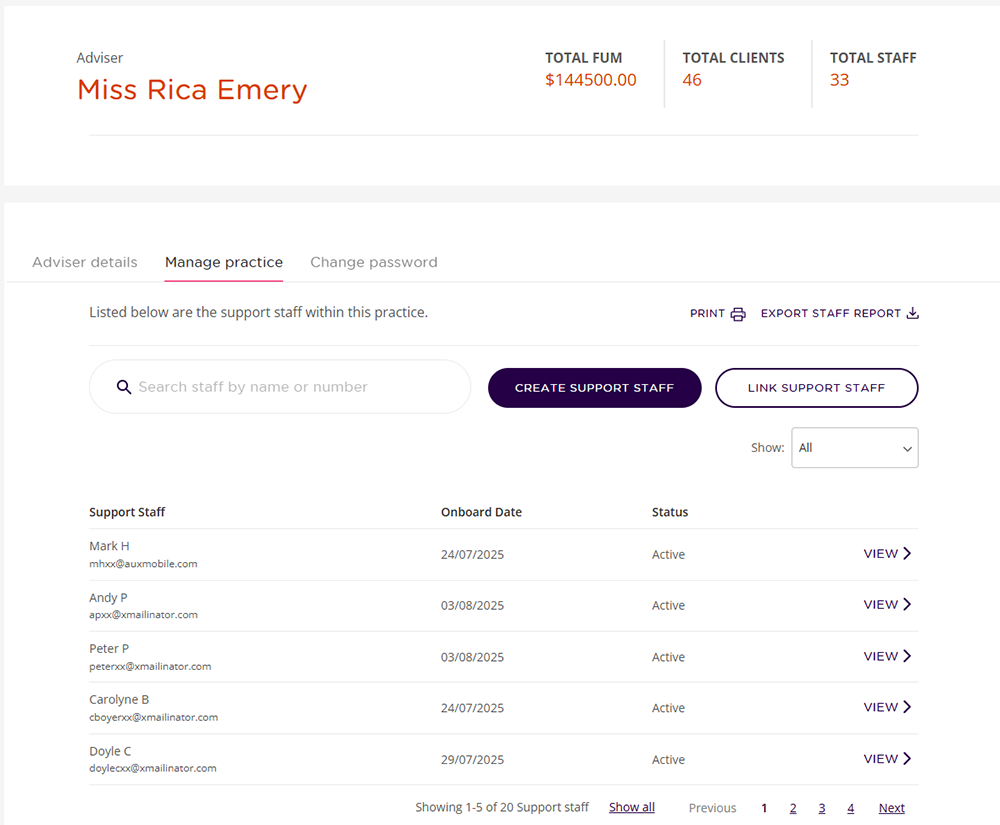

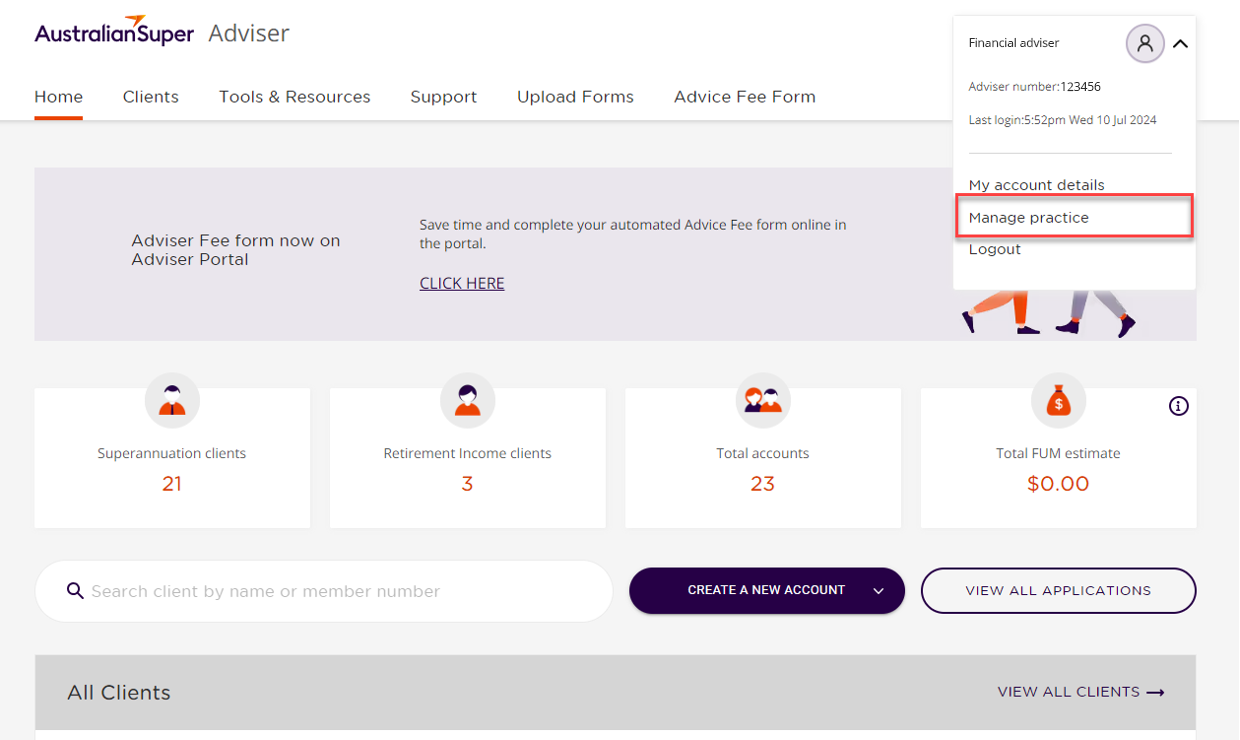

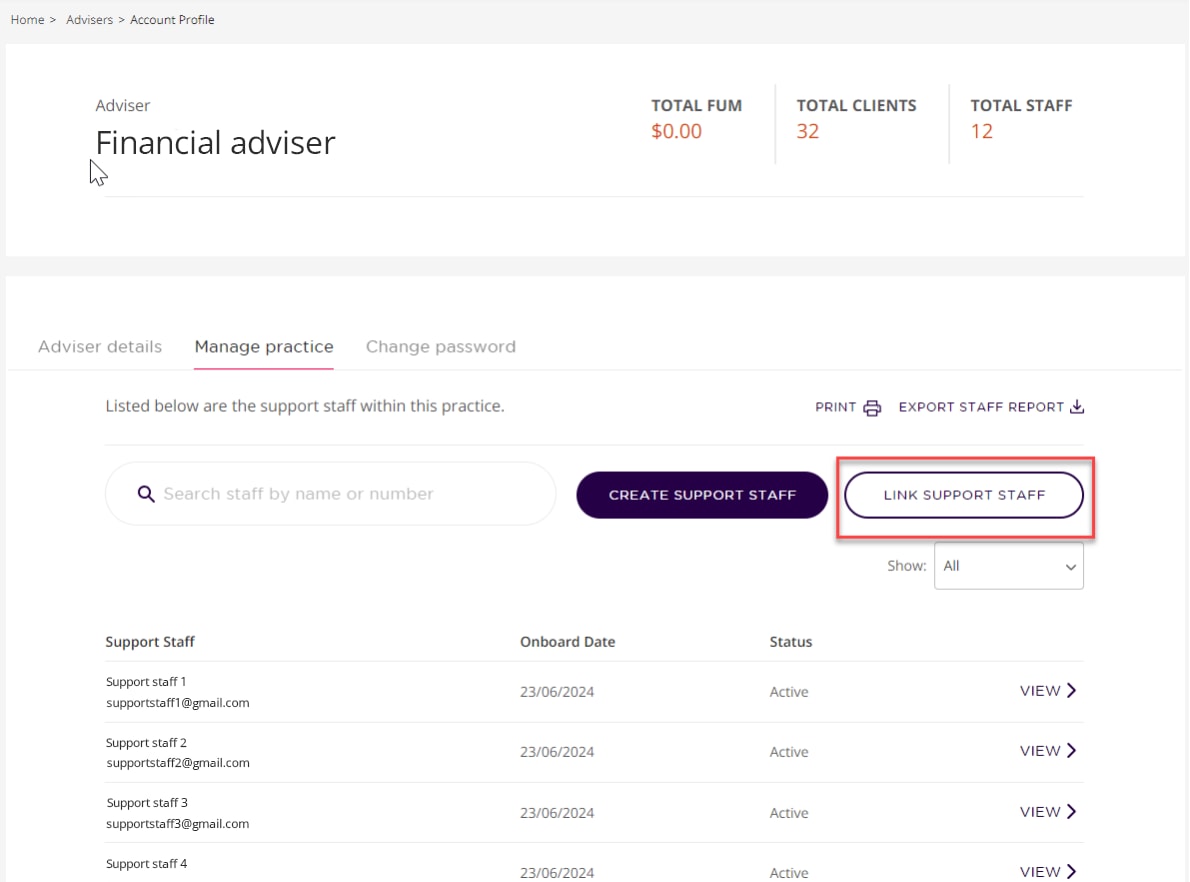

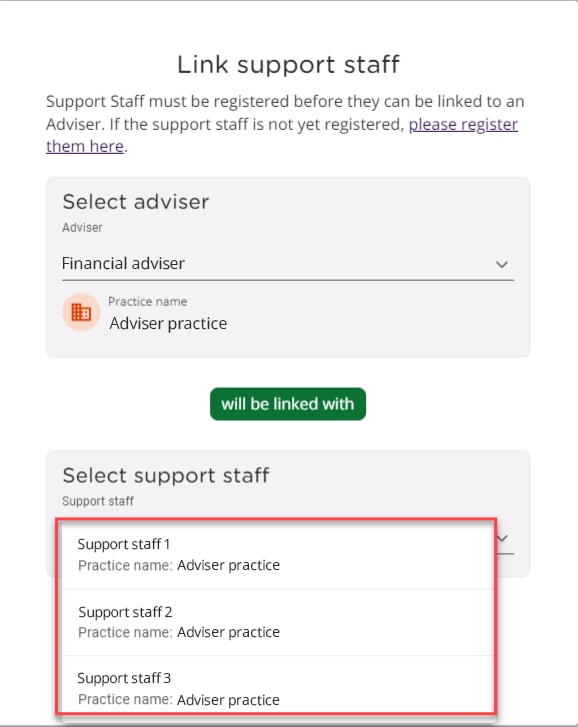

- Navigate to 'My account details' and click on the 'Manage Practice' tab. Here you’ll find a list of your support staff and their contact details.

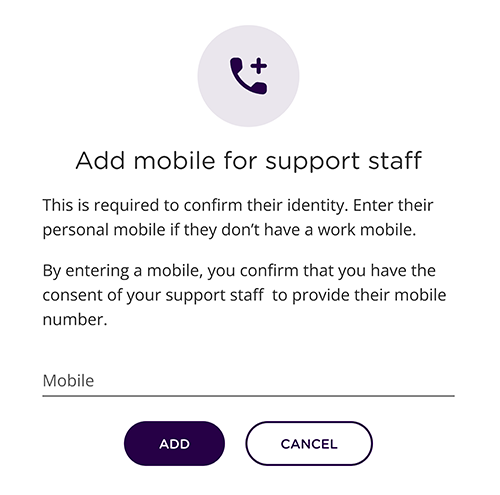

- Click 'view' to see your support staff’s profile, then click 'add mobile'.

- Add your support staff’s mobile number.

- Support staff can call us on 1300 362 453 weekdays from 9am-5pm (AEST). For privacy and security reasons, we'll need to verify their identity before changing any details.

Please note that we cannot accept email as a method of adding or updating a mobile number.

-

Update a mobile number for support staff

If your support staff need to update their mobile number recorded in the Adviser Portal, there are two options available:

- You can call the Adviser Services team and update the mobile number on their behalf. We’ll need to verify your identity before changing any details.

- Alternatively, your support staff can call to speak to the Adviser Services team to update their mobile number. For privacy and security reasons, each user must call to update their own mobile number so we can verify their identity.

Our Adviser Services team are available on 1300 362 453 or +61 3 8677 3240 for international callers, weekdays from 9am-5pm (AEST).

Please note that we cannot accept email as a method of updating a mobile number.

-

Check your recorded mobile number

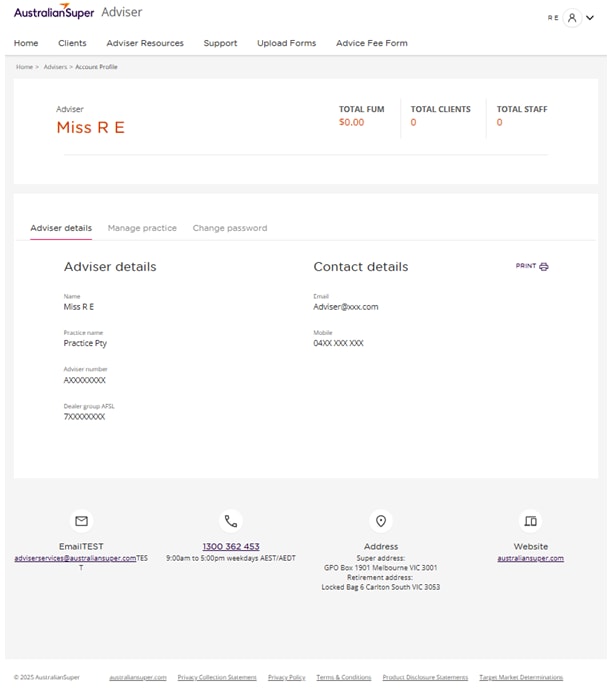

To ensure you are prepared, log in to the Adviser Portal to check your mobile number.

You can do this by:

- Navigating to the top right corner of the Adviser Portal home screen and clicking on the drop-down arrow next to your name.

- Select 'My account details' to view your recorded mobile phone number under Contact details.

If your mobile number is correct, you don’t need to do anything.

-

Update your mobile number

If your mobile number is incorrect, please call us on 1300 362 453 weekdays from 9am-5pm (AEST). For privacy and security reasons, we'll need to verify your identity before changing any details.

Please note that we cannot accept email as a method of updating a mobile number.

We’re here to help.

If you have any questions or would like to know more, please email us at adviserenquiries@australiansuper.com.

This article is accurate as at the date of publishing: 7 January 2026.Improved accumulation join process in the Adviser Portal

We’ve listened to your feedback and improved the way your clients apply to join AustralianSuper when it’s done through the Adviser Portal.

These changes will increase client engagement, reduce your workload, and enhance compliance throughout the (accumulation account) application process.

-

What’s changed for your clients?

- Easier to review and validate their application details, reducing the risk of errors

- Improved messaging at key points throughout the application process

- Clearer timeframes around completion dates

- The PDS and TMD will be presented directly to them

- They’ll directly approve the ‘Declaration and acknowledgement’ section, reducing reliance on the Adviser

- Before reviewing their application, clients will need to verify their identity using a one-time-password (mobile number will be a mandatory field).

-

What’s changed for Advisers and Support staff

- Data quality in the applications will improve, reducing the need for follow ups

- A wider range of ‘Status’ types in the Adviser Portal, for a clearer overview of all join applications at any point in time

- A new ‘Action’ column in the Adviser Portal, making it easier to understand the next steps in the process

- Improved messaging during the process, enabling you to assist your client if required.

-

We’re here to help

- If you’d like a walk-through of the improved accumulation join process, email adviserservices@australiansuper.com

- For general troubleshooting, email Advice Operations at adviserenquiries@australiansuper.com

- To set up Adviser Portal access, scroll to the top of this page and select the dropdown option from the ‘Login’ button.

And remember, if your client needs support during the application process (e.g. they didn’t receive a one-time-password for verification) we’ll communicate with both you and your client, to make it easy for you to provide them with assistance.

This article is accurate as at the date of publishing: 29 January 2026

Important updates to the Member Direct investment option

From 28 March 2026, there will be several important updates to the Member Direct (MD) investment option.

-

If your clients have this option, they’ll be informed that we’re

- changing the research provider from UBS Securities Australia Limited (‘UBS’) to Morningstar Australasia Pty Ltd (‘Morningstar’) to expand research coverage of ASX listed securities

- reducing Portfolio administration fees for ‘Term Deposits’ and ‘Shares, ETFs & LICs’ levels of access

- reducing Brokerage fees when buying and selling shares, ETFs or LICs

- enhancing the cash transfer process to allow members, and their advisers, to specify dollar amounts to be transferred into or out of AustralianSuper’s other investment options when actioning a cash transfer from or to the MD Cash account

- specifying the order in which we’ll action the early redemption of Term Deposits when we dispose of or rebalance their MD investments

- updating the Terms and Conditions for using the AustralianSuper Member Direct online platform.

-

What this means for your clients with MD

MD online platform

You or your clients won’t be able to access the MD online platform between 11pm AEDT on Friday 27 March 2026 and 1pm AEDT on Saturday 28 March 2026 while we update the system. We encourage members to log in once the system is back online to familiarise themselves with the changes, including reading all explanatory notes and disclaimers.

Re-submission of orders

To help us manage the change, any remaining open orders as at 11pm AEDT on Friday 27 March 2026 will be cancelled. This includes open or unfilled 30-day limit orders, and open part-filled at market orders.

Accordingly, members will be advised not to set up any limit orders after market close (4pm AEDT) on Friday 27 March 2026 as these will be automatically cancelled at 11pm AEDT. If required, they can set up new limit order requests once the platform is back online on Saturday 28 March 2026.

Fee changes

If members have selected the Cash Account level of access their fees won’t change. In all other cases, their Portfolio administration fee and any Brokerage fees will reduce from Saturday 28 March 2026.

-

What advisers need to do

When you first access the MD online platform from 28 March 2026, you’ll need to read and accept the updated Terms and Conditions for using the AustralianSuper Member Direct online platform available on our Member Direct page.

In addition we’ll also be updating the:

- MD investment option guide, Fees and Costs IBR and the Choice Income PDS,

- MD investment menu on, or around 1 April 2026 with additions and deletions as part of the annual review,

- TTR Income PDS, as the associated join form is being refreshed and the Binding death nomination form is being updated.

As distributors of our products, it’s important that you:

- dispose of all previous versions of the documents mentioned above (including any join forms) to ensure your clients receive the most current versions, and

- use the updated documents (including any join forms) from 28 March 2026.

-

What your clients with MD need to do

When your clients first access the MD online platform from 28 March 2026, they’ll need to read and accept the updated Terms and Conditions for using the AustralianSuper Member Direct online platform, available on our Member Direct page.

If they wish to change their level of access to take advantage of the reduced fees, they can log into MD and make the change in their account settings once the platform is back online on Saturday 28 March 2026.

If your client is not comfortable with the changes and they wish to cancel their MD account, they can log into MD and make the change in their account settings before 4pm AEDT on Friday 27 March 2026.

-

We’re here to help

For more information, including details of fee reductions , please refer to the SEN titled Important updates to the Member Direct investment option February 2026.

If you have any questions, email adviserservices@australiansuper.com or call 1300 362 453 weekdays from 9am – 5pm AEST/AEDT.

Important changes for Advisers from 23 October 2025

We’re releasing new Choice Income and Transition to Retirement (TTR) Income Product Disclosure Statements (PDSs), join forms, Target Market Determinations (TMDs) and Investment Guide effective 23 October 2025.

-

Updated PDS documents, join forms and TMDs

As distributors of our products, it’s important that you:

-

Minimum balance to open new Retirement accounts

Please note that the minimum balance to open a:

- Choice Income account has changed from $50,000 to $10,000,

- TTR Income account has changed from $25,000 to $10,000.

-

Making it easy for your clients to refresh their income account and top-up their savings

AustralianSuper has introduced a simplified account recycling service, enabling advisers to help clients boost their retirement savings with ease.

To learn more, download the form and read our FAQs, please visit our Refresh your income account and top-up your savings page

-

Updated SuperRatings benchmarks

In July 2025, the SuperRatings benchmarks used in the investment objectives of some PreMixed investment options, to compare performance to other funds, were changed. The change removed the number of providers in each benchmark, e.g. ‘50’ was removed from the SR50 Balanced (60-76) Index.

Investment option Super and TTR From To Stable SR50 Capital Stable (20–40) Index SR Capital Stable (20–40) Index Conservative Balanced SR25 Conservative Balanced (41–59) Index SR Conservative Balanced (41–59) Index Balanced SR50 Balanced (60-76) Index SR Balanced (60-76) Index High Growth SR50 Growth (77–90) Index SR Growth (77–90) Index Choice Income From To Stable SRP50 Capital Stable (20–40) Index SRP Capital Stable (20–40) Index Conservative Balanced SRP25 Conservative Balanced (41–59) Index SRP Conservative Balanced (41–59) Index Balanced SRP50 Balanced (60-76) Index SRP Balanced (60-76) Index High Growth SRP50 Growth (77–90) Index SRP Growth (77–90) Index This article is accurate as at the date of publishing: 23 October 2025

Support staff can now create super accounts online

Previously, we announced that advisers and public trustee officers (PTOs) can open super (accumulation) accounts for their clients directly in the Adviser Portal.

To make things even easier for advisers, we’ve enhanced the portal to allow adviser support staff to pre-fill new account applications using their own login details.

-

More information

Main benefits

- Saves time for advisers who delegate this task to their support staff.

- More secure than sharing login details with others.

- Will help to open super accounts faster for clients.

How does it work?

When creating an application, the support staff will select the adviser/PTO who will review and approve (or reject) the application.

On the last page of the application, the option to ‘submit’ is replaced with ‘send for review’. The application will be sent to the selected adviser/PTO to review and approve (or reject).

Help and support

To learn more about the Adviser Portal and support staff access, please read the FAQs on our Adviser Resources page. And if you need further help, please refer to the related article, “Open super accounts online” or contact us.

Important notice about Annual Statements

AustralianSuper will send annual statements to members from September 2025. Advisers should be aware that while the closing balance shown on these statements is correct, it may not match the closing balance members see in the member portal and app.

This is due to a known issue, and AustralianSuper is actively working on a fix. We’re also adding messages to both the member portal and app to alert members about this discrepancy.

If you receive any enquiries from your clients, please explain the situation and reassure them that AustralianSuper is resolving the issue. Then direct them to refer to their annual statement to see the correct closing balance.

If you have any further questions, please contact the Adviser Services team.

This article is accurate as at the date of publishing: 11 September 2025.Important changes for Advisers effective 1 August 2025

We're releasing new Accumulation, Choice Income and Transition to Retirement (TTR) Product Disclosure Statements (PDS) effective 1 August 2025.

-

Updated PDS documents and join forms

As distributors of our products, it’s important that you dispose of all previous versions of our PDSs to ensure your clients receive the most current PDS and join form. Please begin using the updated join forms included in the new PDS.

-

Fees and costs

The confirmed fees and investment costs have been included in the August 1 Accumulation, TTR and Choice Income PDSs, and are also available on our website. -

Changes to our Socially Aware option

AustralianSuper has recently reviewed the investment exclusions (or ‘screens’) that apply to the Socially Aware investment option to better meet member expectations, specifically in relation to the areas of concern subject to screening, and to ensure as far as practical that screens apply to all assets held by the option.

Effective from 1 August 2025, the review has resulted in changes to the strategic asset allocation, investment objectives, risk levels and screens that apply.

For full details of the Socially Aware investment option, including updated details on the implementation and monitoring of screens, refer to:

- For super accounts: australiansuper.com/InvestmentGuide

- For Choice Income or TTR Income accounts: the relevant product disclosure statement at australiansuper.com/pds

New Member Direct FAQs

We’ve recently refreshed the Member Direct FAQs with screenshots to better guide you how to perform key tasks.

Notice of Intent (NOI) and rollover/withdrawal timing - Best practice

To support smooth processing and protect your client’s ability to claim a tax deduction, check the Adviser Portal to confirm the client’s NOI has been processed, before submitting any rollover or withdrawal requests.

This approach ensures contributions are eligible for deduction and avoids delays or unintended tax outcomes.

To find this information, go to your client’s ‘Transactions’ screen on the portal. By choosing the financial year, the description of the transaction will display as ‘Notice of Intention (NOI) tax deduction’ – see below for example:

Insurance enhancements through TAL Connect

As part of our ongoing commitment to improving member experience, we’ve introduced more efficient and user-friendly ways to lodge insurance claims and underwriting applications through our insurance provider TAL Life Limited.

-

Online claims

Members can now lodge claims for Total & Permanent Disablement (TPD), Income Protection or terminal illness through the AustralianSuper Member Portal, Member App, or by speaking with a TAL claims consultant via tele-claim.

These options provide numerous benefits, including:

- Reduced waiting time for claim forms via mail

- Intuitive forms based on member claim type and condition, and

- Direct claim lodgement to the TAL claim team.

Members can also complete a greenID check in TAL Connect for Income Protection payments. For TPD and terminal illness, additional ID checks will be required.

Paper-based claims remain available and are required for Third Party Authorities (TPAs) and restricted members.

-

Start your basic cover - new

New members can now apply online to start their basic cover before they turn 25 and their super balance reaches $6,000 (age limits and eligibility conditions apply). Members can continue to submit paper Start your basic cover application forms included in their Welcome pack.

-

Life events

Eligible members can apply for new or additional cover following certain life events, if their insurance needs have changed. Members now have 120 days to apply. A child starting primary school and a child starting secondary school have been added as life events.

-

Salary increase

Eligible members now have 90 days to apply for an increase to their Income Protection cover amount following a salary increase. Evidence requirements have also been simplified.

-

Transfer of cover

Eligible members can transfer their existing insurance cover from another super fund to AustralianSuper - up to $2m for Death and TPD, and $20,000 a month for Income Protection (subject to maximum cover limits). We can now also match long-term Income Protection benefit payment periods (certain occupations can’t have a long-term benefit payment period).

For more information about any of these insurance changes, download the Insurance in your super guide.

AustralianSuper insurance is provided by TAL Life Limited (the Insurer) ABN 70 050 109 450, AFSL 237848.

Uploading forms in the Adviser Portal

You can now upload all your forms directly through the Adviser Portal. If you haven’t already, we encourage you to start using the 'Upload forms' page in the portal for all form and client request submissions. It’s a quicker and more efficient way to get things processed.

Open super accounts online

Advisers and public trustee officers can now open super accounts for their clients directly in the Adviser Portal.

Simply select ‘Create a new account > Superannuation’ from the main dashboard page and follow the on-screen prompts.

Once submitted online, the account will automatically be set up. There are no identity verification requirements for super accounts, so this doesn’t apply for the online process like it does for our Choice Income or Transition to Retirement products.

Please note, the process requires downloading a prefilled application form. This doesn’t need to be submitted to AustralianSuper however you’ll need to obtain the client’s signature and keep the signed form on file. Like our other application forms, you may be asked to produce this in future and are expected to do so within five business days.

We’re planning to extend this enhancement to authorised support staff in the future.

Choice Income online join via Adviser Portal

There are a few ways to submit a Choice Income application to Adviser Services. The fastest way to open an account is online via the Adviser Portal.

- Online forms will only proceed with all the required information, reducing the need for unnecessary re-work.

- Applications are received quicker, so they’re processed promptly by our admin team.

- Any issues with Electronic ID are identified at lodgement stage and if certified ID is required, this can be sent directly with the application to Adviser Services to avoid delay.

If you need help with lodging an online application, please contact our Adviser Services team.

Submitting third party authorities

To ensure a smooth process when submitting your own third-party authority form to AustralianSuper, please follow these guidelines:

- Adviser’s email: include email address of the adviser requesting authorisation.

- Support staff authorisation: if you’d like your team to assist with client matters, please include a line on your form authorising ‘all support staff’.

Frequently Asked Questions

Registration

General info

-

How do I register as a financial adviser with AustralianSuper?

- Complete the Financial adviser registration form online

- Once completed, we’ll be in touch with next steps.

Please note: Currently, only advisers licensed by a licensee who are registered with AustralianSuper are eligible to register and deduct advice fees. If your licensee is not yet registered, please see our Super for financial advisers page for further information or get in touch with us at adviserenquiries@australiansuper.com

-

Who do I contact if I have any questions about becoming a registered adviser?

If you can’t find all the answers you’re looking for on our For advisers page, email adviserenquiries@australiansuper.com

-

What do I need to do if I’m already registered as an adviser with AustralianSuper but moving to another licensee?

If you’re moving to another licensee, complete the online Adviser Registration form with your new details.

Our team will review your completed registration form and get in touch with the next steps.

Please note: if you’re transferring to a non-registered licensee, you’ll still be able to access your client details via the Adviser Portal (if they haven’t opted out) but you’ll no longer be able to deduct advice fees from AustralianSuper.

Working with us

Starting out

-

How do I get in touch if I have questions about AustralianSuper?

Registered advisers with AustralianSuper can email or call our dedicated Adviser Services team:

- Phone: 1300 362 453 (9am – 5pm weekdays AEST)

- Email: adviserservices@australiansuper.com

Our Adviser Distribution team are Fund and Product experts, dedicated to developing and maintaining strong, long-term relationships with external licensees and financial advisers. The team make regular visits to licensees throughout the year and will work with you to ensure you have the right information, tools and support.

-

How do I get listed on the AustralianSuper ‘Find an Adviser’ web page and start receiving advice referrals?

AustralianSuper have a limited number of registered financial advisers who may be eligible to receive referrals. Your Adviser Partnership Manager will contact you to discuss this further when there is adequate demand in your region and you have met the eligibility criteria.

-

What is the Fund's ABN, SPIN and USI?

Superannuation

- Unique Superannuation Identifier (USI): STA0100AU accumulation

- Superannuation Fund Number (SFN): 2683 519 45

- Superannuation Product Identification Number (SPIN): STA0100AU

- Australian Business Number (ABN): 65 714 394 898

Pension/Retirement

- Unique Superannuation Identifier (USI): STA0002AU pension

- Australian Business Number (ABN) 65 714 394 898

- Superannuation Product Identification Number (SPIN): STA0002AU

-

Do I need to provide original documentation?

The only time we require original documentation is when you’re submitting:

- Guardianship order; or other Certified documents.

All other AustralianSuper forms can be scanned and emailed to us. You can find a full list of forms accepted by email on our Guide to submitting forms page.

To return a form via mail, please refer to the Help & Support page.

-

Does AustralianSuper accept digital signatures?

Yes. We accept digital signatures on most of our forms. There are a few exceptions; binding death nominations, guardianship, power of attorney and certified documents. You can find further information on our Guide to submitting forms page.

-

When do I need to provide certified ID? What are the certification requirements?

Take a look at our Guide to providing proof of your identity fact sheet for information on when certified ID is needed, and what other certification requirements are needed.

If you’re certifying the ID in your role as financial adviser, the certification must:

- Be easy to read

- Include the adviser’s full name and occupation e.g. financial adviser

- Include the adviser’s ASIC Authorised Representative or AFSL number

- Be signed by the adviser

- Show the date of certification which must be within the last 6 months.

-

What are the expected time frames for processing paperwork?

All correctly completed forms are generally processed within 7 -10 business days from receiving your email.

For Advice Fee requests, please refer to the Advice Fee Payment Schedule in our FAQs for timeframes.

If we’re operating outside of this time frame due to high volumes, we’ll notify you via auto-reply emails and other methods of communication if needed.

The easiest way to check for the completion of your requests is by logging into the Adviser Portal.

Client account

-

How can I set up an account for my client?

You can open an Accumulation, Choice Income or TTR Income account on behalf of your client using online join form in the Adviser Portal, or by completing the join form included in our Product Disclosure Statements (PDSs).

The online join form for accumulation accounts is intended for members who don’t currently have an AustralianSuper accumulation account. If your client already has one, you’ll need to fill out two forms on their behalf:

Please scan these completed forms and upload them to the Adviser Portal, ensuring the file size does not exceed 3MB per file.

-

Why does my client have two numbers, and which one do I use?

You may be aware that our members have two unique numbers used to identify them:

- A member number

- An account number. The account number should always be used on all forms.

-

How do I access my client’s AustralianSuper account information?

Your client can sign a form to Give access to their financial adviser or you can use your own third-party authority form, if it clearly identifies both the member and adviser. Please note it is mandatory to include the Licensee AFSL number if you’re using your own form. You then submit either form to us via email and within 5 business days, you’ll have access to your client’s account information.

The easiest way to access member account details is by logging in to the Adviser Portal. If you haven’t yet registered for the Adviser Portal, please register or get in touch at adviserenquiries@australiansuper.com.

-

Does my authority and Adviser Portal access to my client’s account details expire?

All third-party authorities are valid for a maximum of 10 years from commencement. You can always submit a new authority to access information signed by your client at any time.

-

How does my client register for online access to their account?

Once their AustralianSuper account is active, members can register for online access to their account by visiting australiansuper.com/register All they need is their AustralianSuper member number (Customer reference number (CRN) for Choice and TTR Income account members) and email address.

Members will be able to check their account balance and withdrawals, manage their investments and insurance cover (if applicable), and make and/or change beneficiary nomination(s).

Registering is easy and should only take a few minutes.

Downloading the AustralianSuper app

Once a member has set up their account online, they can download the AustralianSuper app; a free and easy way to access and manage their account on mobile or tablet device.

To download the app from the Apple Store or Google Play, members can visit australiansuper.com/mobile

Members will be able to use the same login as the one created for their AustralianSuper account online the first time they access the app. They can then create a four-digit pin for all future logins to the app.

-

If there’s a valid binding nomination on the account (for the deceased’s spouse), do I still need a No intent to apply for a death payment form from the adult children of the deceased?

If a client passes away, and their spouse has submitted a death claim, the Trustee (AustralianSuper) is obliged to assess the Binding Death Benefit Nomination (BDBN) form submitted by the member to determine whether the BDBN is valid as at the date the member passed away.

This includes any issues of the member’s capacity to make the BDBN and a determination as to whether the person nominated is a ‘dependant’ under the law. Therefore, we’re required to conduct enquiries about the member and their circumstances.

A No intent to apply for a death payment form doesn’t need to be completed by the deceased member’s adult children, but if the completed form is provided to us, it will assist with our enquiries.

Also, we still have duties (as a Trustee) to notify all potential claimants of our intention to distribute a benefit in a certain way. A 28-day letter, with the opportunity to object to us, and then onto an external dispute resolution body (AFCA) is required under the Corporations Act s1056.

If we don’t do this, and the fund pays a benefit to a beneficiary (under a binding nomination) that’s proven to be invalid, AustralianSuper may have to pay the benefit twice.

-

How should Power of Attorney (POA) documents be prepared and submitted?

To ensure timely processing, please be advised that POA documents should:

- be in writing and be made by a person aged 18 years or over who can understand the nature of a POA

- be scanned certified copies.

- be certified on the first and last pages and initialled on all other pages, at a minimum. Note: If all POA pages are certified, this is also acceptable.

- include the original certified identification for the nominated POA. AML/CTF legislation prevents us from acting on any instruction from an attorney until this is received. Acceptable forms of photo ID are driver’s licence or a passport.

- include at least 3 client identification points such as client’s full name, date of birth, member number and address, for security reasons. Alternatively, a cover letter accompanying the POA document dated and signed by the nominated attorney, adviser (with third party authority) or the client containing 3 points of member identification is acceptable.

- be emailed to adviserservices@australiansuper.com. Remember to also attach a copy of the documents (including the cover letter, if used) for our reference.

-

Are amendments allowed to an already completed Binding nomination form?

No, if any changes, amendments or corrections need to be made to a form, then a new form is required. The member cannot initial changes on an existing form, and the same form cannot be submitted.

Contributions

-

How does my client contribute to their AustralianSuper account?

Personal contributions can be made to your client’s AustralianSuper account via BPAY, Cheque, Direct Debit or EFT.

BPAY1 – is the fastest way for a personal contribution to be made to AustralianSuper. BPAY payment details are unique to each member and can be found on their member profile on the Adviser Portal, the member’s online AustralianSuper account, or can be requested via the Adviser Services team.

Cheque – A cheque made payable to AustralianSuper can be mailed to us.

Add to your super with after-tax contributions

Direct Debit – We can set up a once off or ongoing Direct Debit from your client’s bank using the below form:

Add to your super with after-tax contributions

This form can be emailed to the Adviser Services team at adviserservices@australiansuper.com

EFT – We can also accept an EFT payment to:

BSB: 083-355

Account: 674065855

Bank: National Australia Bank

Reference: Account Number

Account name: Pacific Custodians P/L ATF AustralianSuperEFT must only be made once a member’s account is open. Once payment has been made, the Adviser Services team must be advised by email at adviserservices@australiansuper.com to have the payment allocated. If the Adviser Services team is not advised, the payment may not be allocated and could be refunded back to the member.

1. ® Registered to BPAY Pty Ltd ABN 69 079 137 518 -

How does my client make a Downsizer contribution?

Acceptable forms of payment for a Downsizer contribution are:

- EFT payment to:

BSB number: 083-355

Account number: 674065855

Account name: Pacific Custodians P/L ATF AustralianSuper

Bank: National Australia Bank

Reference: Your AustralianSuper Member Number_First Name_Last Name

EFT must only be made once a member’s account is open. Once payment has been made, the Adviser Services team must be advised by email at adviserservices@australiansuper.com to have the payment allocated. If the Adviser Services team is not advised, the payment may not be allocated and could be refunded back to the member.

- Cheque – made payable to AustralianSuper can be mailed to us.

When the Downsizer contribution is received via EFT or cheque, a completed ATO Downsizer contribution into superannuation form must also be received for the Downsizer contribution to be allocated. The signed and dated ATO form must be received by the fund either before, or at the same time, the fund receives the contribution.

If you make multiple contributions to the fund, you must provide a Downsizer contribution into superannuation form for each contribution, remembering the total of your contributions must not exceed $300,000.

Please visit ato.gov.au to download a copy of the ATO Downsizer contribution into superannuation form.

- EFT payment to:

-

How does my client make a Capital Gains Tax (CGT) Election Payment?

Acceptable forms of payment for a CGT contribution are:

- Cheque – made payable to AustralianSuper can be mailed to us.

- EFT payment to:

Account name: Pacific Custodians P/L ATF AustralianSuper

BSB: 083-355

Account number: 674065855

Bank: National Australia Bank

Reference: Account NumberWhen making a payment, please:

- Ensure the member’s account is open.

- Complete the ATO Capital Gains Tax Cap Election form.

- Email the Adviser Services team with the attached form to have the payment allocated.

Please note we must receive the signed and dated ATO form before, or at the same time, that we receive the contribution.

If the above steps are not completed, the payment may not be allocated and could be refunded.

-

How do I complete a recontribution strategy for my client at AustralianSuper?

A recontribution strategy can be completed by withdrawing a lump sum from any combination of AustralianSuper accumulation, TTR Income or Choice Income account(s). Your client will need an AustralianSuper accumulation account to receive the contribution.

Follow the steps below to complete a recontribution strategy.

1

Consider tax deductions

Complete a Claiming a tax deduction for personal contributions form before the withdrawal is made if your client intends to claim a tax deduction.

Complete a Claiming a tax deduction for personal contributions form before the withdrawal is made if your client intends to claim a tax deduction.2

Withdrawal from accumulation account

Complete an Apply for a payment form for a full or partial withdrawal from your client’s accumulation account.

Complete an Apply for a payment form for a full or partial withdrawal from your client’s accumulation account.

If you apply for a partial withdrawal, ensure there is an account balance of at least $6,000 to keep the account open.

If you apply for a full withdrawal, the account will be closed, and any insurance will be cancelled.2

Withdrawal from TTR Income/Choice Income account

Complete a Request a full withdrawal of your Choice Income or TTR Income account form for a full withdrawal and closure of your client’s Choice Income or TTR Income account.

Complete a Request a full withdrawal of your Choice Income or TTR Income account form for a full withdrawal and closure of your client’s Choice Income or TTR Income account.

Complete a Request a partial withdrawal of your Choice Income or TTR Income account form for a partial withdrawal of your client’s account balance.3

Recontribution type

Your client has an accumulation account: Recontribution can be made to the existing account.

Your client has an accumulation account: Recontribution can be made to the existing account.

Your client does NOT have an accumulation account OR Your client has an accumulation account but wants to keep the tax-free component segregated: Your client will need to open a new/additional Personal Plan accumulation account.4

Open Personal Plan accumulation account

Read the PDS before applying for a new AustralianSuper accumulation account.

Read the PDS before applying for a new AustralianSuper accumulation account.5

Investment choice

Complete the Investment choice form before the contribution is made if your client would like to pick their investment options.

Complete the Investment choice form before the contribution is made if your client would like to pick their investment options.6

Recontribute the money into the accumulation account as a tax-free non-concessional contribution

7

Optional: Open Choice Income account

Read the PDS before applying for a new AustralianSuper Choice Income account. Your client can then request to transfer whole or partial balance of the accumulation account to the Choice Income account.

Read the PDS before applying for a new AustralianSuper Choice Income account. Your client can then request to transfer whole or partial balance of the accumulation account to the Choice Income account.

SMSF

-

How does my client roll in to AustralianSuper from their Self-Managed Super Fund (SMSF)?

To rollover their SMSF super balance into their AustralianSuper account, clients can complete the Combine your super form at australiansuper.com/forms

They will need to provide us with the following details for AustralianSuper to request the transfer of super:

- SMSF name and ABN

- Active SMSF Electronic Service Address (ESA)

Obtaining an Electronic Service Address (ESA)

If the client needs an ESA, they can obtain this from:

- their SMSF Administrator, tax agent, accountant or bank; or

- a dedicated SMSF messaging provider – go to ato.gov.au/esa for registered providers.

-

How does my client roll out from AustralianSuper to their Self-Managed Super Fund (SMSF)?

To rollover their AustralianSuper account balance to their SMSF, clients can complete the Apply for a Payment form at australiansuper.com/adviserresources

They will need to provide us with the following details:

- SMSF name, ABN and bank account details

- Active SMSF Electronic Service Address (ESA)

- Certified copy of a SMSF bank document that clearly displays the SMSF account name, BSB and account number (current document issued within last 12 months)

Obtaining an Electronic Service Address (ESA)

If the client needs an ESA, they can obtain this from:

- their SMSF Administrator, tax agent, accountant or bank; or

- a dedicated SMSF messaging provider – go to ato.gov.au/esa for registered providers.

Our products

General info

-

Where can I find AustralianSuper’s product TMDs and learn more about adviser Design and Distribution Obligations (DDO) responsibilities?

A Target Market Determination (TMD) describes the target market for a financial product and relevant conditions in relation to the distribution of the product to consumers. It also includes the events or circumstances where we may need to review our products and the TMD. You can view AustralianSuper’s TMDs here.

TMDs are a requirement of the Treasury Laws Amendment (Design and Distribution Obligations and Product Intervention Powers) Act 2019. Read the FAQs to learn about superannuation product design and distribution obligations (DDO) for financial advisers.

-

What’s the difference between Personal, Industry and other accumulation product divisions at AustralianSuper?

If you’re setting up a new member to join AustralianSuper, we have a range of accumulation divisions tailored for different individuals, employers and employment arrangements. Below provides a brief description of the main divisions:

- Personal Plan (no default insurance) – this division is for members who do not require default insurance, or are self-employed as sole traders, or as a partner in a partnership, or who aren’t currently in paid employment, or who are retired or who won’t be receiving regular Super Guarantee (SG) contributions.

- AustralianSuper plan (Industry division with default insurance) – this is our largest division and is open to members in full-time, part-time or casual employment within any industry, who receive regular SG contributions, and require default insurance (insurance is activated by and dependant on receiving SG contributions).

For further details on our accumulation product divisions, download the relevant PDS under the All documents tab on this site.

Note: If you join up a member to the Industry division (AustralianSuper plan), default insurance is provided automatically once they’re eligible. They’re eligible once they’re 25 or older; and have a super balance of $6,000; and receive an employer super contribution after they meet both age and balance requirements (other conditions apply). They will also need to ensure they have enough money in their super account to cover the cost of insurance. If your client does NOT want default insurance, you should consider the Personal Plan. Please read the PDS for further details on each division.

-

How do crediting rates and investment returns work?

We calculate the investment performance of your clients’ investment options every business day. We do this through crediting rates, published on our public site.

Crediting rates change based on movements in investment markets and can increase your client’s account balance if positive, or reduce if negative. Their balance is likely to change most days based on these movements and any transactions on your account.

Crediting rates are net of fees and tax, so they’re shown after all fees and taxes related to managing the investment portfolio have been taken out.

To learn more on how these rates are published, when they’re applied and how they’re calculated, you can view on our crediting rates page.

-

What is your insurance cover design?

The default insurance cover design depends on the division your client joins. Please note that default insurance is not available in the Personal Plan. Default insurance cover available in AustralianSuper Select may differ due to tailored employer-sponsored insurance arrangements.

Eligible members receive a basic level of age-based cover without having to provide any health information. They’re eligible once they’re 25 or older; and they have a super balance of $6,000; and they’re receiving employer super contributions (age limits and other conditions apply). If your client is younger than 25, they’ll have to apply for cover.

Income Protection is available from age 15 to age 69, and your client can choose between age-based or fixed cover. Default Income Protection isn't available in Super Options, but your client can apply for it anytime.

Death cover is available from age 15 to age 69, and Total & Permanent Disablement (TPD) from age 15 to 64. For Death and TPD cover, your client can choose between age-based, age-based plus extra (fixed) cover or just fixed cover. If your client has Death or TPD cover with AustralianSuper they may be able to claim a benefit for terminal illness.

Generally, the cost of cover increases as the member gets older. Insurance premiums are quoted on a weekly rate and are deducted monthly from the member’s super account. For further details on our insurance, please read the relevant PDS and Insurance Guide available under the All documents tab on this site.

-

How do I access term deposits for my client?

Term deposits are available only via Member Direct. If you require term deposits for your client, they’ll need to register for a Member Direct account. Please see the steps above to register for a Member Direct account and refer to the Member Direct Guide for further details.

-

Does AustralianSuper publish its PreMixed option asset allocation by weight?

Yes, we publish the asset allocation for each Premixed investment option every quarter1. This also includes:

- Foreign currency exposures

- Growth and Defensive assets split

- Performance snapshot

- Investment objectives, and

- Risk levels based on the time invested.

You can view this information on our PreMixed investment options page. For asset allocations for previous quarters, please contact our Adviser Services team.

1 Data is published approximately 45 days after the end of each quarter. This ensures the protection of members’ interests by avoiding the disclosure of our investment strategy in a manner that could negatively impact members’ returns.

Retirement

-

What are your retirement income products at AustralianSuper?

If you’re setting up a client to join AustralianSuper, and who’s transitioning to either part or full retirement, they have two choices for an income stream:

- Choice Income account – for clients retiring and wanting to draw an income from their savings in a tax-effective environment.

- Transition to Retirement (TTR) Income account – for clients not yet retired and looking to supplement their income by drawing on their super savings.

Note: Generally, your client will need a $10,000 minimum balance for a Choice Income account and $10,000 minimum for a TTR account. However, where their advice strategy requires a lower starting balance, we may be able to arrange an exception for you. If this is the case, please get in touch to discuss.

For further details on our retirement product divisions, download the relevant PDS under the All documents tab on this site.

-

How do I roll a pension over from another fund to AustralianSuper? Do I need to open a super account first or can the pension be rolled over directly to an AustralianSuper Choice Income account?

Unless your client is adding money from outside super (for example, making a non-concessional contribution), then you can roll their external pension directly to a new AustralianSuper Choice Income account. Join the new member using an application form for the relevant retirement account via the PDS or online. On the application form, there’s space to roll in one external fund. If there’s more than one external fund rolling in to the new account, also complete a Combine your super into AustralianSuper form.

It’s a good idea when rolling a pension over from another fund, to check if the pension is a Death Benefit Pension, as these monies must remain separate in terms of legislation and cannot be sent via SuperStream. It’ll be necessary for the outgoing fund to process your request manually and provide us with a Death Benefit RBS.

Please get in touch at adviserservices@australiansuper.com if you have any questions.

-

What happens when a TTR Income account transfers to a Choice Income account?

When a member meets a condition of release, their TTR Income account is converted to a Choice Income account. All details including account number stay the same, but the name of the product changes. When this occurs, a Balance Booster amount will be credited to the account on the day the account changes over. This will happen automatically when the member turns 65 years. Additionally, if the member had an AustralianSuper accumulation super account before moving to a TTR Income account, their whole account history is taken into account when Balance Booster is calculated.

Member Direct

-

What is Member Direct?

The Member Direct investment option offers members more control and choice of their super or retirement income investments. They can invest in shares, Exchange Traded Funds (ETFs), Listed Investment Companies (LICs), term deposits and cash – all from an easy-to-use online platform.

There’s a separate AustralianSuper Member Direct portal where you can access your client’s Member Direct investment details and make transactions on their behalf (subject to having submitted a valid client authority form.

-

How does my client set up Member Direct?

Before commencing a Member Direct account, we recommend that both you and your client read the Member Direct Investment Guide and the Member Direct Menu located under the All documents tab on this site.

Step 1: Your client first needs to have an AustralianSuper accumulation or pension account, and register for member online access to the Member Portal.

Step 2: Once the funds are available in their AustralianSuper account, the member can then register for a Member Direct account. They can do this by logging in to their online account and locating the ‘Member Direct’ tile via the Investments tab.

Step 3: To register for Member Direct, they’ll need to make a cash transfer from their existing AustralianSuper account. Please note they cannot transfer their whole balance into Member Direct. A minimum of $5,000 needs to remain in their PreMixed and/or DIY Mix options. It takes two days before the cash is available to invest on Member Direct. You may prefer to assist the member with this process; however access is only available via the member’s online account.

Step 4: Your client will need to complete a Give Access to your Member Direct Account form, and nominate your access as either “read only” or “read and transact”. Please email this completed form to adviserservices@australiansuper.com and you’ll be sent the login details to the Member Direct portal.

Step 5: To access your client’s Member Direct accounts, simply login to the Member Direct portal. The link is also under the Member Direct tab on this site. Once logged into the Member Direct portal, you can make transactions in Member Direct on behalf of your client via the UBS share trading facility. You’ll need to have ‘read and transact’ access in order to do this.

Step 6: If you’re charging for an advice fee to be debited from the client’s Member Direct account, use the Request to Pay Advice fee - Member Direct form

Handy hints:

- Members in a Transition to Retirement (TTR) Income account can only register for Member Direct using their Accumulation account, not their TTR Income account.

- Special rules apply to Member Direct. There are minimum account balance requirements and investment limits that apply to ETFs, LICs, and shares. Also, once you open a Member Direct account, you must keep a minimum ongoing balance in your other AustralianSuper investment options at all times. For all the information you need to help your client set up and maintain their Member Direct account, visit australiansuper.com/MemberDirectGuide.

- Member Direct investing uses a separate system to regular AustralianSuper accumulation and retirement products.

- Using the regular AustralianSuper Adviser Portal, you’ll only be able to view the high level amounts in you client’s Member Direct option. To view the full details of their investments or transact on their account (subject to your authorisation level), you’ll need to log in via the Member Direct portal.

-

How do I transact on Member Direct for my clients?

You transact via the Member Direct portal at memberdirectnew.australiansuper.com/login. Your client’s account will be available once we have received and processed a completed Give Access to your Member Direct account form.

-

How do I get access to a member’s Member Direct account?

- Your client needs to complete a Give Access to your Member Direct Account form nominating access level as either “read only” or “read and transact”.

- You then email this completed form to adviserservices@australiansuper.com

- You’re then sent the login details to access the Member Direct portal.

-

I’ve received my username and password, how do I log in?

Once you’ve received your username and temporary password, you can log in to Member Direct.

Please note: your temporary password expires 11:59 pm on the same day you receive it, so if it’s no longer working, please email us and we’ll create a new password for you. This process can take 2-3 business days.

-

How do I view my clients in Member Direct?

After you log in, you’ll see the list of your Member Direct clients for which you have read and/or transact access. Under the Administration tab, you’ll be able to select those clients for which accounts you want to administer.

Once you’re in client’s account and wish to swap over to another client, go to the human icon and click on ‘Administration’. This will take you back to the list of your Member Direct clients.

You can now use the ‘Invest’ page to invest in S&P/ASX300 shares, select ETFs and LICs, term deposits, or cash depending on the option they’re in.

-

How do I transfer cash?

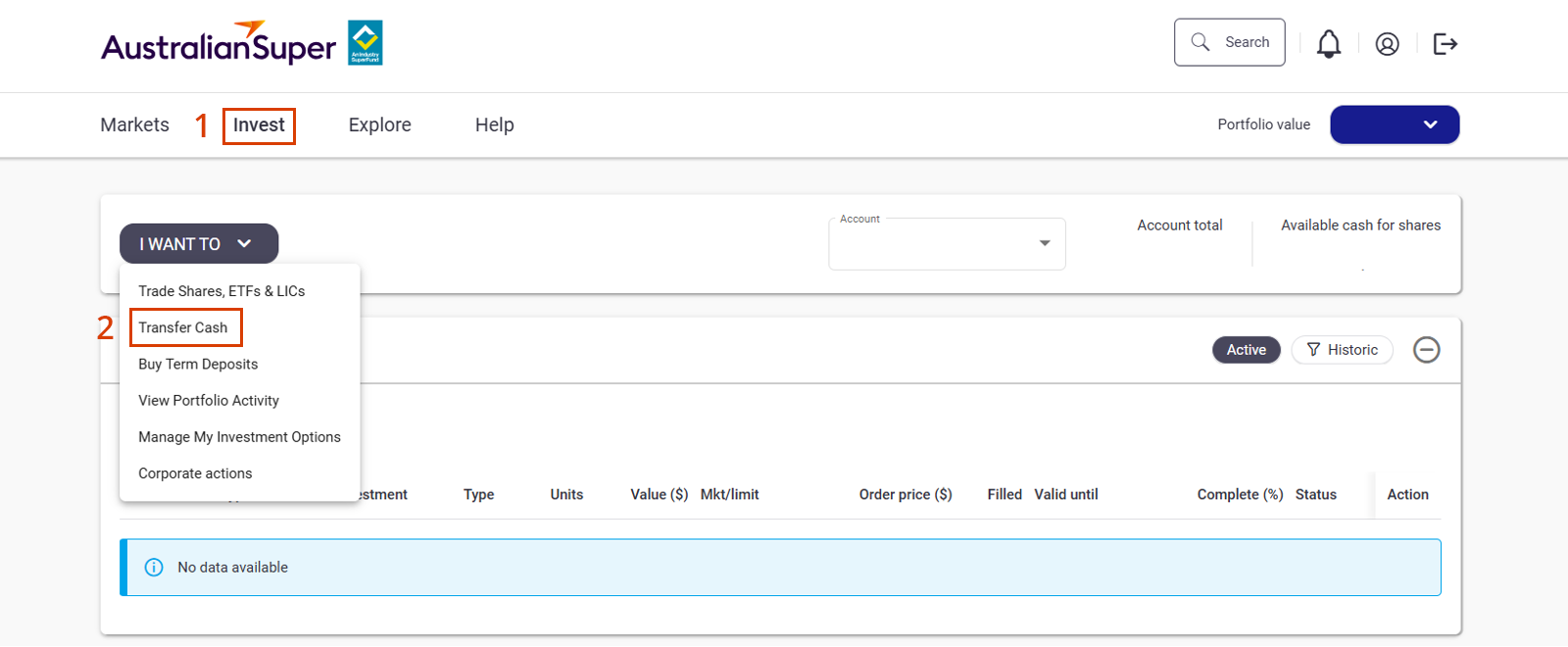

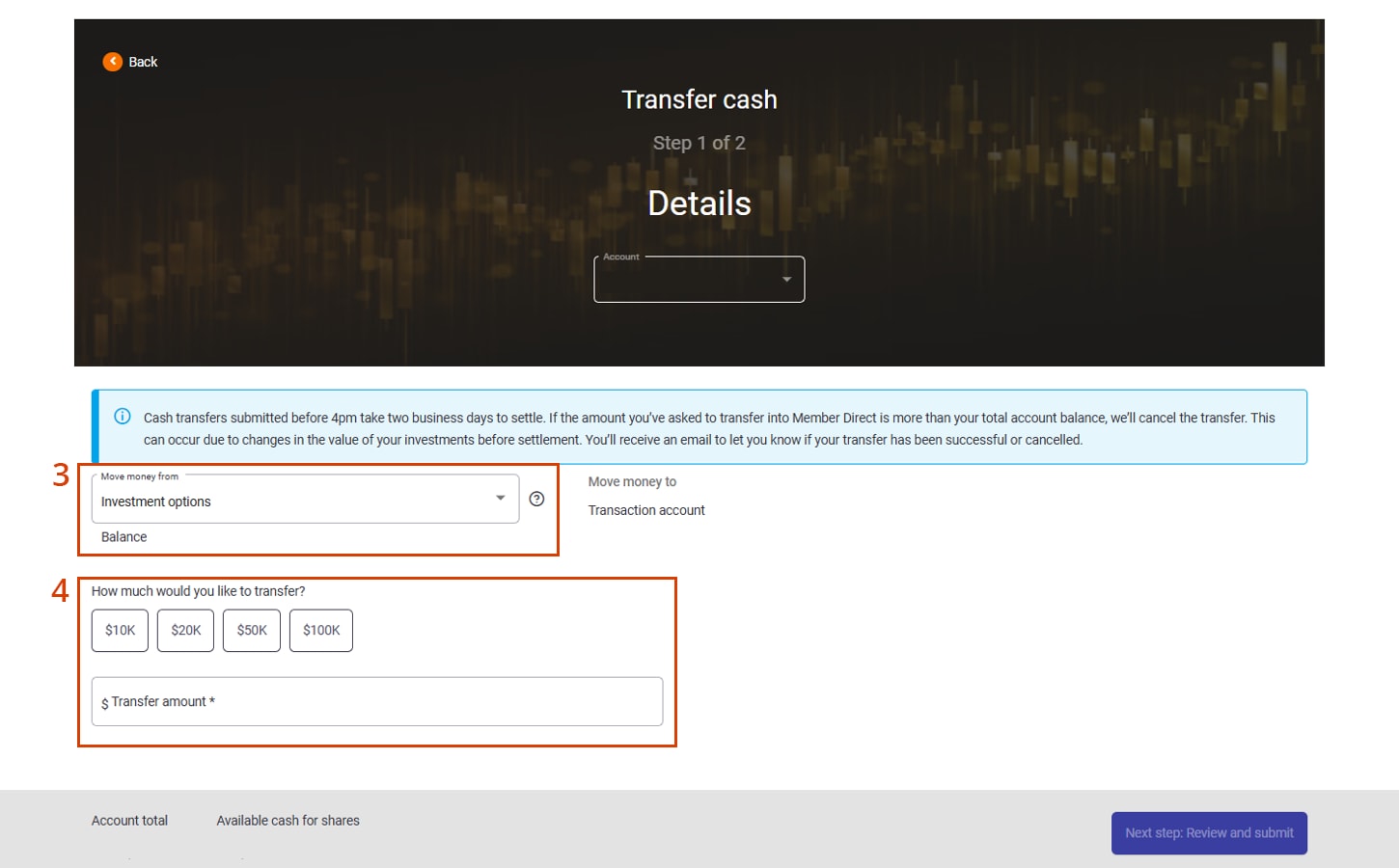

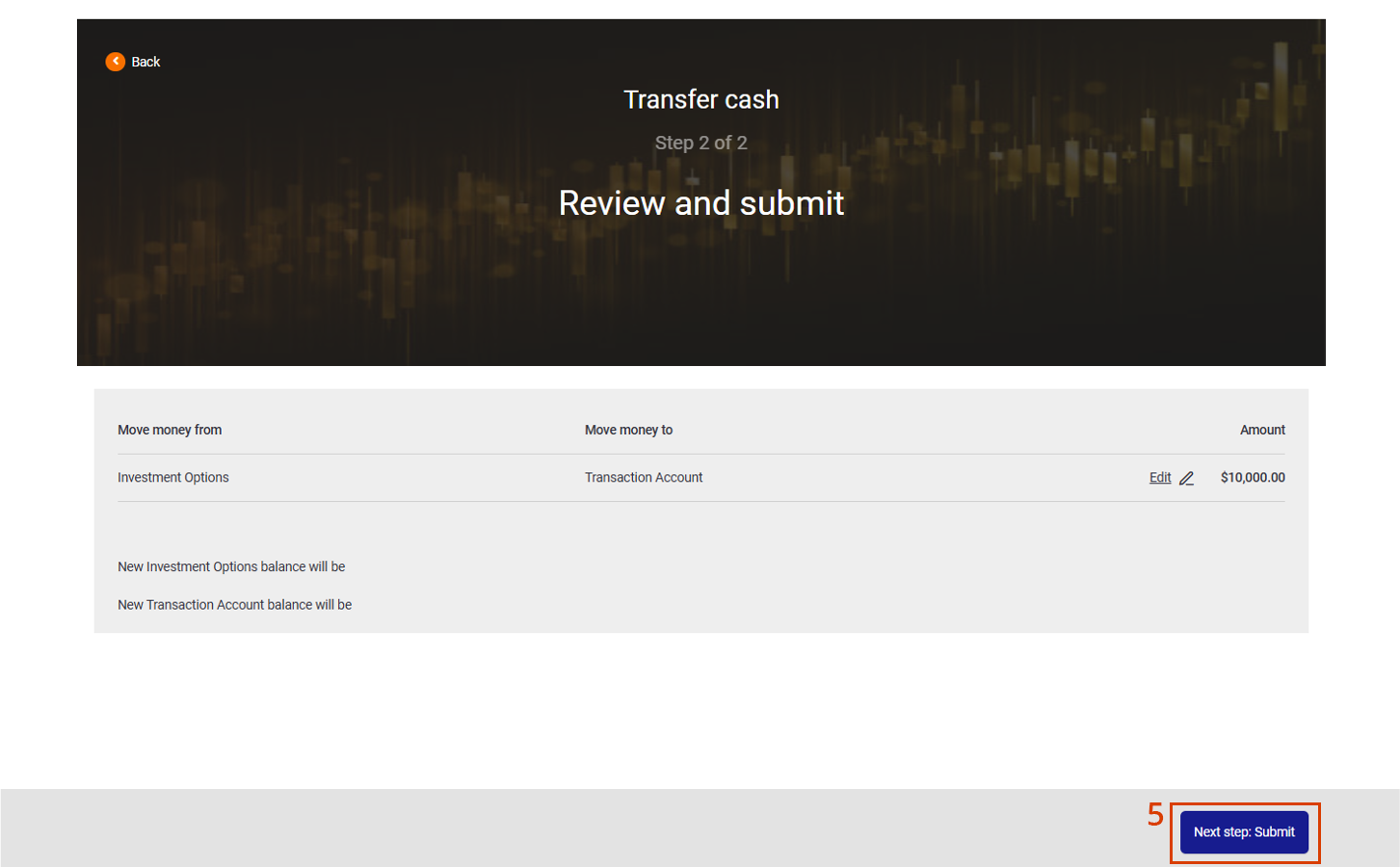

You can transfer cash between the Member Direct Cash account and your clients’ other AustralianSuper investment options once per business day. To make a cash transfer, please follow the steps below:

- Select the ‘Invest’ tab

- Select the ‘Transfer Cash’ button (under the ‘I WANT TO’ button)

- Select the ‘Move money from’ button to switch which account you are transferring from

- Enter the transfer amount. Note: You can nominate a specific amount or choose from the available presets ($10K, $20K, $50K and $100K).

- Select the ‘Review and submit’ button to review your selections before submitting

- Click the ‘Submit’ button to finalise

-

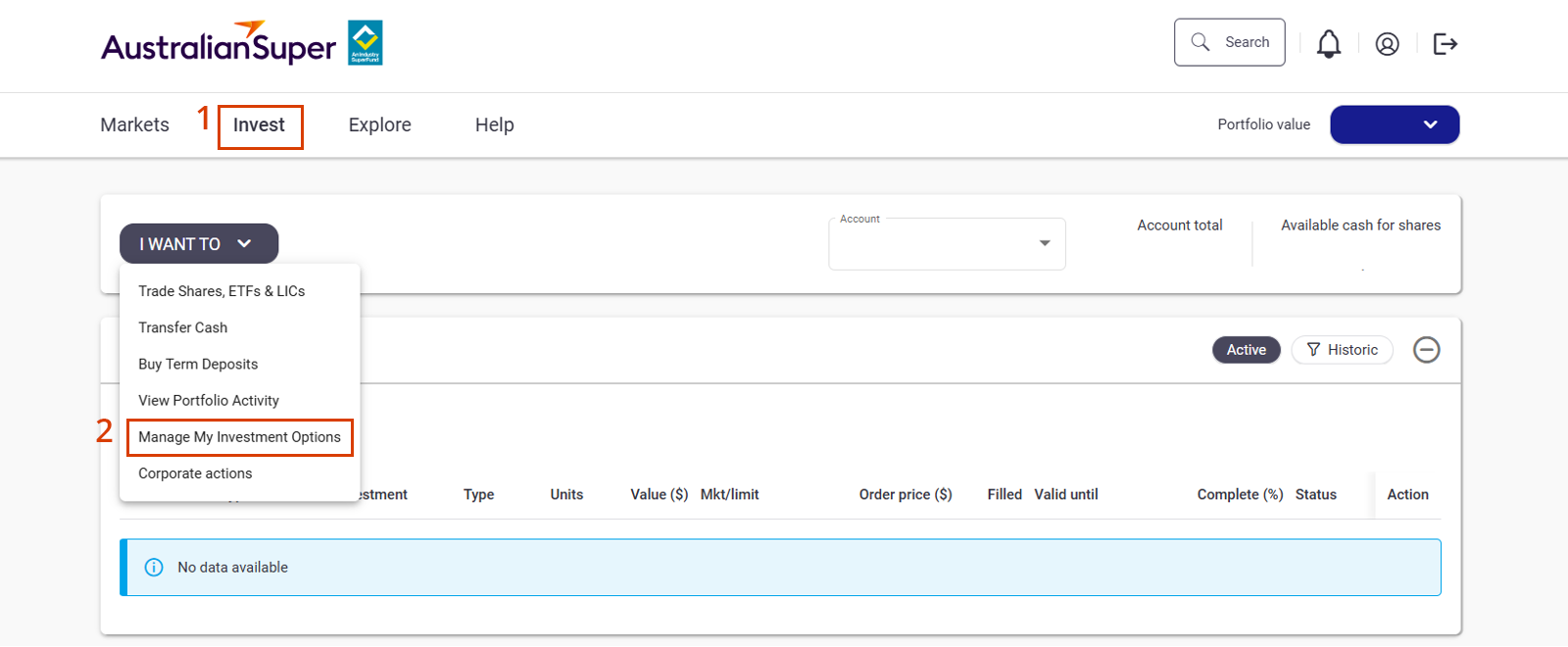

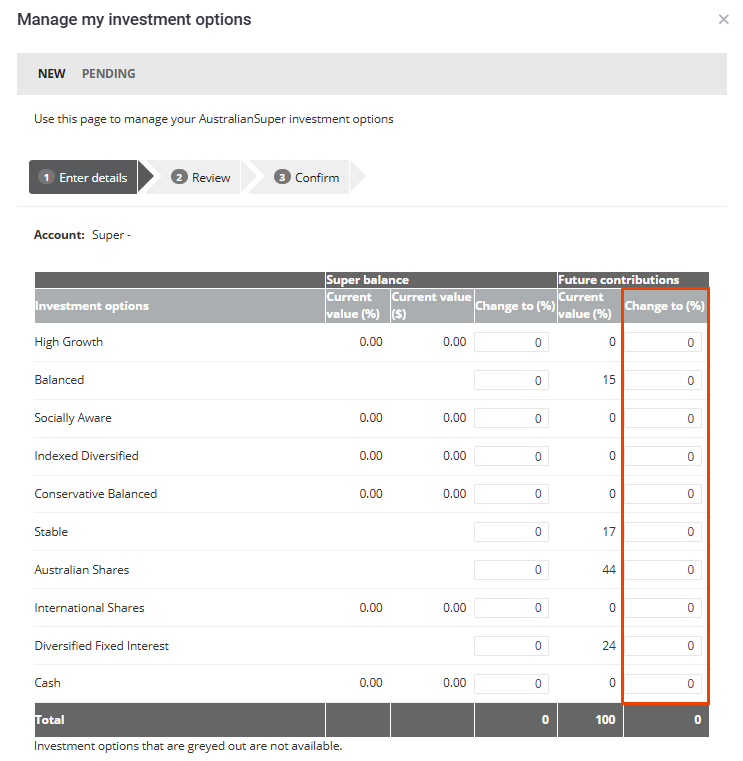

How do I submit an investment switch?

You can submit an investment switch for your clients’ investment options once per business day.

Note: you can’t submit an investment switch and a cash transfer at the same time.

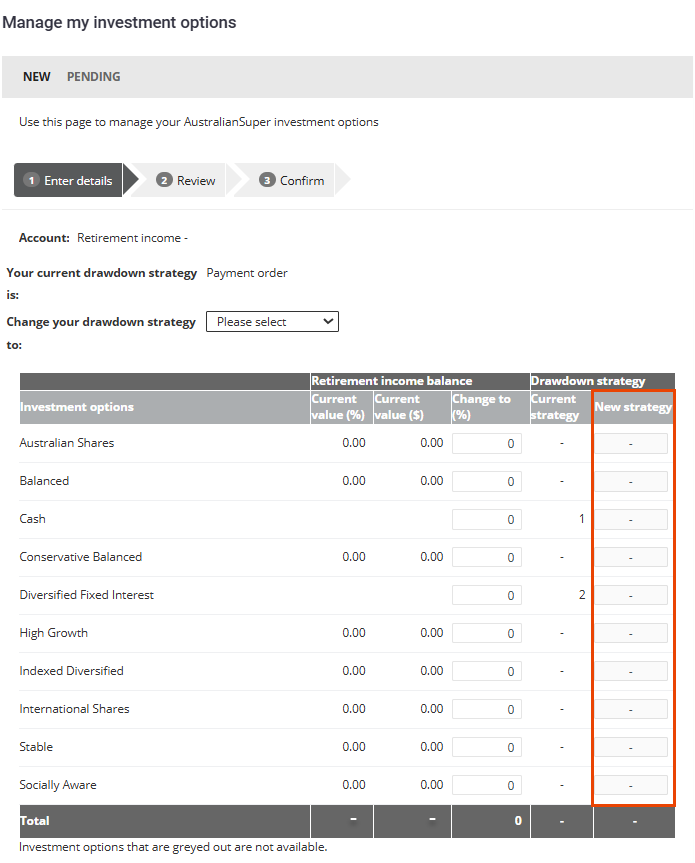

To make an investment switch, please follow the steps below:

- Select the ‘Invest’ tab

- Select ‘Manage My Investment Options’ (under the ‘I WANT TO’ button)

- You’ll see your clients’ current investment mix and weightings under the ‘Current value (%)’ tab. To perform a switch, you’ll need to enter the new weighting in the ‘Change to (%)’ tab. The amount needs to be a whole value, decimals aren’t accepted.

For super accounts, you’ll also need to update the future contribution weightings to allocate where your clients’ contributions are deposited into the future. You can do this by inserting a whole number in the ‘Change to (%)’ tab. Decimals aren’t accepted.

For pension accounts, you can also choose to change your clients’ drawdown strategy and where they receive their pension payments from. You can do this by inserting a whole number in the ‘New strategy’ tab. Decimals aren’t accepted.

-

How do I invest in Term Deposits?

You can request to invest in Term Deposits once a week. If we receive your request before 11.59pm AEST/AEDT (Melbourne time) on a Thursday your investment in the Term Deposit will take effect on the Friday (or the next business day if it is a public holiday). If your request is received after this time, it will take effect from the following Friday (or the next business day if it is a public holiday).

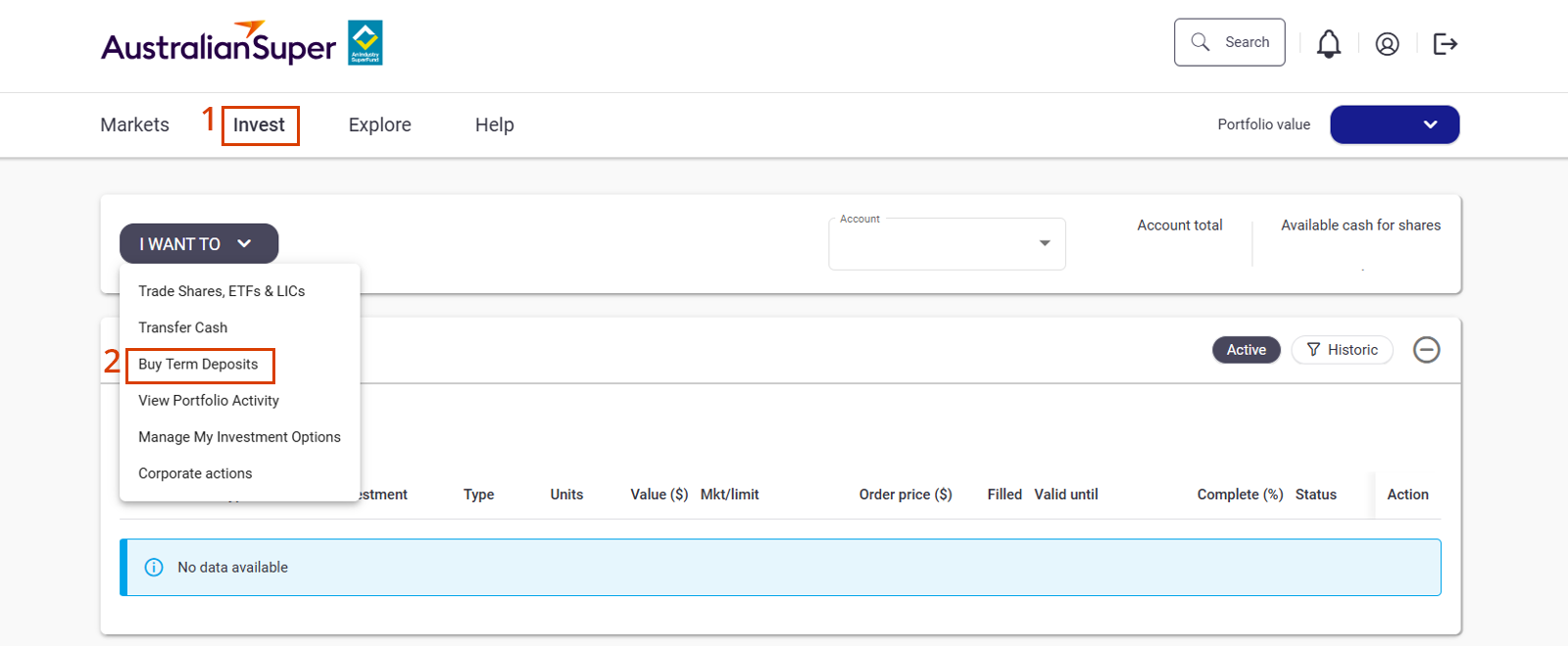

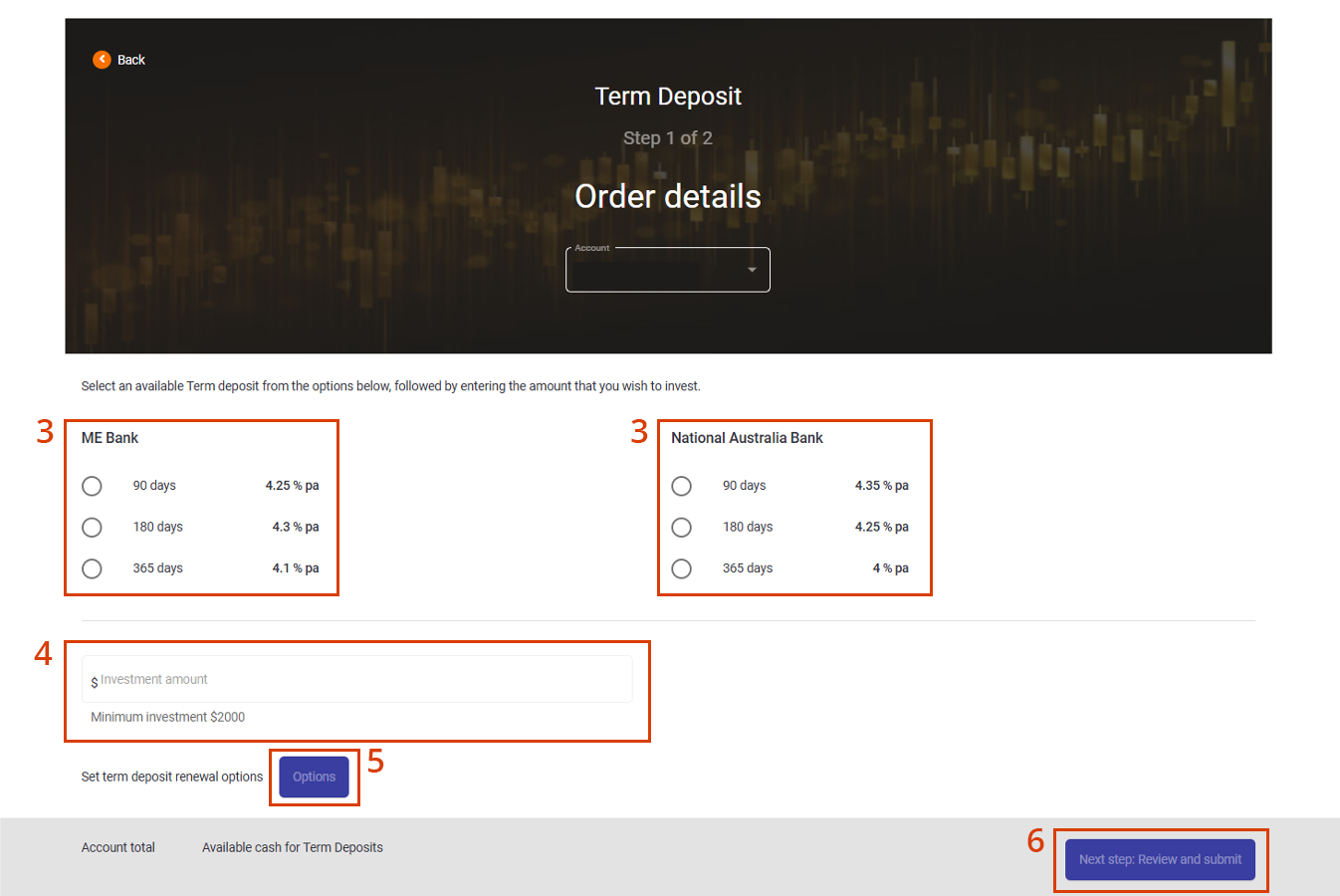

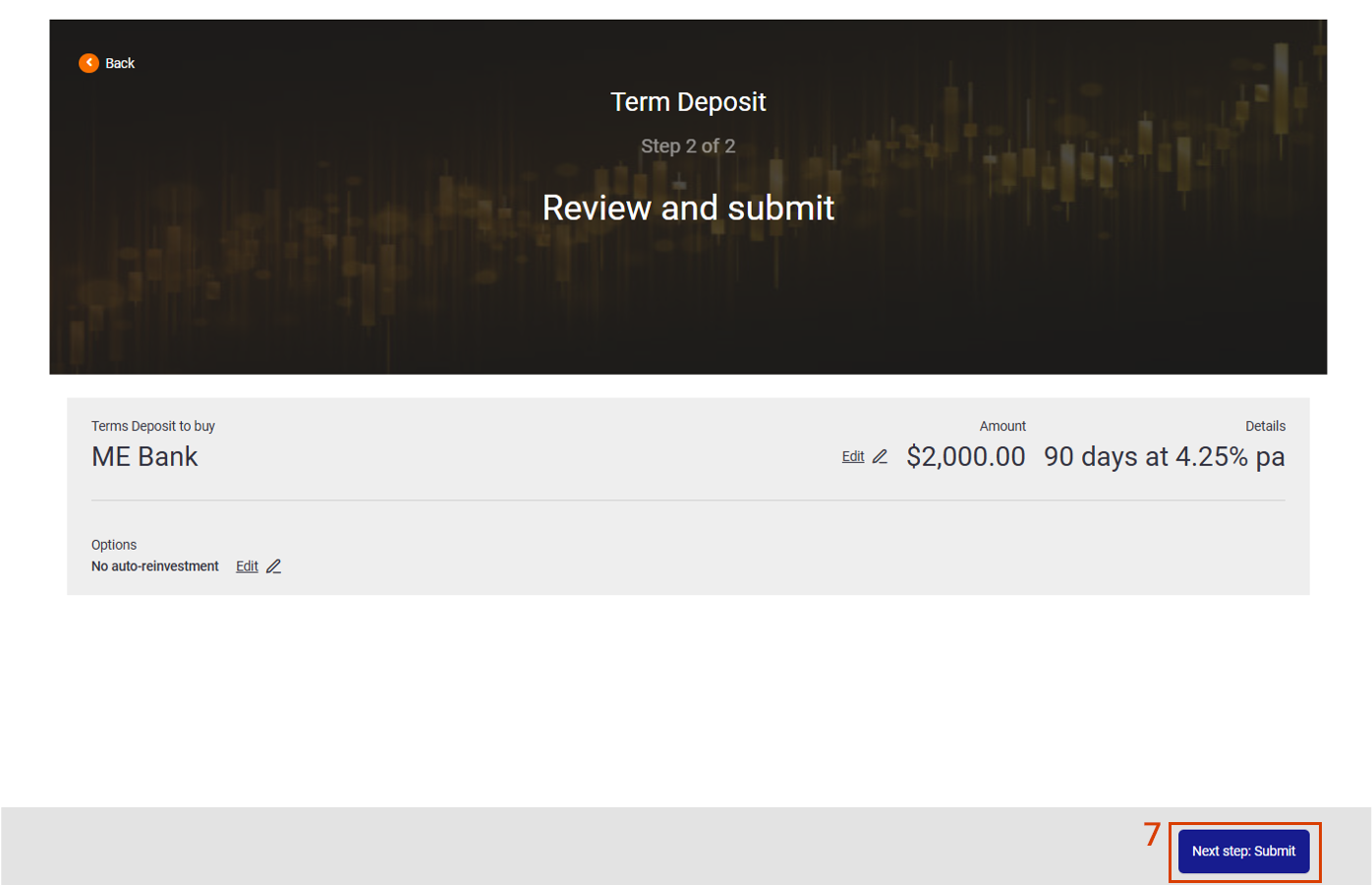

To invest in a Term Deposit, please follow the steps below:

- Select the ‘Invest’ tab

- Select ‘Buy Term Deposits’ (under the ‘I WANT TO’ button)

- Select the available Term Deposit by clicking on the interest rate.

- Enter the investment amount. Note: the minimum investment is $2,000.

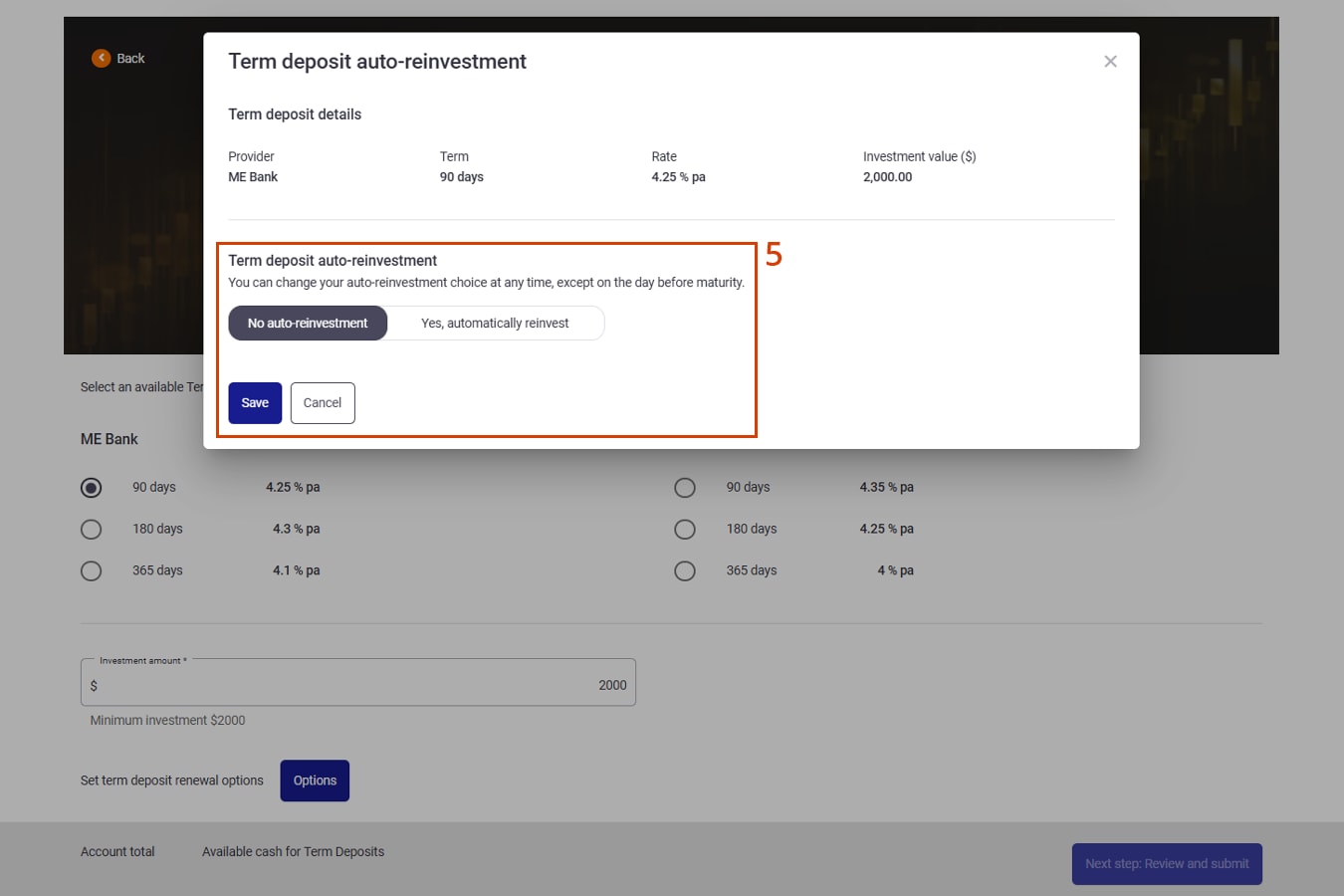

- To set term deposit options, select the ‘Options’ button to choose your auto-reinvestment preference. Click ‘Save’ to proceed.

- Select the ‘Review and submit’ button to review your selections before submitting.

- Select the 'Submit’' button to finalise.

-

How do I buy and sell shares, ETFs and LICs?

You can submit an order request to buy or sell shares, ETFs and LICs at the market price (‘at market order’) or set a price limit (‘limit order’).

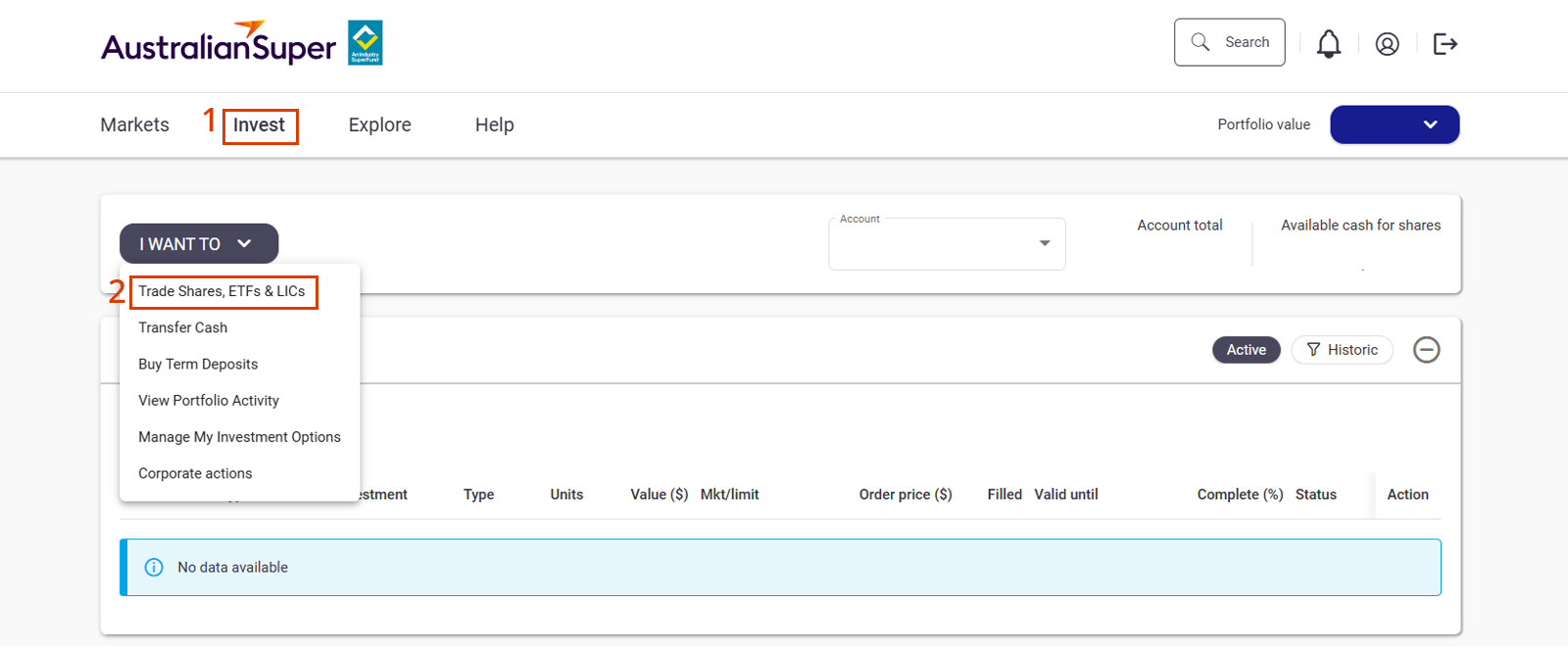

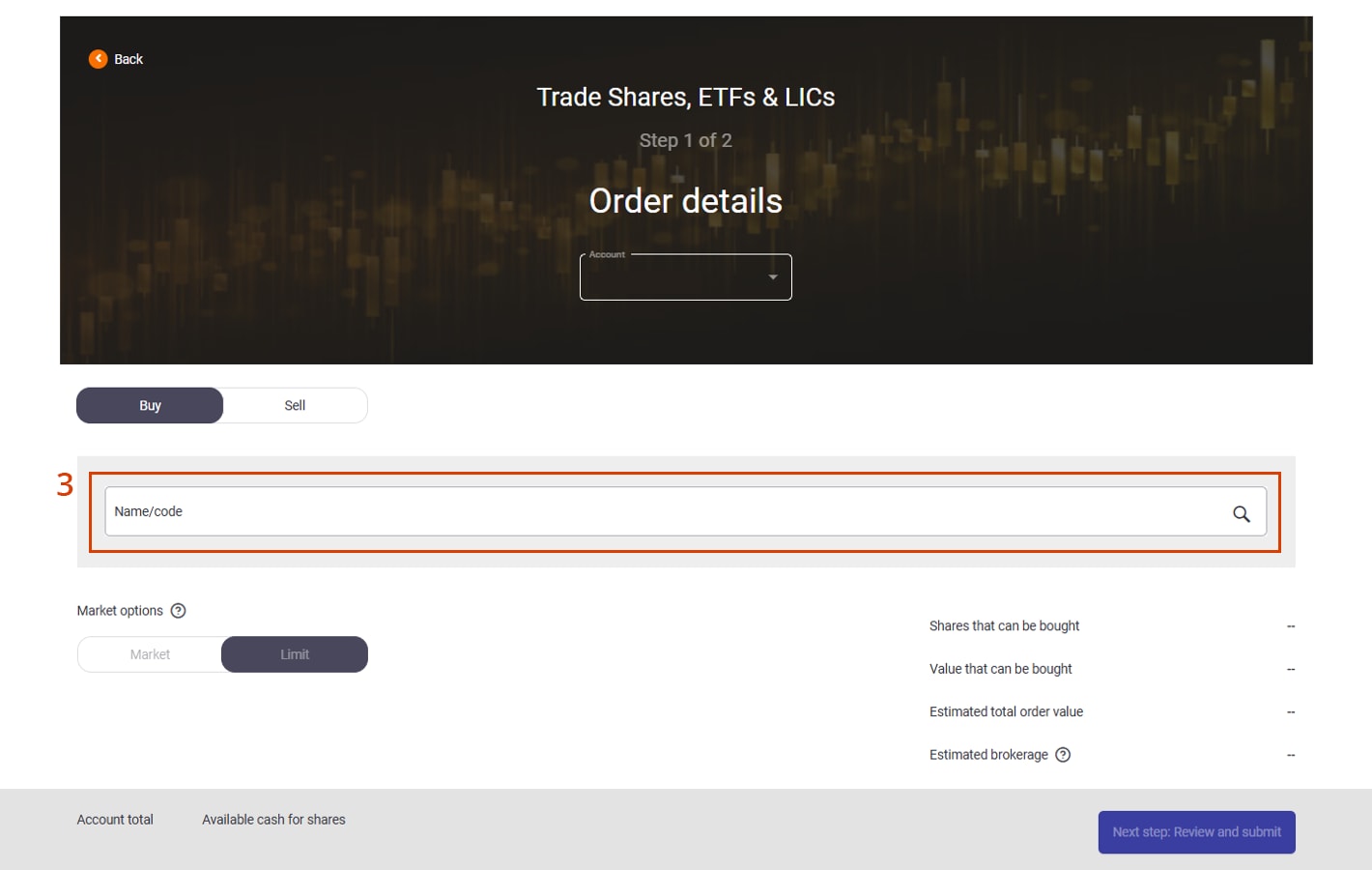

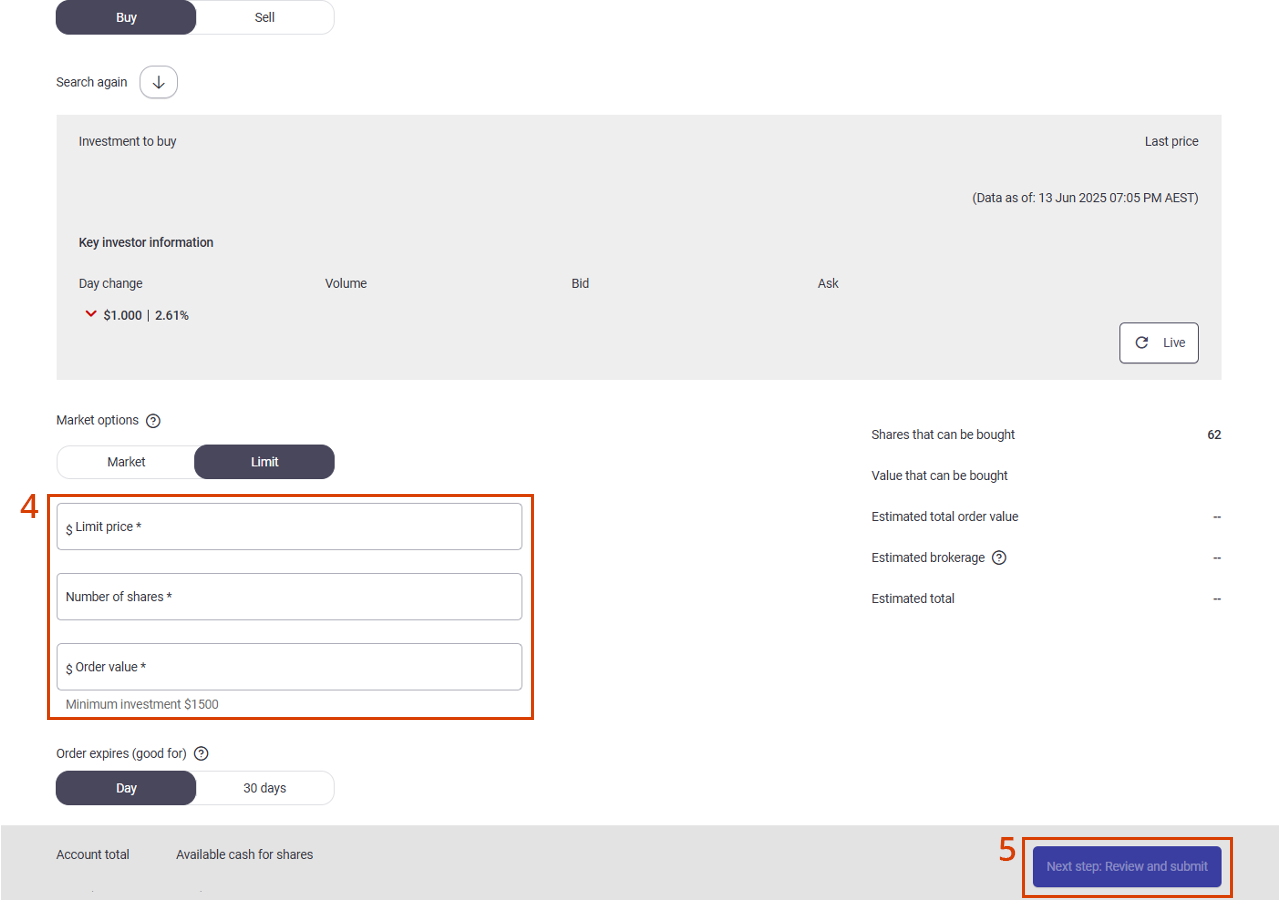

To submit an order, please follow the steps below:

- Select the ‘Invest’ tab

- Select Trade Shares, ETFs & LICs (under the ‘I WANT TO’ button)

- Enter the ASX company name or ticker code

- Enter the Limit Price, Number of Shares or Order Value

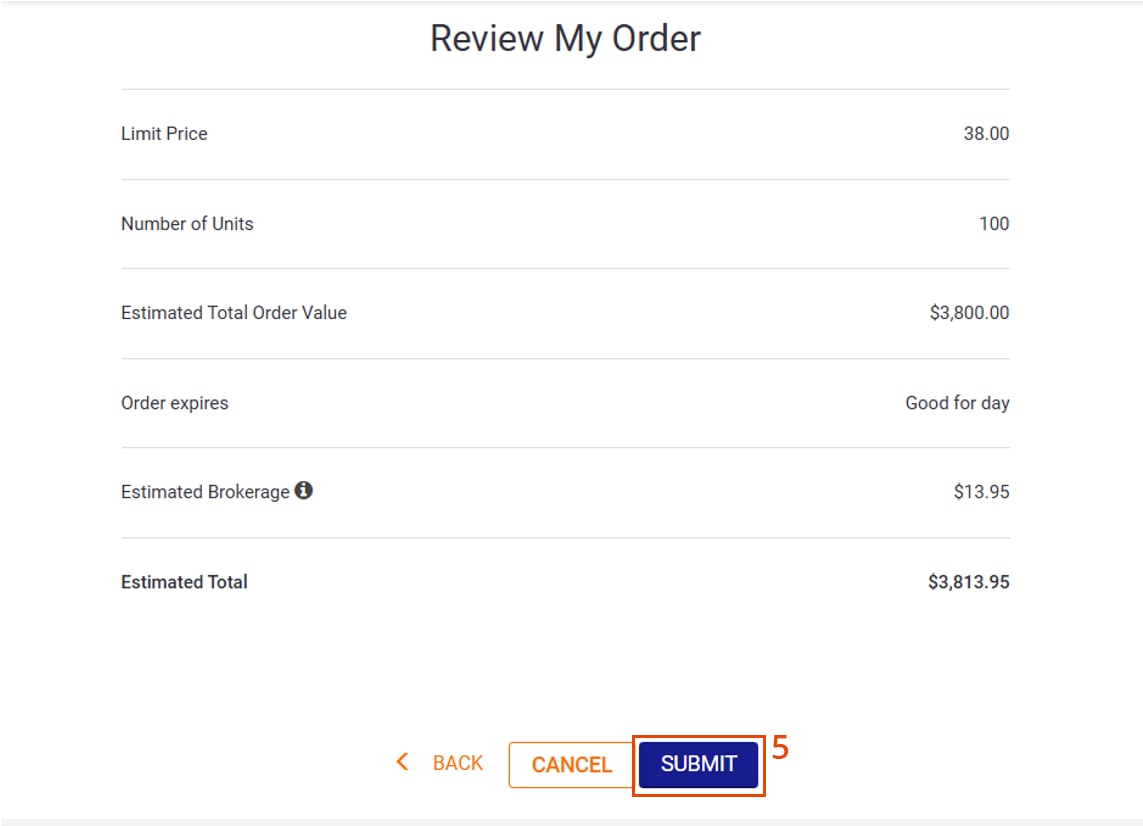

- Review and click ‘Submit’ to finalise.

For more information, please refer to pages 10-11 in the Member Direct guide.

-

How do I change the dividend reinvestment plan (DRP) preference for my clients?

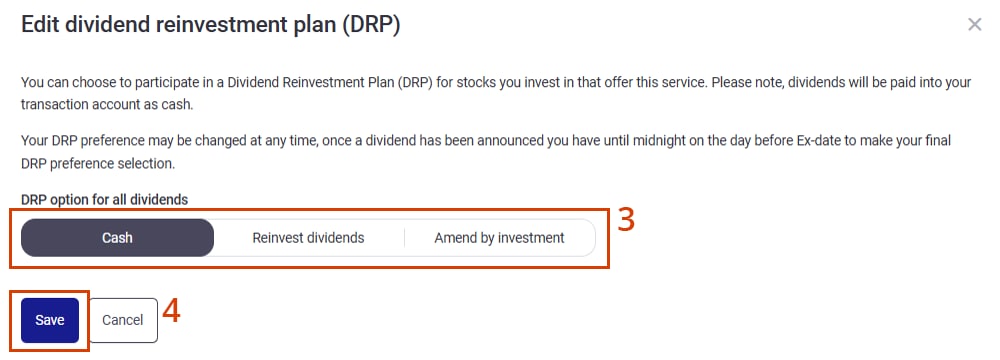

The default setting for DRP is cash however you also have the option to reinvest dividends instead.

To update your clients’ DRP preference, please follow the steps below:

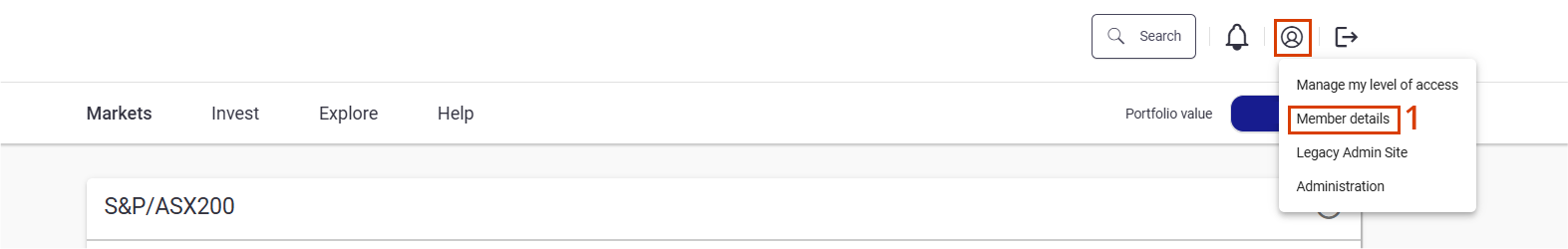

- Hover over the human icon and click on ‘Member details’

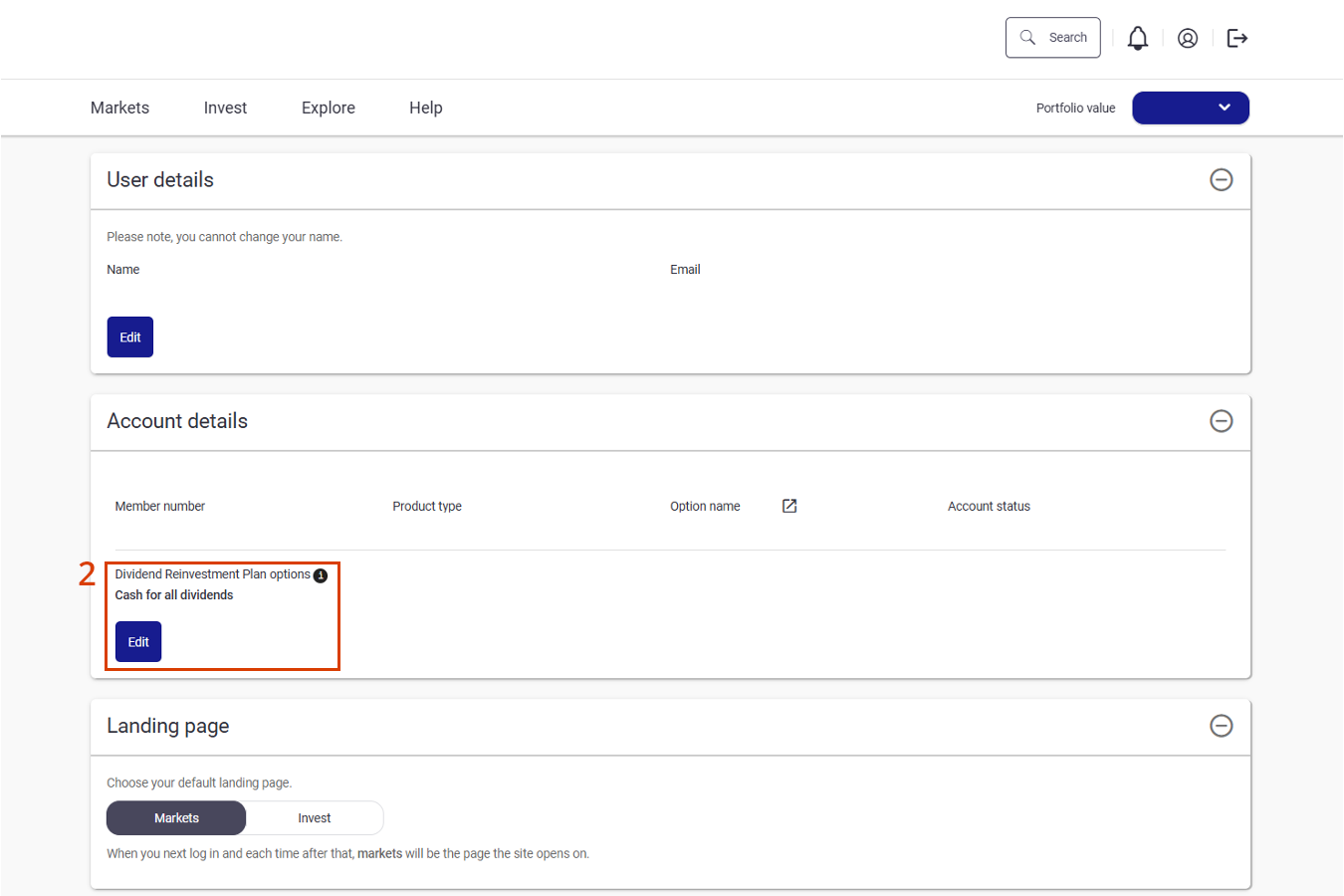

- Default option – Cash for all dividends, click Edit

- You can pick and choose for each listed security held

- Click Save to complete.

-

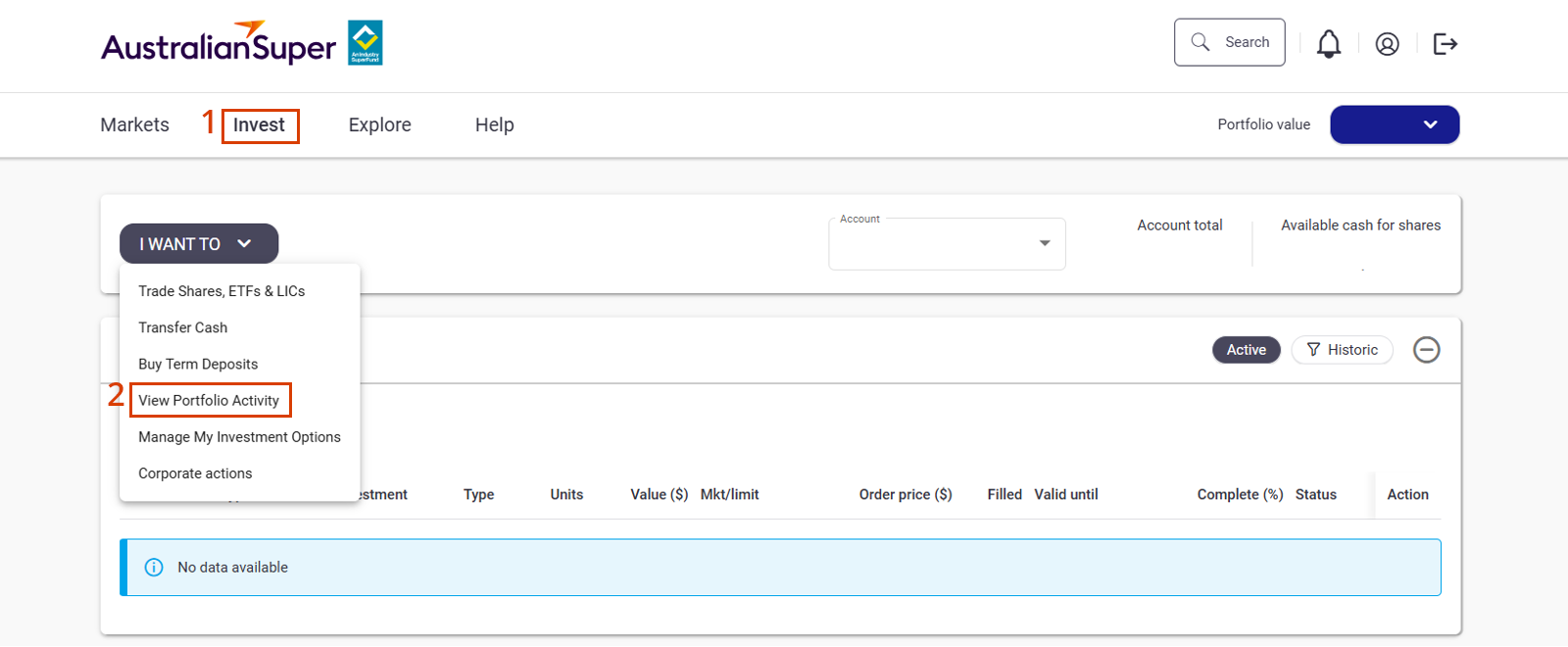

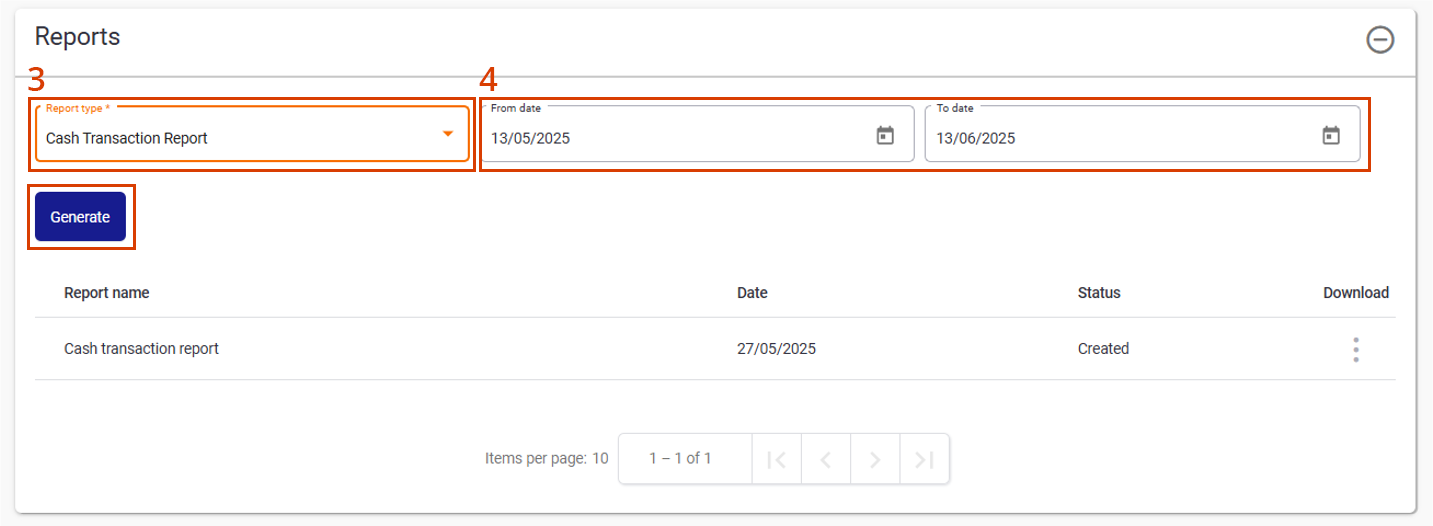

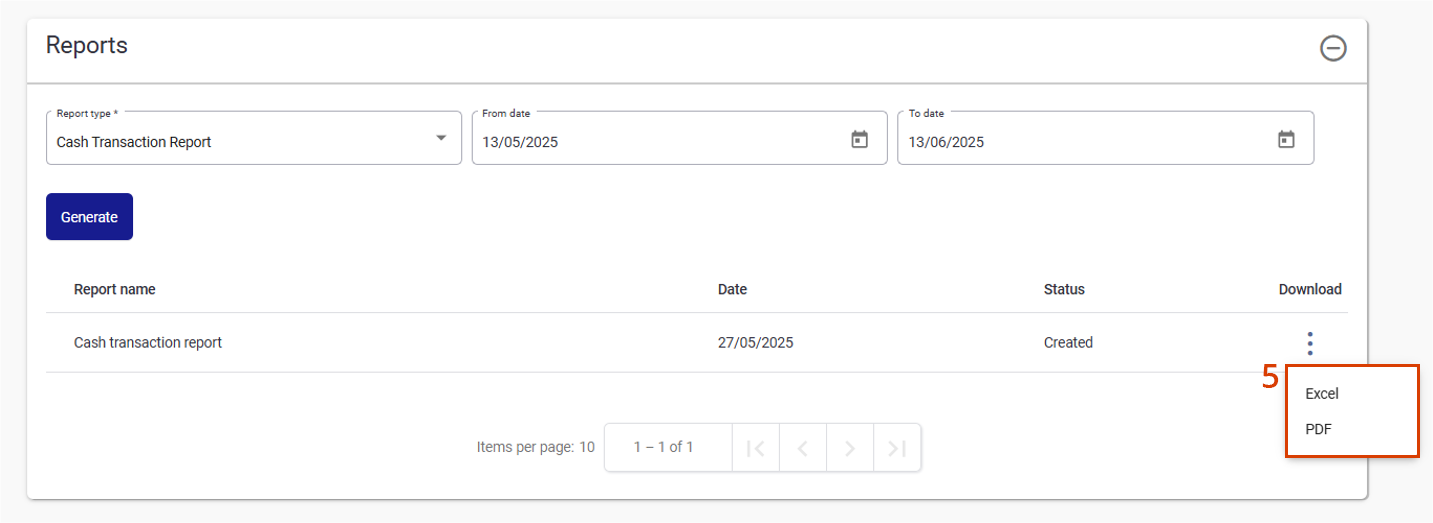

How do I generate reports?

You can generate reports that allow you to track your clients’ investments in Member Direct and other fees and expenses incurred on their account. To get started:

- Select the ‘Invest’ tab

- Select ‘View Portfolio Activity’ (under the ‘I WANT TO’ button)

- Scroll down to Reports – select the report you’re after

- Choose a date range and click ‘Generate’

- Once the report is generated, you’ll be able to download this as an Excel file or PDF.

Balance Booster

-

What’s Balance Booster?

Balance Booster is a tax saving. If the member meets the eligibility requirements, we’ll pass this tax saving on to them. When the member has a super account or TTR Income account, AustralianSuper sets money aside to pay for future capital gains tax when investment assets are sold.

When the member moves from a super or TTR Income account to a Choice Income account (account based pension), their balance is transferred to a tax free environment. Assets sold in retirement phase are not taxed, so the amount set aside in the member’s super or TTR Income to cover a future capital gains tax liability can be passed to them as a credit – their Balance Booster payment.

-

Does Balance Booster count towards the $2m transfer cap?

Yes, it does. Members need to make sure that the amount they transfer from their super or TTR Income account, plus their Balance Booster and any other money they hold in other retirement income accounts, does not exceed this cap. If the Balance Booster triggers an excess transfer balance, the member will need to reduce the excess amount from their account and pay the excess transfer balance tax. The ATO has further information on what to do for excess transfer balances. -

What can affect the value of a Balance Booster payment?

One of the factors that may influence the value of a potential Balance Booster payment is the amount of time the member has been invested in the option in a super or TTR income account, as this may impact the capital gains made, and also the money set aside for applicable capital gains tax.

If the member changes investment options prior to moving to a Choice Income account, their accrued Balance Booster amount may be reduced to zero. This is because some of the money that was set aside is now used to pay the applicable capital gains tax for the assets sold during the switch. The same result can also apply when undertaking a cash out and a re-contribution strategy.

-

How can I get a Balance Booster estimate for my client?

Simply contact the Adviser Services team. Please note that the estimate will be based on the balance the day it’s calculated and not based on the date the Choice Income account application is processed. Therefore, there’s likely to be a difference between the estimate and final amount, since the daily crediting rates change.

Advice fees

Advice fee payment

-

How are advice fees paid?

For payment to be made, a completed fee request form - either a Paying an advice fee form or a Paying an advice fee – Member Direct form - must be sent to Adviser Services at adviserservices@australiansuper.com, along with the member’s certified copy of identification (e.g. driver’s licence, passport, birth certificate etc.) attached.

The fee request will then be assessed, and if approved, deducted from the member’s account and sent to your licensee within six to eight weeks for distribution. See our advice fee payment schedule for our fee processing dates.

-

Advice fee payment schedule

Where completed fee deduction requests are received between the start and end dates of a payment cycle, assuming that all necessary information has been provided and the fee meets the requirements for approval, this calendar shows the expected date of deduction from a member’s account, and the date of expected payment to your licensee. For Member Direct fees, the expected date of payment to the Licensee is the second Tuesday of each month.

For External Reference Fee Run Reference No. Start date End date (COB) Expected date of deduction from member account Expected date of payment to licensee AF149 24/12/2025 09/01/2026 Friday, 16 January 2026 Tuesday, 27 January 2026 AF150 10/01/2026 23/01/2026 Friday, 30 January 2026 Tuesday, 10 February 2026 AF151 24/01/2026 06/02/2026 Friday, 13 February 2026 Tuesday, 24 February 2026 AF152 07/02/2026 20/02/2026 Friday, 27 February 2026 Tuesday, 10 March 2026 AF153 21/02/2026 06/03/2026 Friday, 13 March 2026 Tuesday, 24 March 2026 AF154 07/03/2026 20/03/2026 Friday, 27 March 2026 Tuesday, 7 April 2026 AF155 21/03/2026 03/04/2026 Friday, 10 April 2026 Tuesday, 21 April 2026 AF156 04/04/2026 17/04/2026 Friday, 24 April 2026 Tuesday, 5 May 2026 AF157 18/04/2026 01/05/2026 Friday, 8 May 2026 Tuesday, 19 May 2026 AF158 02/05/2026 15/05/2026 Friday, 22 May 2026 Tuesday, 2 June 2026 AF159 16/05/2026 29/05/2026 Friday, 5 June 2026 Tuesday, 16 June 2026 AF160 30/05/2026 12/06/2026 Friday, 19 June 2026 Tuesday, 30 June 2026 AF161 13/06/2026 26/06/2026 Friday, 3 July 2026 Tuesday, 14 July 2026 AF162 27/06/2026 10/07/2026 Friday, 17 July 2026 Tuesday, 28 July 2026 AF163 11/07/2026 24/07/2026 Friday, 31 July 2026 Tuesday, 11 August 2026 AF164 25/07/2026 07/08/2026 Friday, 14 August 2026 Tuesday, 25 August 2026 AF165 08/08/2026 21/08/2026 Friday, 28 August 2026 Tuesday, 8 September 2026 AF166 22/08/2026 04/09/2026 Friday, 11 September 2026 Tuesday, 22 September 2026 AF167 05/09/2026 18/09/2026 Friday, 25 September 2026 Tuesday, 6 October 2026 AF168 19/09/2026 02/10/2026 Friday, 9 October 2026 Tuesday, 20 October 2026 AF169 03/10/2026 16/10/2026 Friday, 23 October 2026 Tuesday, 3 November 2026 AF170 17/10/2026 30/10/2026 Monday, 9 November 2026 Tuesday, 17 November 2026 AF171 31/10/2026 13/11/2026 Friday, 20 November 2026 Tuesday, 1 December 2026 AF172 14/11/2026 27/11/2026 Friday, 4 December 2026 Tuesday, 15 December 2026 AF173 28/11/2026 11/12/2026 Friday, 18 December 2026 Tuesday, 29 December 2026 AF174 12/12/2026 25/12/2026 Monday, 4 January 2027 Tuesday, 12 January 2027 -

Can I submit a Paying an advice fee form for one-off, fixed term or ongoing advice fees using the same form?

Yes, provided it meets the fee requirements and AustralianSuper’s standard advice fee cap.

-

What types of one-off advice can and cannot be paid from an AustralianSuper account?

For one-off advice services, any advice provided in a Statement of Advice or Record of Advice that relates to the member’s AustralianSuper account, can be paid from their AustralianSuper account, such as:

- Super advice (e.g. accumulation, investment choice, contributions, withdrawals)

- Pre-retirement pension advice (e.g. transition to retirement)

- Post-retirement advice (e.g. account-based pensions)

- Insurance and claims advice (e.g. death, TPD, income protection)

- Estate planning advice (e.g. binding death benefit and reversionary beneficiary nominations)

- Including incidental advice such as simple cash flow analysis, retirement projections and applying for social security which supports the provision of advice relating to an AustralianSuper product

- Implementation of the above.

Any one-off advice services that do not relate to the member’s AustralianSuper account, cannot be paid form their AustralianSuper account, such as:

- Super advice (e.g. investment choice, contributions, withdrawals, accumulation accounts, defined benefit account, self-managed super fund)

- Non-super investment advice (e.g. managed funds, shares, property)

- Pre-retirement pension advice (e.g. transition to retirement)

- Post-retirement advice (e.g. account-based pensions, annuities, lifetime pensions)

- Insurance advice and claims (e.g. death, TPD, income protection, trauma)

- Estate planning advice

- Debt, lending and credit facilities

- Implementation of the above.

-

What types of fixed term or ongoing advice services can and cannot be paid from an AustralianSuper account?

For fixed term or ongoing advice services, any advice services provided during the agreed service period that relates to the member’s AustralianSuper account, can be paid from their AustralianSuper account, such as:

- Personal advice (Statement of Advice or Record of Advice)

- Review meeting(s)

- Administrative support and implementation services

- Investment portfolio updates.

Any fixed term or ongoing advice services provided during the agreed service period, that do not relate to the member’s AustralianSuper account, cannot be paid from their AustralianSuper account, such as:

- Personal advice relating to the member’s property holdings or other non AustralianSuper investments.

- Review meeting(s)

- Administrative support and implementation services

- Investment portfolio updates

- Other services (e.g. newsletters, invitations to events, access to the adviser).

-

Can the member pay an advice fee from their AustralianSuper account if some of the services provided did not relate to their AustralianSuper account?

No, the member cannot pay advice fees from an AustralianSuper account for services that:

- don’t relate to their AustralianSuper account (such as non-super investments, advice about loans); or

- relate to someone else (such as their spouse or partner), even if the other person is an AustralianSuper member.

Only the portion of the one-off, the fixed term or ongoing advice fee that relates to their AustralianSuper account can be paid from their AustralianSuper account.

-

Can the member pay an advice fee from their AustralianSuper account if some of the services provided related to their partner?

No. The member cannot pay advice fees from an AustralianSuper account for services that:

- don’t relate to their AustralianSuper account; or

- relate to someone else (such as their spouse or partner), even if the other person is an AustralianSuper member.

Only the portion of the one-off, the fixed term or ongoing advice fee that relates to their AustralianSuper account can be paid from their AustralianSuper account.

-

I have an ongoing fee arrangement with my client where I provide them with ongoing financial services. Can the fee be paid from their AustralianSuper account?

Yes. An ongoing advice fee can be deducted from the member’s AustralianSuper account for an ongoing fee arrangement of more than 12 months.

However, for ongoing advice fees, AustralianSuper:

- will only allow up to 12 months of the advice fees for this arrangement to be paid from a member’s account,

- will require a new Paying an advice fee form each time the ongoing fee arrangement is renewed, and

- will not process the request if the member’s nominated account is a Super (Accumulation) account and all or part of that account is invested in AustralianSuper’s Balanced (MySuper) option.

Advice fee types

-

What types of fees can be deducted from an AustralianSuper account?

One-off, fixed term and ongoing advice fees can be deducted from the member’s AustralianSuper account, with some important exceptions.

Only the portion of the total advice fee that relates directly to AustralianSuper account(s) can be deducted from the member’s nominated account.

You cannot request a fee to be deducted from a member’s AustralianSuper account(s) for advice, if it’s:

- not related to member’s AustralianSuper account(s), or

- related to another member or non-member, including a spouse, or

- related to an ongoing advice fee where the member’s nominated account is a Super (Accumulation) account and all or part of that account is invested in AustralianSuper’s Balanced (MySuper) option, or

- from an account where the advice fee will reduce the balance of the member’s account below $15,000 at the time of the fee request.

-

What is a one-off advice fee?

It is an advice fee for a one-off service where you have provided a Statement of Advice (or Record of Advice) to the member.

-

What is a fixed term advice fee?

It is an advice fee for a non-ongoing fee arrangement where you and the member have agreed to a service arrangement for a period of 12 months or less. -

What is an ongoing advice fee?

It’s an advice fee for an ongoing arrangement of more than 12 months.

AustralianSuper only allows up to 12 months of the advice fees for this arrangement to be paid from your client’s account and requires a new Paying an advice fee form each time an ongoing fee arrangement is renewed.

Where your client’s nominated account for the ongoing advice fee deduction is their AustralianSuper (Accumulation) account, and all or part of that account is invested in the Balanced (MySuper) option, AustralianSuper cannot process the request.

-

What is the service period ‘start date’ for an ongoing advice fee?

For a new ongoing fee arrangement:

The start date is the day the arrangement was entered into.

For a renewal of an ongoing fee arrangement:

The start date is:

- if the arrangement was entered into before 10 January 2025, and

- this renewal is before 10 January 2025 – the Anniversary day, or

- this is the first renewal on or after 10 January 2025 – the Anniversary day,

- for any other renewal – the reference date applicable to the ongoing fee arrangement consent that most recently ceased.

- if the arrangement was entered into before 10 January 2025, and

-

What is the ‘end date’ for an ongoing advice fee?

This is the day before the next reference date.

-

What is the next ‘reference date’ for an ongoing advice fee?

The next reference date can be any day after the service period start date, but no later than the anniversary of the service period start date.

Note: The next reference date is the date specified as such in the current ongoing fee arrangement consent that the member has given to you. If no next reference date has been specified in that consent, the next reference date will be the anniversary of the service period start date.

-

What is the ‘anniversary’ day for an ongoing fee arrangement?

It is the anniversary of the day on which the ongoing fee arrangement was entered into.

Advice fee form completion

-

How do I complete a Paying an advice fee form?

As part of the Delivering Better Financial Outcomes (DBFO) package, AustralianSuper has updated the Paying an advice fee forms and the process for completing them. The previous PDF forms are no longer available on the Adviser resources webpage. The Advice Fee form must now be completed online through the Adviser Portal, with step-by-step guidance to make it an easy process.

By completing the Advice Fee form online via the portal, your inputs will be validated for accuracy as you complete the form. This will reduce the potential for any errors, before you print the form for your client’s consent, so we can process the submission faster and you’ll receive your fee payment sooner.

Advisers can access the Advice Fee form via the Adviser Portal:

- For new clients that do not already exist in the Adviser Portal, use the link at the top of the screen.

- For existing clients that are in your client list, access the form through the client record.

Note: There is no change to how the form should be completed and submitted, including the requirement to provide your client’s certified ID and having the printed form signed by the client.

For more information, please refer to the Frequently Asked Questions (FAQs) in the Adviser Portal Support tab.

-

What are the requirements for certified ID when submitting with the Paying an advice fee form?

If you’re certifying the ID in your role as financial adviser, the certification must:

- Be easy to read

- Include your full name and occupation e.g. financial adviser

- Include your ASIC Authorised Representative or AFSL number

- Be signed by you

- Show the date of certification, which must be within the last 12 months.

Take a look at our Guide to providing proof of your identity fact sheet for more information.

Please note: electronic verification is not available for certified ID submitted with the Paying an advice fee form.

-

Do I need to outline the services I provide in the one-off, fixed term and ongoing fee sections of the form?

Yes, you’ll need to select all the service(s) provided. We need this information to ensure that we only deduct advice fees that relate to the member’s AustralianSuper account. A member cannot pay fees to their financial adviser from their AustralianSuper account for services that:

- don’t relate to their AustralianSuper account (such as non-super investments, advice about loans), or

- relate to someone else (such as their spouse or partner), even if they are an AustralianSuper member.

If the advice services section is not completed, the fee request will be rejected.

-

Do I need to complete all the sections in the fee form?

All relevant sections of the Paying an advice fee form must be completed in full and correctly signed by both the member and the adviser. -

Why does AustralianSuper sometimes request further information or documentation about the advice fee before it is processed?

As a Trustee, AustralianSuper has an obligation to always act in the member’s best interest. This ensures advice fees deducted from a member’s account are both appropriate and, in the member’s, best interests. The Trustee must also comply with the sole purpose test (SIS Act) and take reasonable steps to ensure advice fees are only deducted for advice that relates to the member’s interest in AustralianSuper. -

Can I use digital signatures on the Paying an advice fee form?

Yes. However, please ensure:

- You provide a digital signature certificate / audit report as verification that the member has signed the form. If a digital signature certificate / audit report is unable to be produced, our Adviser Services team will need to contact the member; and

- You have used the email address nominated on the member’s account.

You can find further information on our Guide to submitting forms page

-

Can Paying an advice fee forms be accepted if either the adviser or member signs in the wrong signature field?

No. A new form will be required to be correctly signed to ensure we have the proper consents and declarations from the member and the adviser. -

When submitting the Paying an advice fee form, can an editable version be submitted?

No. The form must be submitted as a non-editable form. -

What happens with the fee form if I change licensee?

We will pay the advice fees to the Licensee named on the fee form, until we become aware that the adviser has changed licensees. Once we are aware, we will liaise with the adviser to determine next steps depending on the advice fee type, the date of licensee change and the fee payment status.

Advice fee amount

-

What is the standard advice fee cap?

The total advice fee deduction requests allowed to be submitted within a rolling 12-month period for a member cannot exceed the lower of (GST inclusive):

- $7,700; or