- News

- FAQs

- All documents

- Products

- Portal updates

Documents for advisers

Find our latest forms, fact sheets, PDSs (with join forms), guides, brochures and reports to download. Before submitting a form to AustralianSuper, refer to the guide below.

Adviser forms and guides

-

Forms (2)

-

Guides

Before submitting a form to AustralianSuper, refer to our Guide to submitting forms webpage. This guide explains the requirements for submitting forms in the correct manner. This will ensure efficient processing and avoid any unnecessary delays.

Reports, SOA wording and Trust Deed

-

Reports (2)

-

SOA Wording (1)

Statement of Advice (SOA) wording - pdf, 341KB

AustralianSuper provides this SOA template to advisers to help ensure clarity, compliance and consistency in financial advice, to enhance client understanding and trust.

-

Trust Deed (1)

AustralianSuper Trust Deed - pdf, 524KB

Investment performance, fact sheets and guide

-

Performance data

Advisers have easy access to our most recent and previous investment performance reports:

- Download the most recent Super Investment Performance report from our new Super products page. This page also has Performance data (super and retirement) in Excel format.

- Download the most recent Choice Income Investment Performance report from our new Retirement products page.

- Download previous Super and Choice Income Investment Performance reports from our Archived performance reports page.

-

Asset allocation

Advisers can view the most recent asset allocations on these pages:

And for asset allocations from previous quarters, please contact our Adviser Services team.

-

PreMixed options fact sheets (6)

High Growth option - pdf, 217KB

This PreMixed option invests in a wide range of assets with a high focus on growth assets.

Balanced (MySuper) option - pdf, 217KB

This PreMixed option invests in a wide range of assets with a focus on growth assets. This is our default option.

Socially Aware option - pdf, 235KB

This PreMixed option invests in a wide range of assets with a focus on growth assets. Certain assets are excluded based on ESG screens.

Indexed Diversified option - pdf, 212KB

This PreMixed option invests in a range of assets using indexing strategies with a focus on growth assets.

-

DIY Mix options fact sheets (4)

Australian Shares option - pdf, 318KB

This DIY Mix option primarily invests in a wide range of shares in listed companies in Australia.

International Shares option - pdf, 319KB

This DIY Mix option invests in a wide range of companies listed on overseas securities exchanges across the world.

Diversified Fixed Interest option - pdf, 319KB

This DIY Mix option invests in a wide range of Australian and international bonds and loans by actively investing in the fixed interest, credit and cash asset classes.

Cash option - pdf, 208KB

This DIY Mix option invests in short-term money market securities and some short-term bonds.

-

Asset class fact sheets (1)

AustralianSuper's unlisted assets - pdf, 693KB

-

Guides (1)

Investment guide - pdf, 12.9MB

Super forms, fact sheets and disclosure documents

-

Forms

To view and download our super forms, please visit our Guide to submitting forms page. This page also explains the requirements for submitting forms in the correct manner, to ensure efficient processing and avoid any unnecessary delays.

-

Fact sheets (3)

-

PDS and TMD documents

Advisers can view and download these disclosure documents:

- Product Disclosure Statements (PDSs) with forms for our super plans, as well as other documents that form part of the PDS.

- Target Market Determinations (TMDs) for our super plans

Retirement forms, fact sheets and disclosure documents

-

Forms

To view and download our retirement forms, please visit our Guide to submitting forms page. This page also explains the requirements for submitting forms in the correct manner, to ensure efficient processing and avoid any unnecessary delays.

-

Fact sheets (3)

-

Guides (1)

Planning your retirement - pdf, 3.7MB

-

PDS and TMD documents

Advisers can view and download these disclosure documents:

- Product Disclosure Statements (PDSs) with forms for our retirement plans

- Target Market Determinations (TMDs) for our retirement income plans

Insurance forms, fact sheets and guides

-

Forms

To view and download our Insurance forms, please visit our Guide to submitting forms page. This page also explains the requirements for submitting forms in the correct manner, to ensure efficient processing and avoid any unnecessary delays.

-

Fact sheets (6)

Applying for a Terminal Illness payment - pdf, 114KB

Applying for Income Protection payments - pdf, 119KB

Applying for a Total & Permanent Disablement payment - pdf, 115KB

Applying for a payment after a member dies - pdf, 143KB

-

Guides (2)

Insurance in your super guide - pdf, 3.5MB

This guide is for members in AustralianSuper plan, Personal Plan and Super Options.

Insurance in your super guide for AustralianSuper Select - pdf, 2.9MB

This guide is for members working for an eligible AustralianSuper Select employer who offers tailored insurance arrangements.

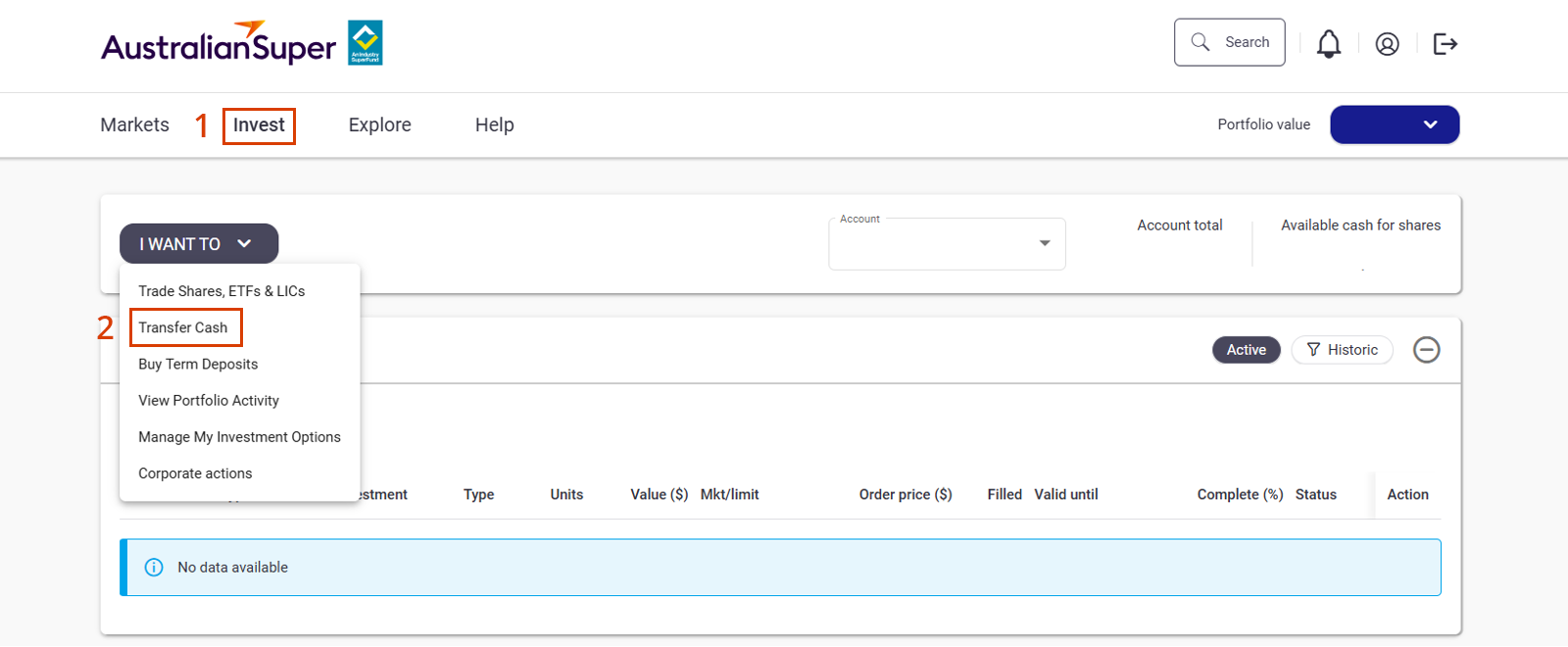

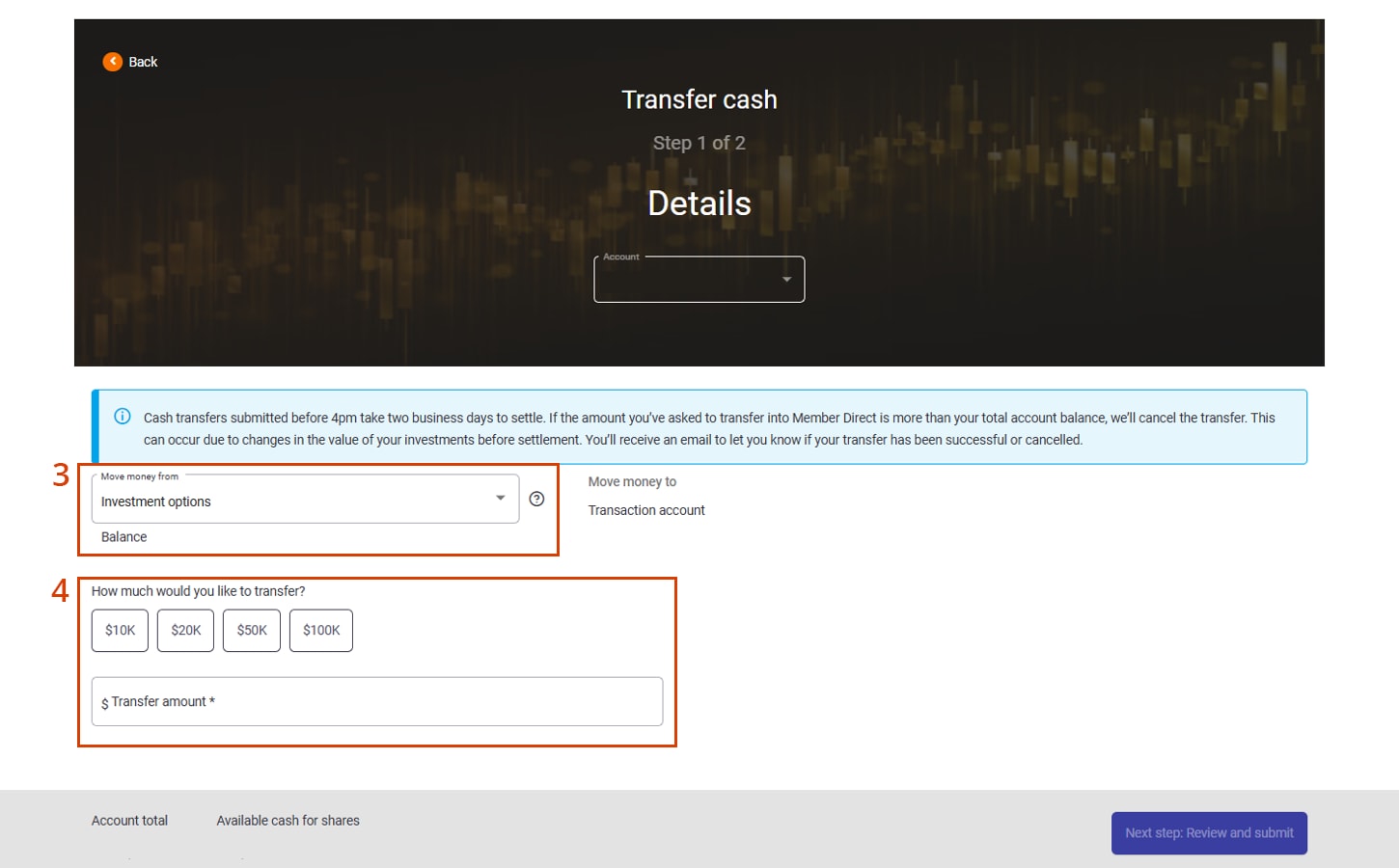

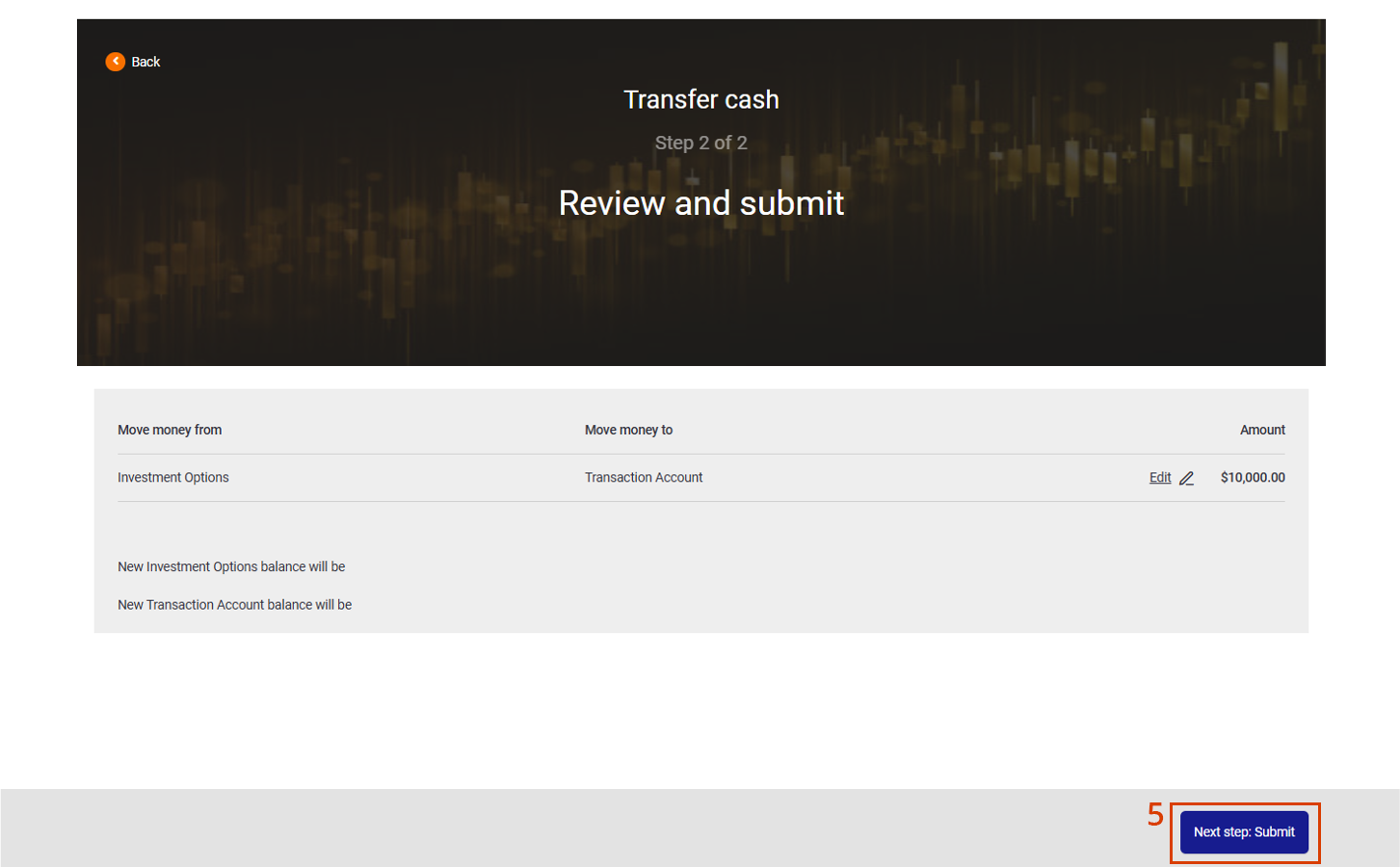

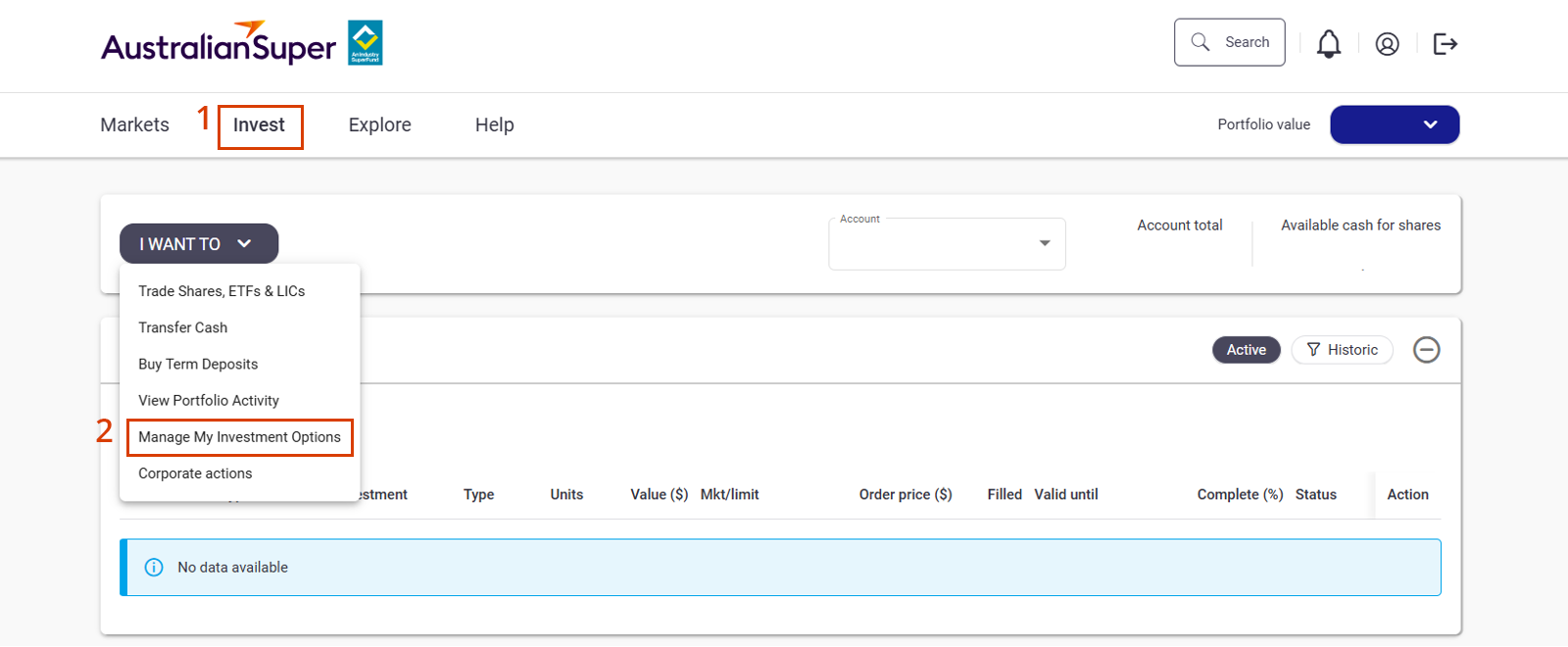

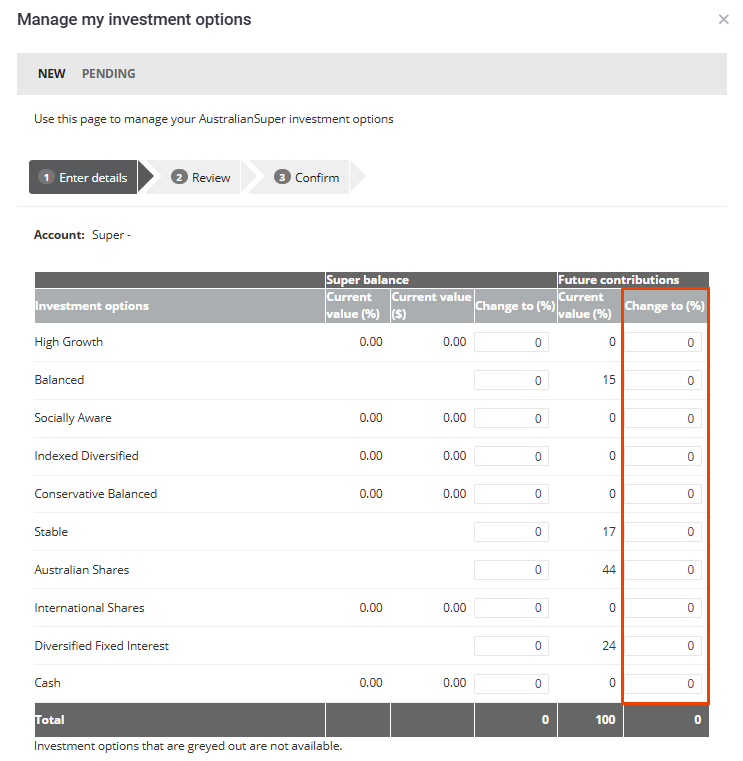

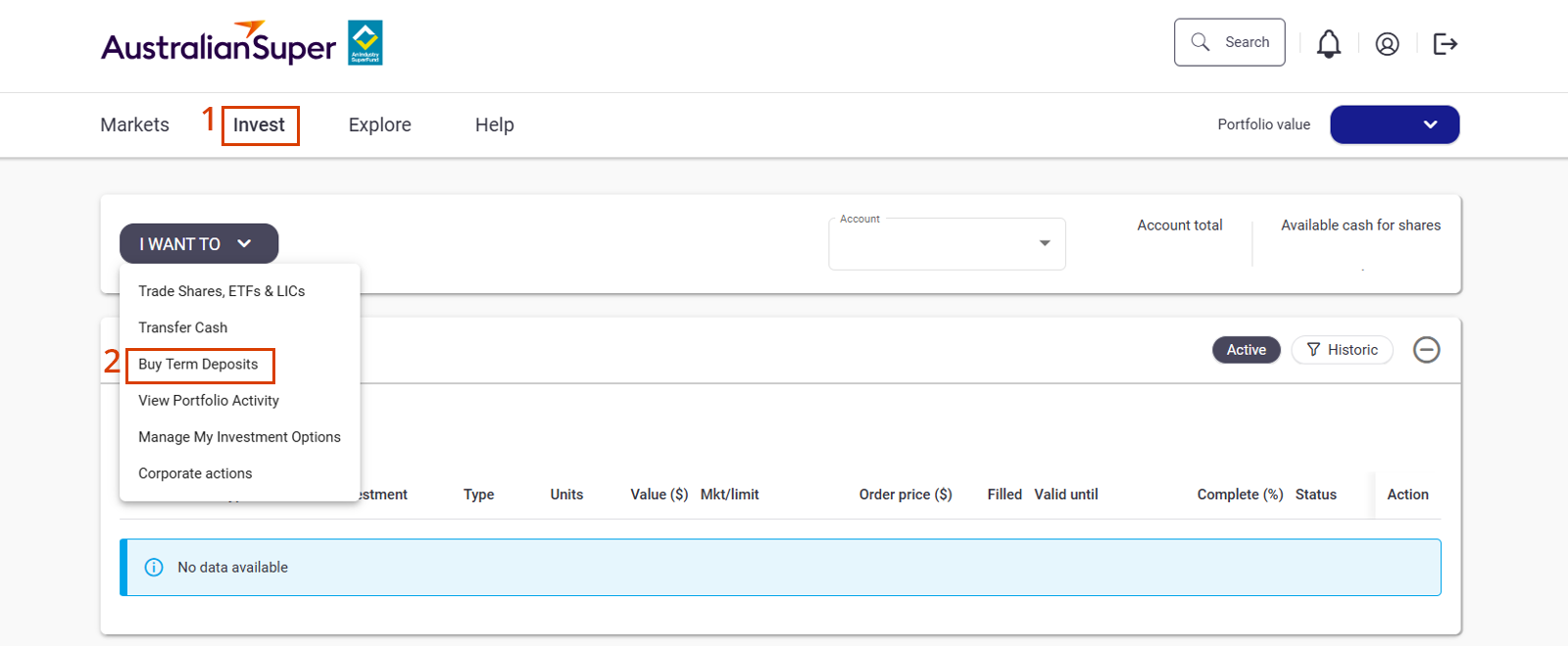

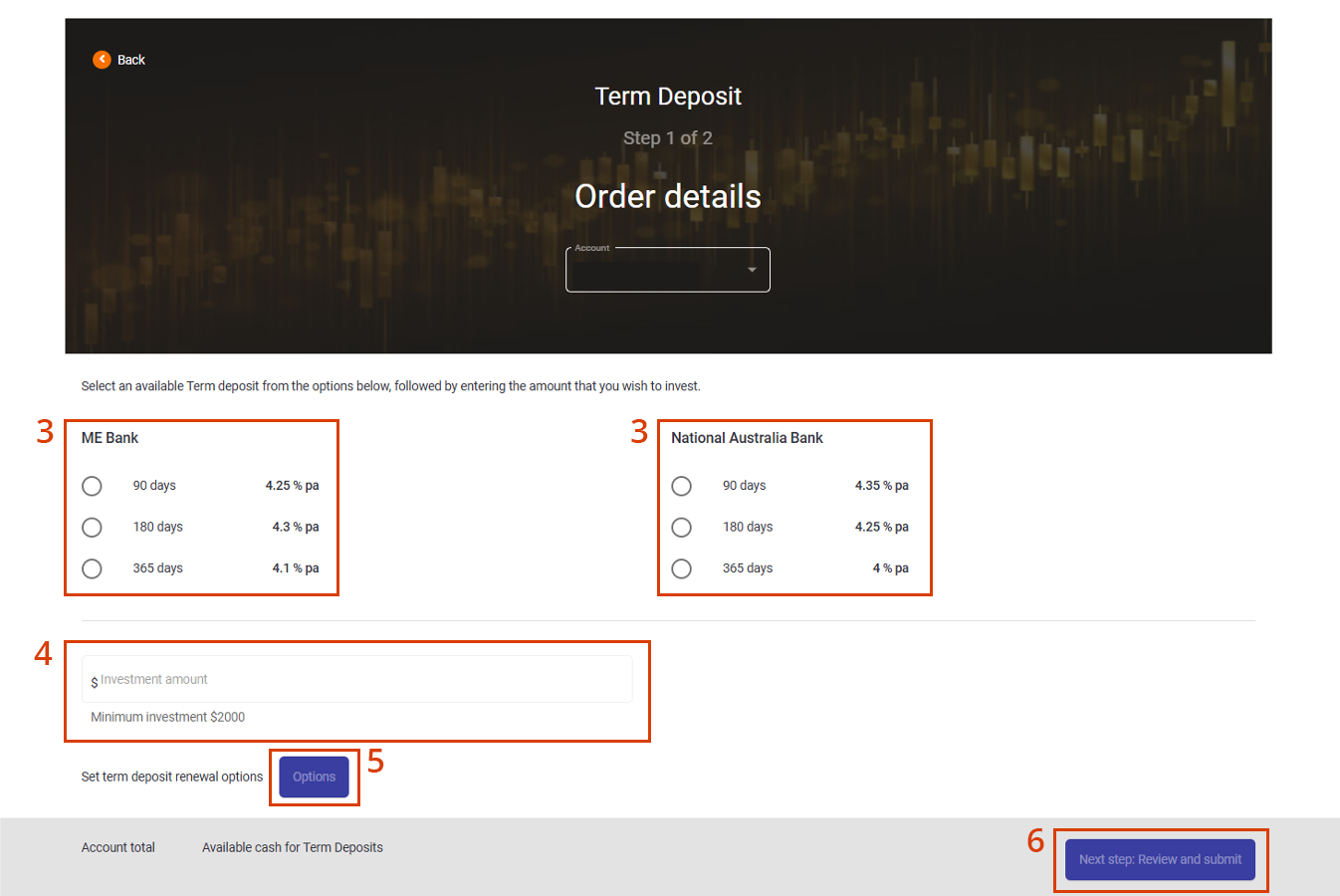

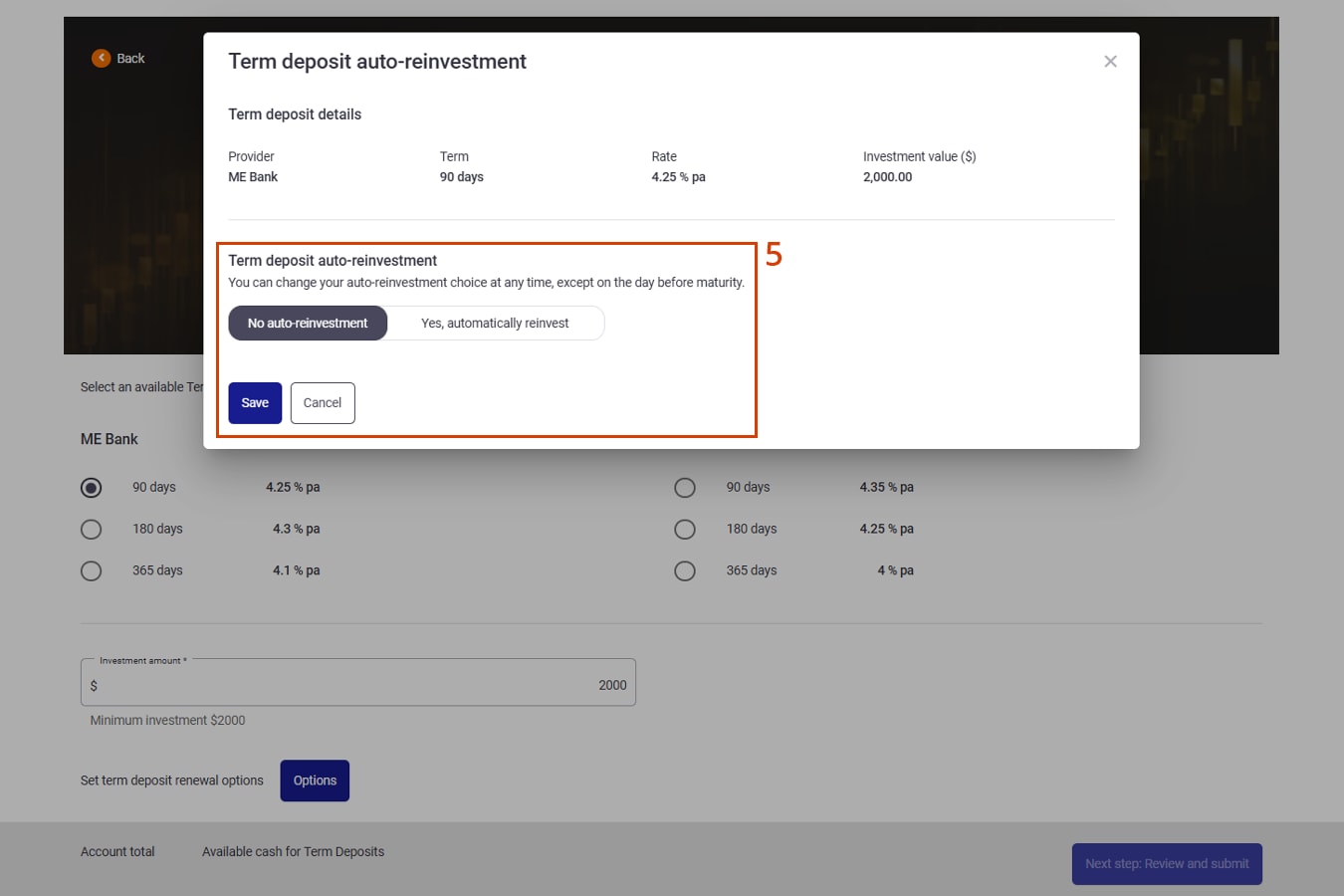

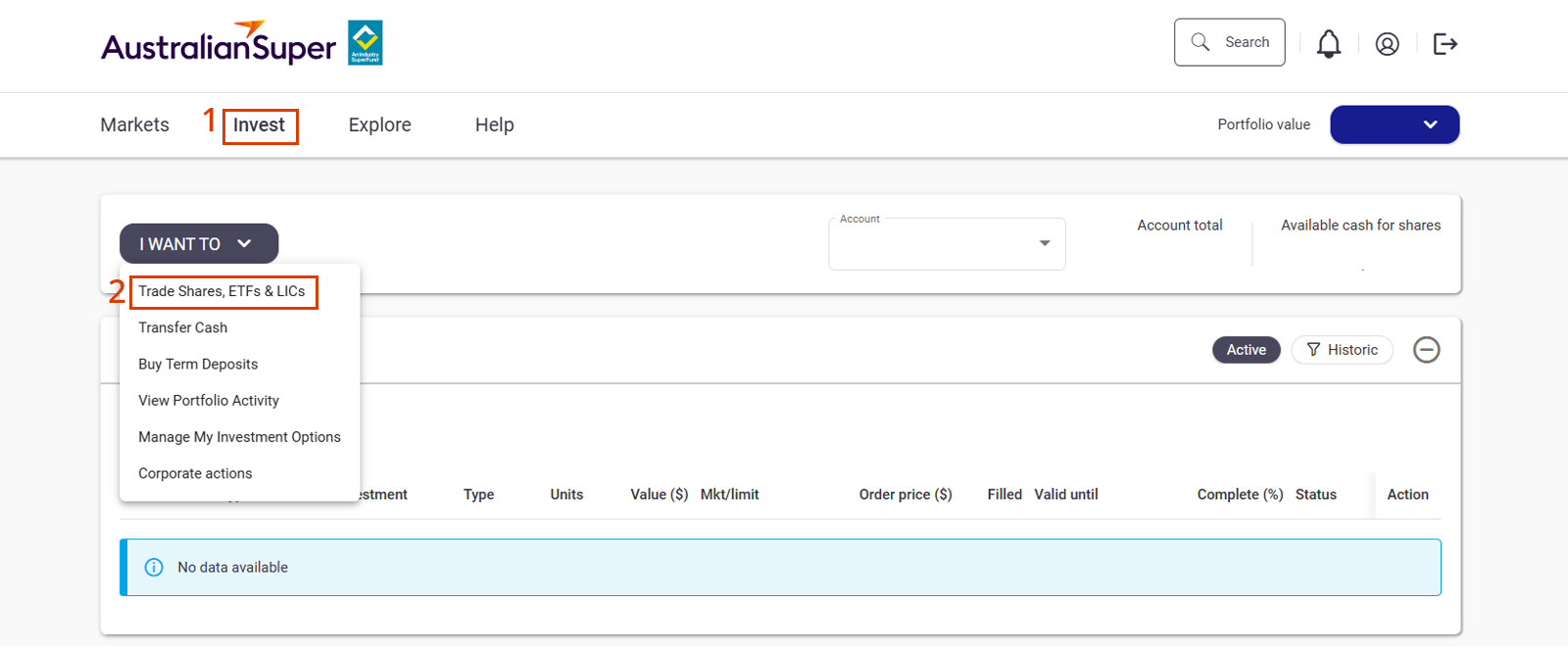

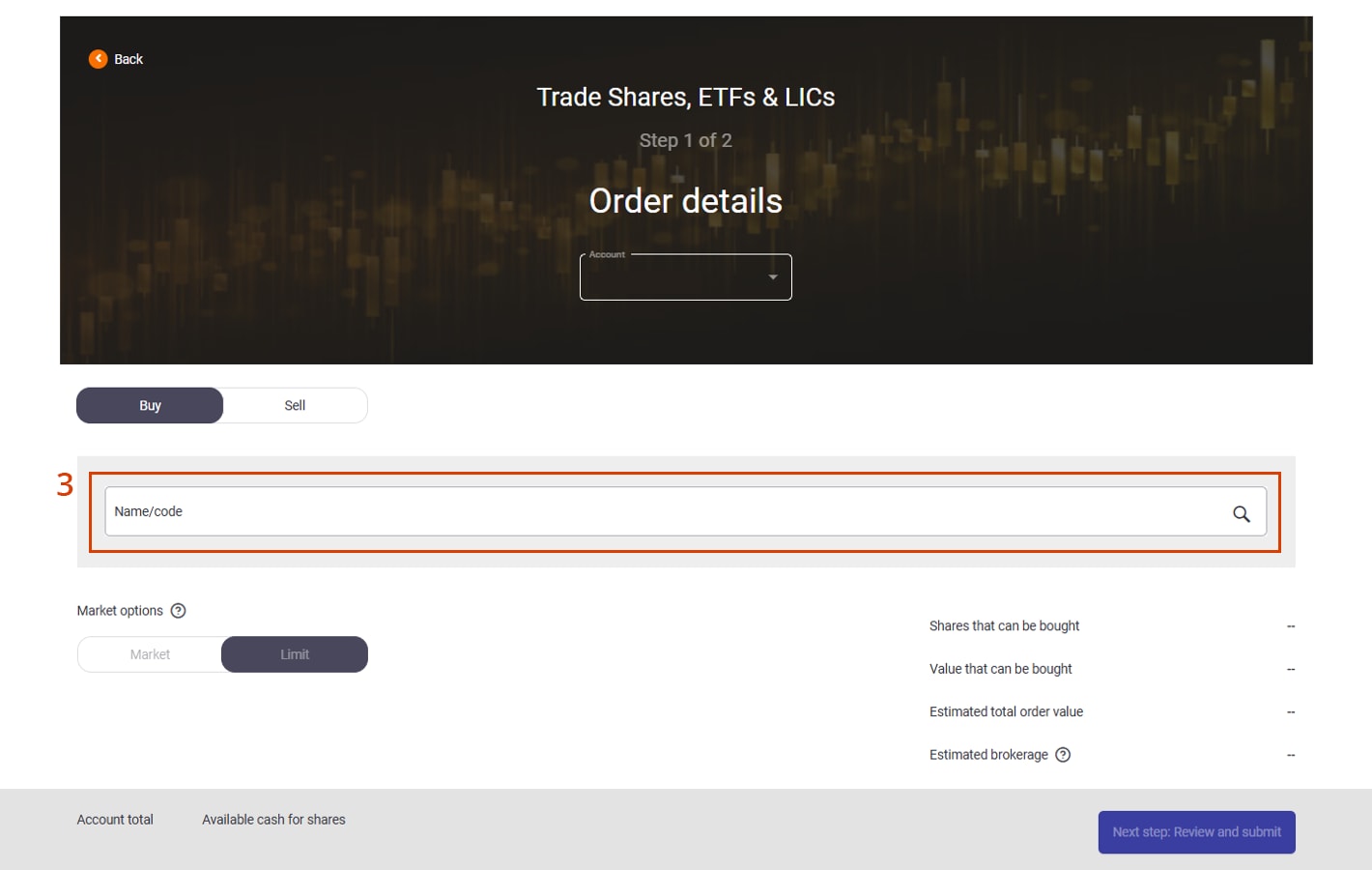

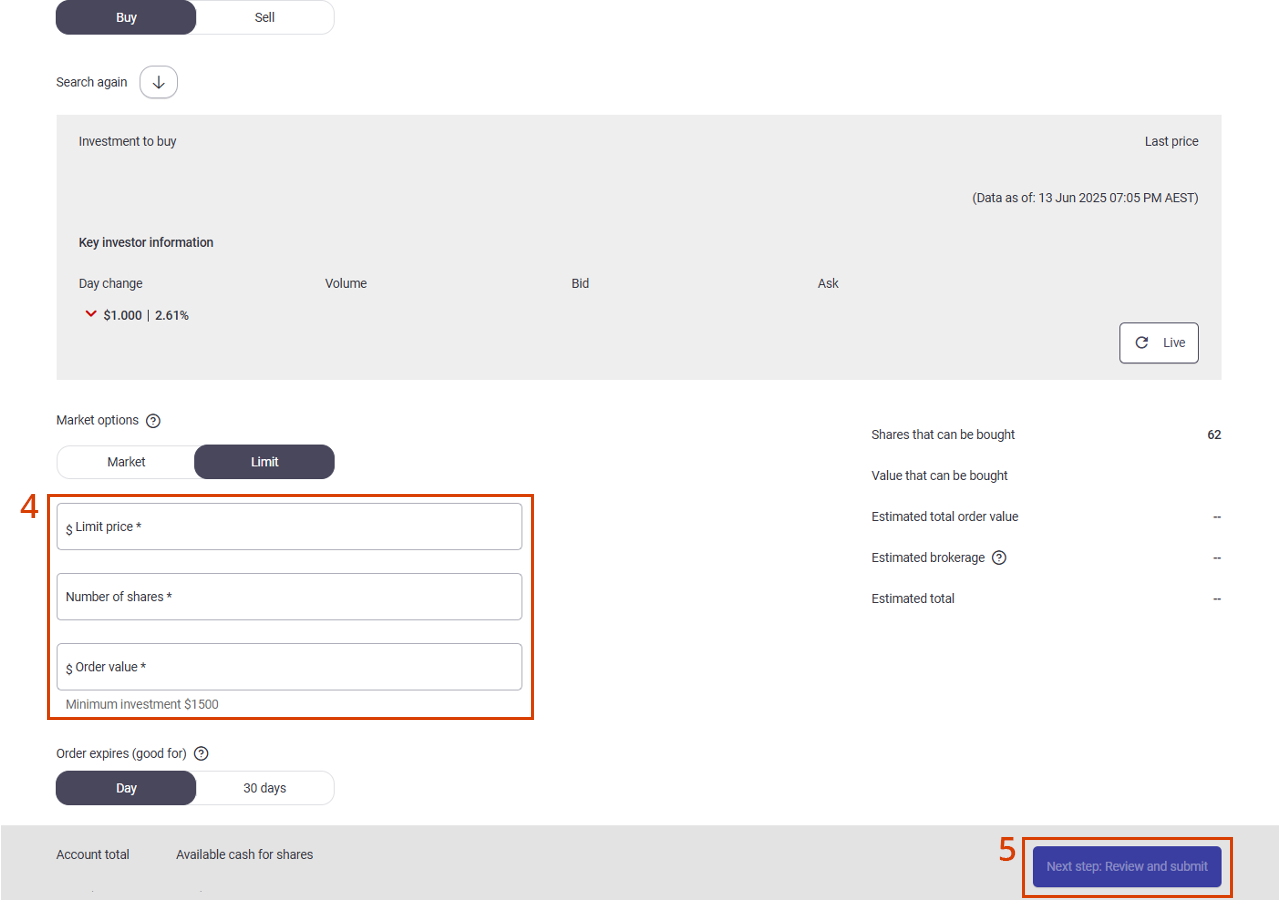

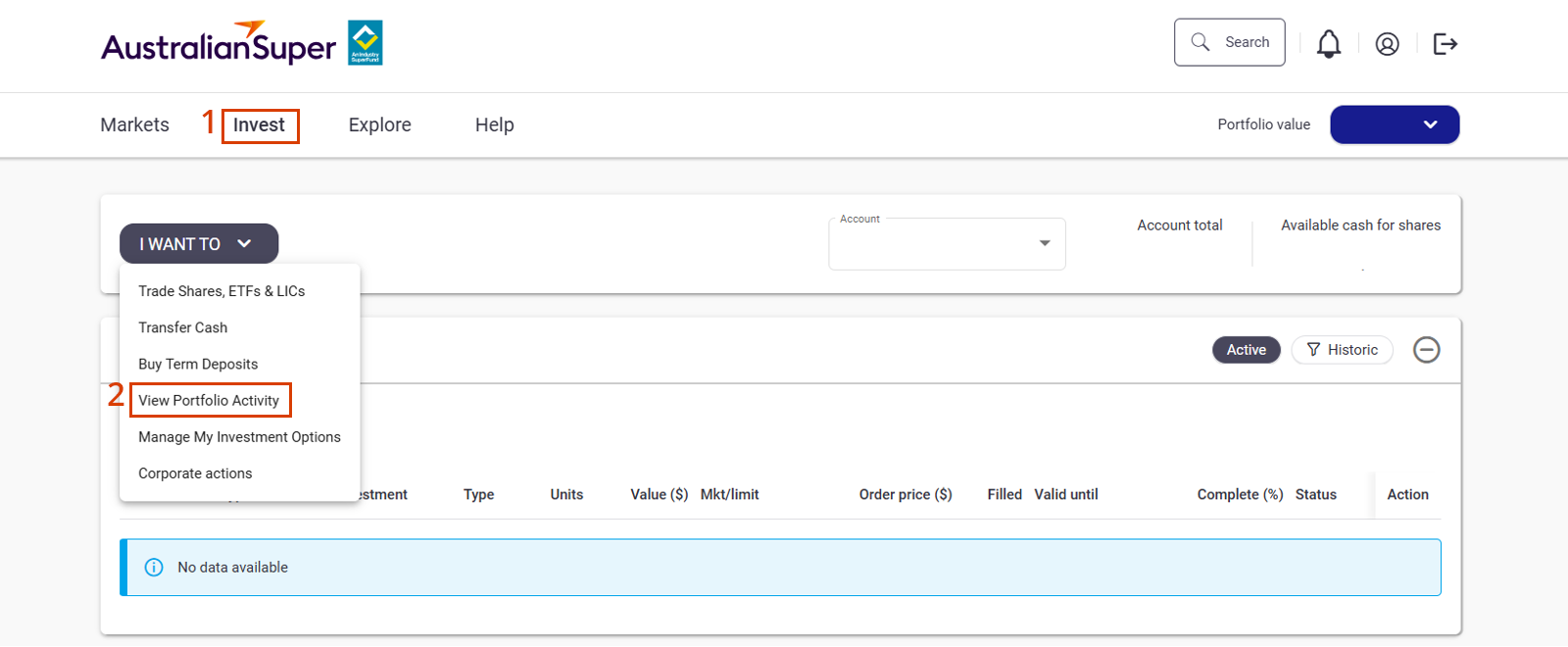

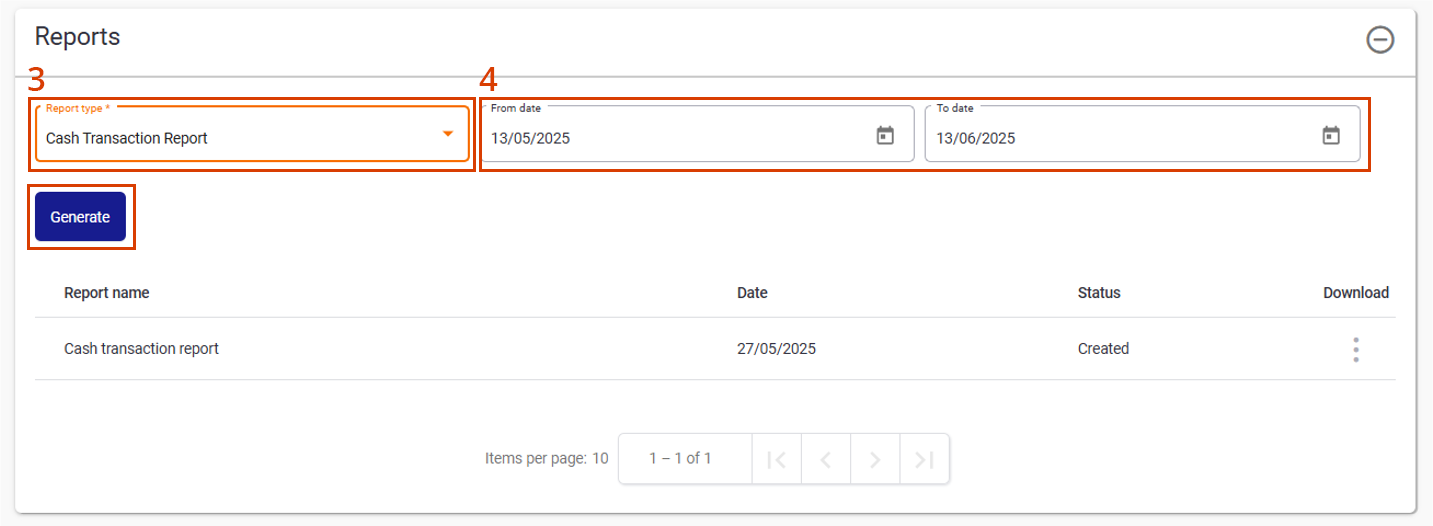

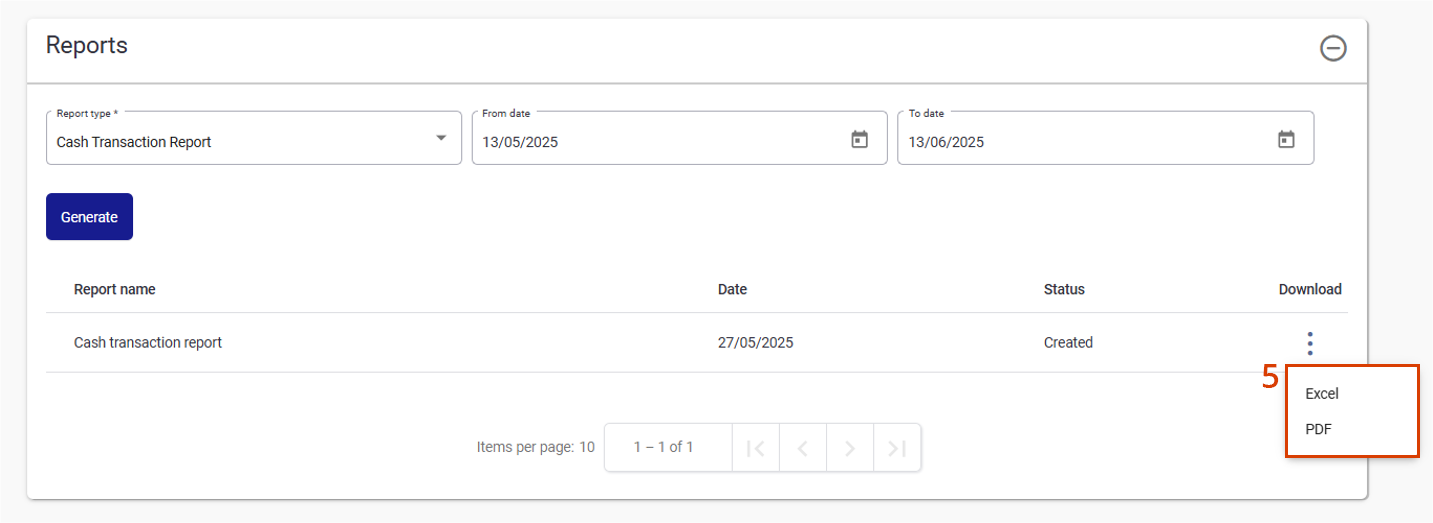

Member Direct forms, fact sheets and guides

-

Forms

To view and download our Member Direct forms, please visit our Guide to submitting forms page. This page also explains the requirements for submitting forms in the correct manner, to ensure efficient processing and avoid any unnecessary delays.

-

Guides (4)

Member Direct investment option guide - pdf, 11.4MB

Terms and Conditions for using the AustralianSuper Member Direct online platform - pdf, 660KB

On 28 March 2026, the Terms and Conditions for using the Member Direct online platform will change. You can view the updated Terms and Conditions below.

Updated Terms and Conditions for using the AustralianSuper Member Direct online platform - pdf, 665KB

Updated version effective from 28 March 2026

Member Direct Investment menu - pdf, 494KB

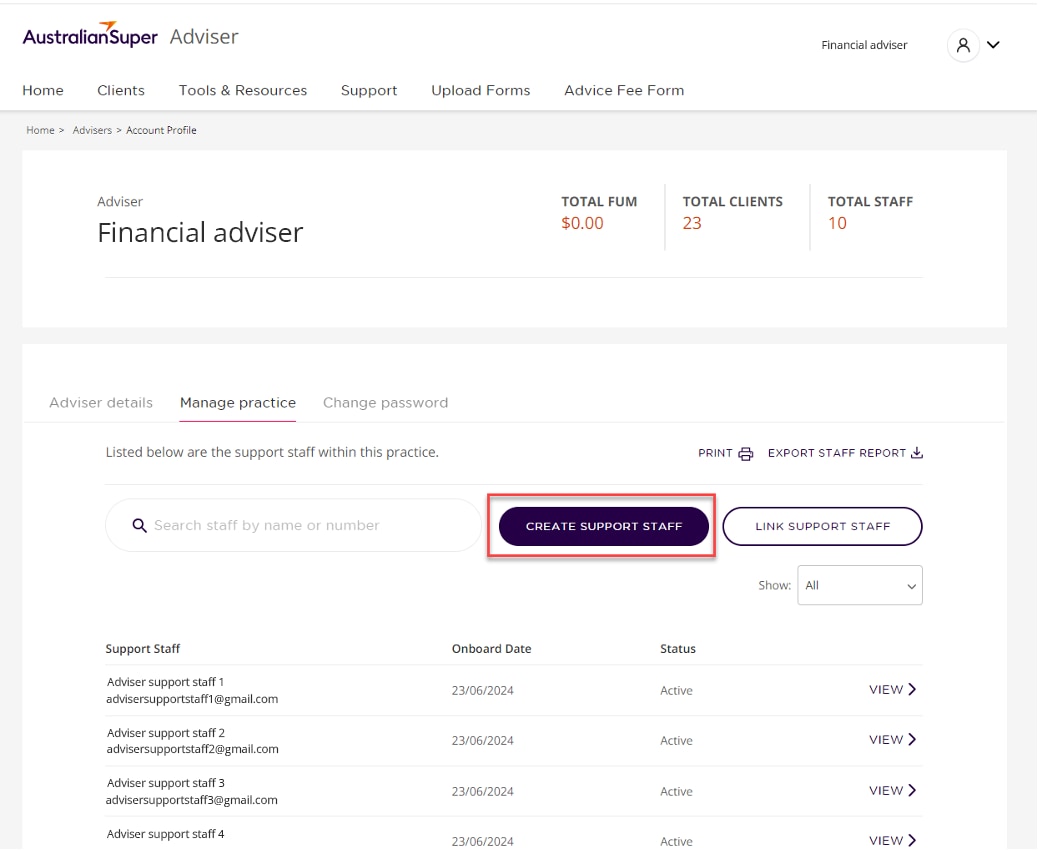

Our Adviser Services team

Our Adviser Services team includes our Adviser Services Managers, a dedicated group of experienced financial services professionals. They can support you with administrative, product or process queries you may have while working with us.

Our Adviser Partnerships team

Our Adviser Partnerships team are Fund and product experts, who are dedicated to developing and maintaining strong, long-term relationships with external licensees and financial advisers. They’ll work with you to ensure you have the right information, tools and support to grow your clients’ savings for a better future.

-

Meet our Adviser Partnerships team

Tim Berkman

Tim Berkman

Manager, Adviser Partnerships (QLD & NT)Phone: 0402 929 972

Email: tberkman@australiansuper.comJoining AustralianSuper in 2010, Tim previously spent eight years with BT and Rothschild. Tim’s role at the Fund involves building adviser and licensee relationships across Queensland and the Northern Territory. His focus is on growing the adviser channel and supporting licensees and advisers in their work with AustralianSuper.

Nikki Spiers

Nikki Spiers

Adviser Partnerships Manager (VIC & WA)Phone: 0429 203 789

Email: NSpiers@australiansuper.comNikki joined AustralianSuper in 2017 after working for 18 years at a major dealer group as Practice and Recruitment Manager. Prior to this, she worked as a Certified Financial Planner and is a member of CPA Australia. She’s responsible for providing support on our products and services to our external advisers and licensees throughout Victoria and Western Australia.

Claire Phillips

Claire Phillips

Adviser Partnerships Manager (NSW)Phone: 0424 970 353

Email: cphillips@australiansuper.comClaire joined AustralianSuper in February 2020 and is the key contact for external advisers and licensees in the NSW North Shore, Far North Coast, Central Coast and Newcastle regions, providing support on our products and services.

Claire has worked in financial services for 15 years in Australia and overseas and spent the past nine years working with financial planners. Prior to joining the Fund, Claire held previous Business Development roles at a number of Australia’s largest financial institutions. Ile Petroski

Ile Petroski

Adviser Partnerships Manager (NSW & ACT)Phone: 0416 278 746

Email: IPetroski@australiansuper.comIle joined AustralianSuper in 2018 and is a contact for external advisers and licensees, providing support on our products and services. He is the key contact within the Sydney CBD and metropolitan areas including East, West and South Sydney regions, as well as Central West, Southern Highlands, Riverina and ACT. He was previously at Vanguard Investments working in their Adviser Distribution team, and prior to that, at Colonial First State working across a number of adviser facing roles.

Ben Thompson

Ben Thompson

Adviser Partnerships Manager (QLD)Phone: 0439 021 385

Email: bthompson@australiansuper.comBen has over 21 years of experience in the financial services sector, working across banking, financial advice and superannuation. He has been with AustralianSuper since 2016 working initially as a comprehensive financial planner, then Education Manager and now in his current role as an Adviser Partnerships Manager.

Peter Bekavac

Peter Bekavac

Adviser Partnerships Manager (VIC, SA & TAS)Phone: 0417 573 112

Email: pbekavac@australiansuper.comPeter has over 20 years’ experience in financial services. He has been with AustralianSuper since 2011 and was a foundation member of the Fund’s external advice channel. Prior to joining AustralianSuper he worked for one of Australia’s largest superannuation administrators, Link Group. With his broad skill set, Peter’s focus is to provide quality training and support on AustralianSuper’s products and services to advisers and support staff.