- News

- FAQs

- All documents

- Products

- Portal updates

Latest news

We’re mandating multi-factor authentication to the Adviser Portal

To help keep your clients’ accounts secure, AustralianSuper will soon be implementing multi-factor authentication (MFA) to the Adviser Portal as a mandatory security measure. To prepare for this change we require advisers, Licensees and support staff to add or update their mobile number to their Adviser Portal profile to ensure uninterrupted access.

Once MFA is implemented, you’ll need to enter a one-time code sent to your mobile phone when you log in.

-

Our commitment to security

The introduction of MFA is an important step in enhancing the security of our members’ personal information. As a member-owned super fund, protecting our members is a top priority. We’re also aware that MFA can result in users having to verify their login multiple times per day. So we’re working on a new feature to improve the log on experience. Stay tuned for further updates.

-

Instructions for advisers adding a mobile number

To add a mobile number to your Adviser Portal profile, you’ll need to call us on 1300 362 453 weekdays from 9am-5pm (AEST). For privacy and security reasons, we'll need to verify your identity before changing any details.

Please note that we cannot accept email as a method of adding or updating a mobile number.

-

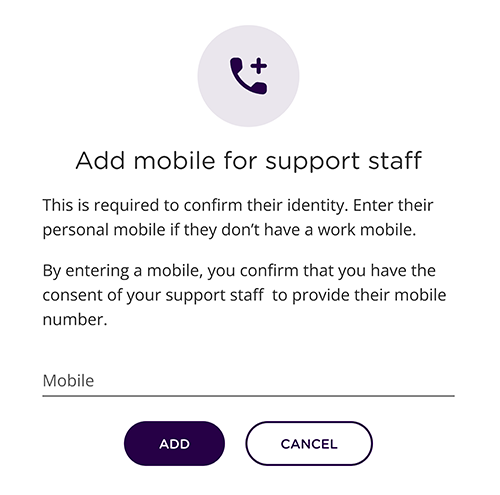

Instructions for support staff adding a mobile number

Mobile numbers can be added to a support staff account in two ways:

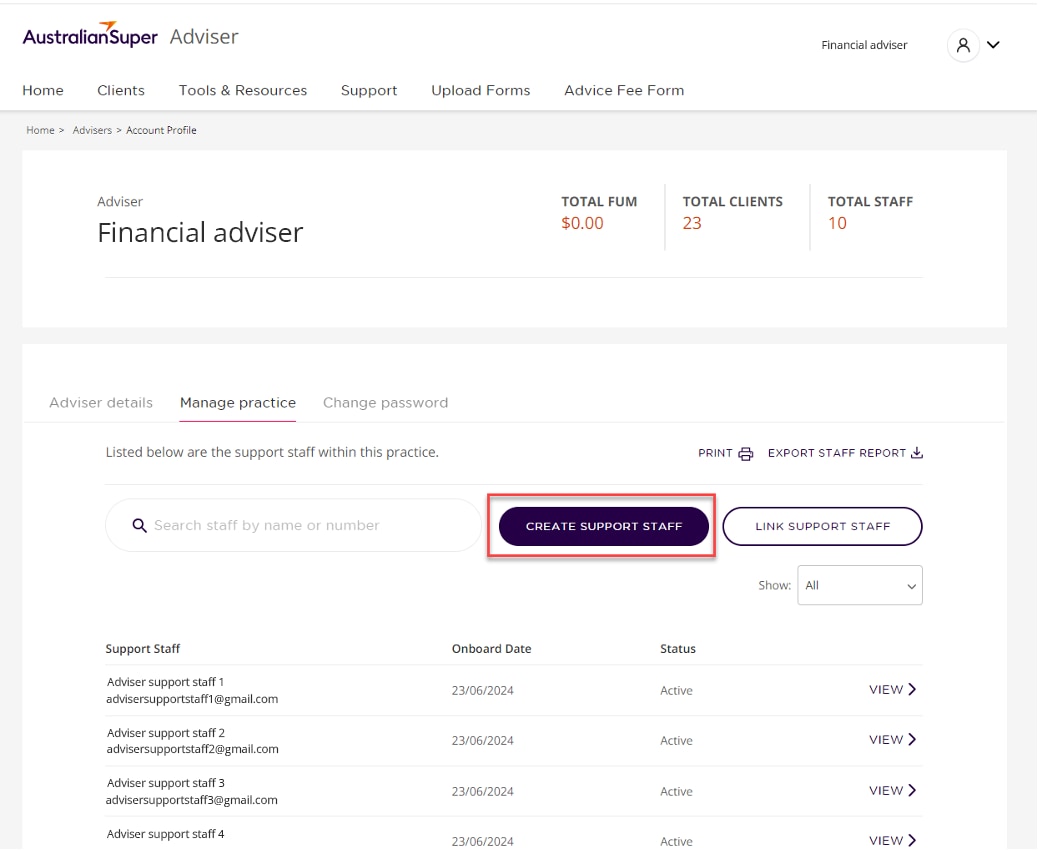

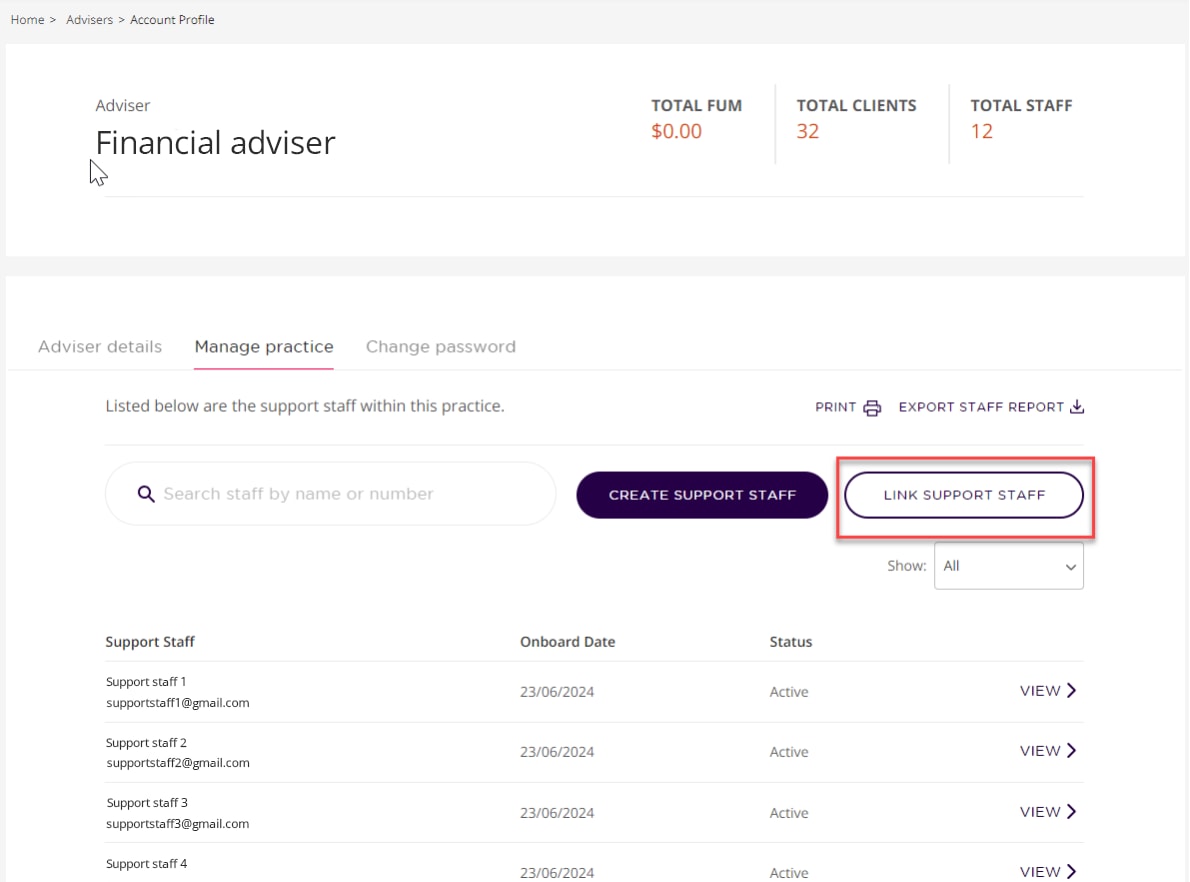

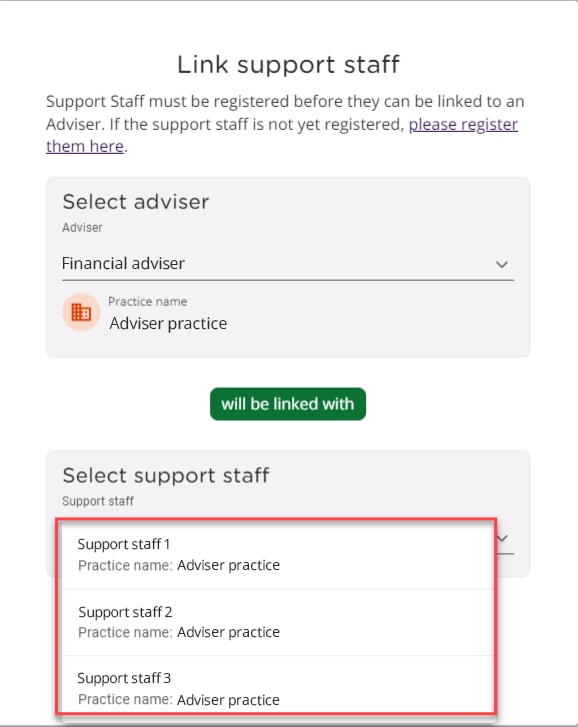

- Advisers can add it in the Adviser Portal:

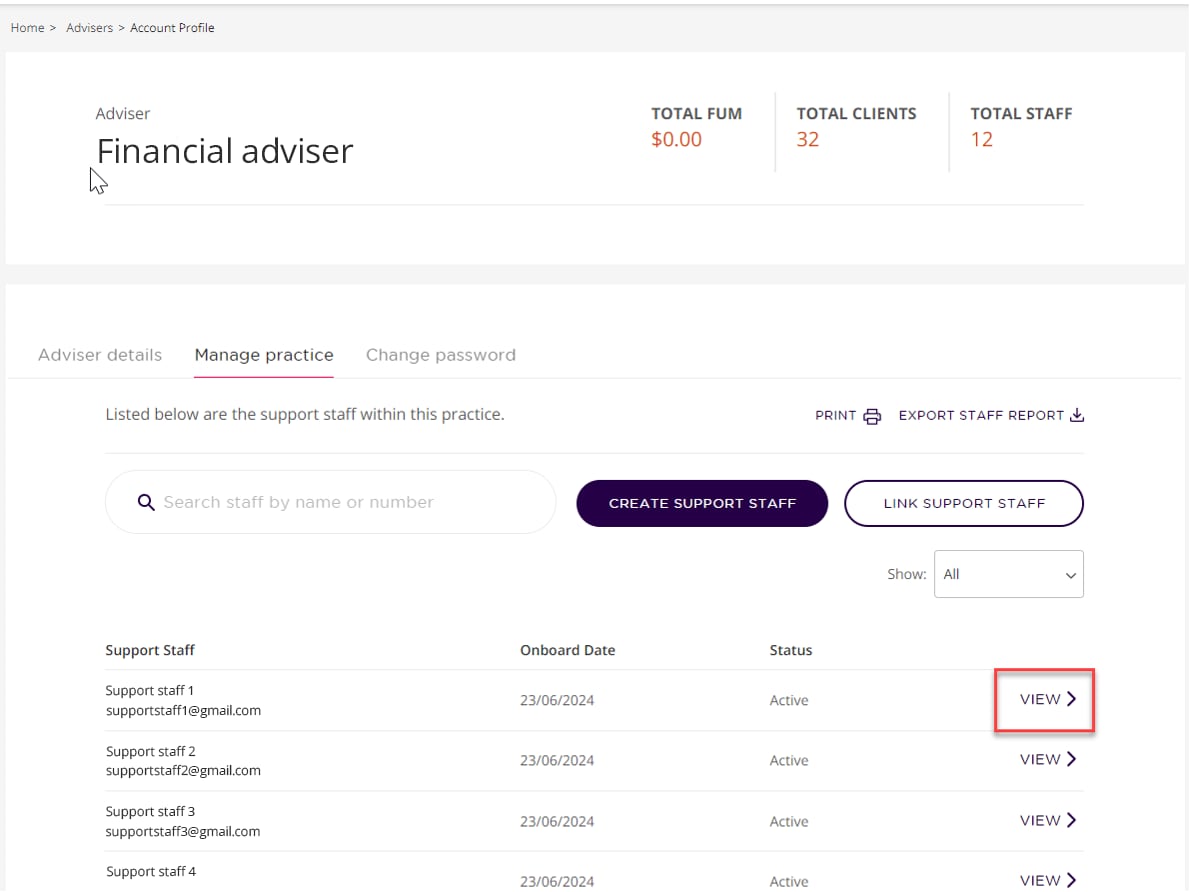

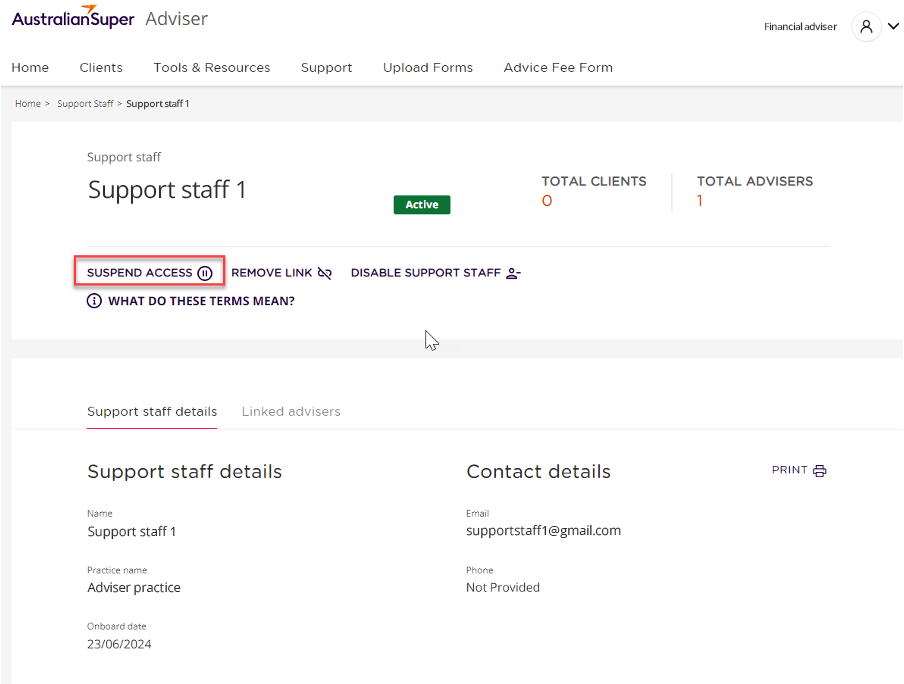

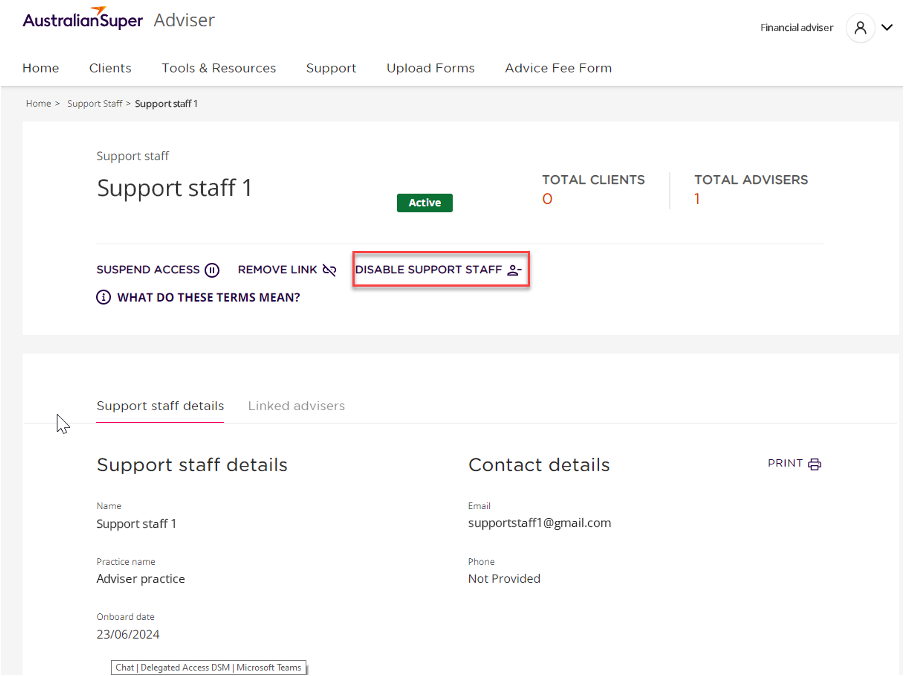

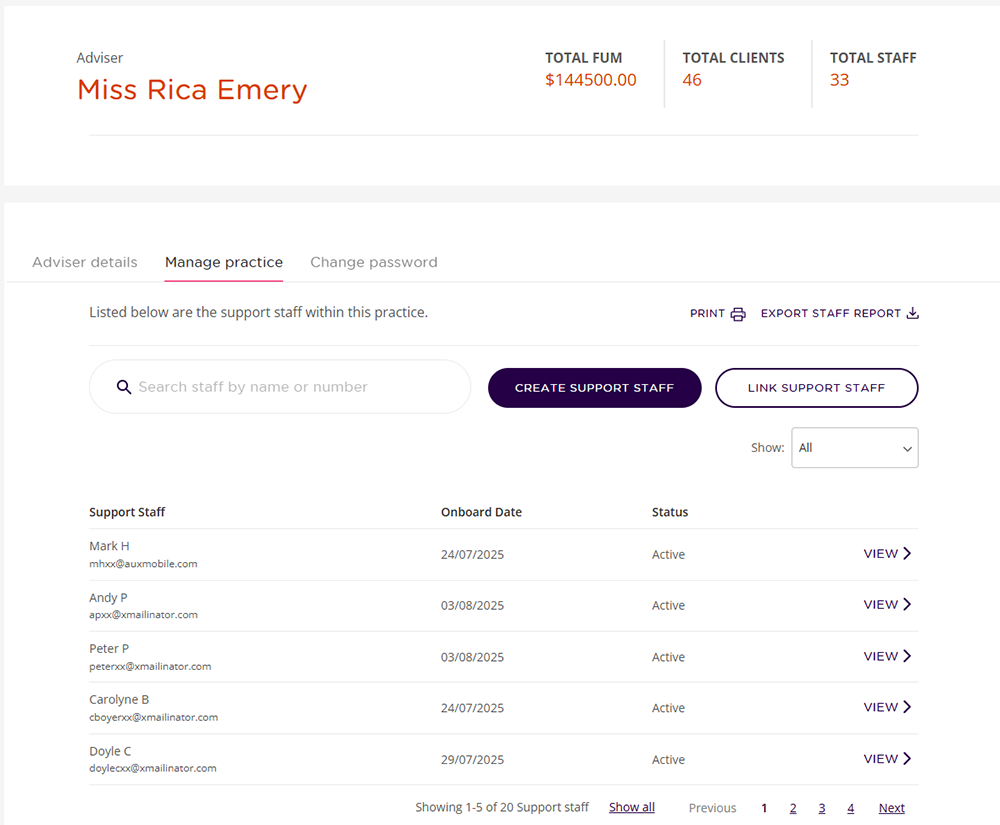

- Navigate to 'My account details' and click on the 'Manage Practice' tab. Here you’ll find a list of your support staff and their contact details.

- Click 'view' to see your support staff’s profile, then click 'add mobile'.

- Add your support staff’s mobile number.

- Support staff can call us on 1300 362 453 weekdays from 9am-5pm (AEST). For privacy and security reasons, we'll need to verify their identity before changing any details.

Please note that we cannot accept email as a method of adding or updating a mobile number.

-

Update a mobile number for support staff

If your support staff need to update their mobile number recorded in the Adviser Portal, there are two options available:

- You can call the Adviser Services team and update the mobile number on their behalf. We’ll need to verify your identity before changing any details.

- Alternatively, your support staff can call to speak to the Adviser Services team to update their mobile number. For privacy and security reasons, each user must call to update their own mobile number so we can verify their identity.

Our Adviser Services team are available on 1300 362 453 or +61 3 8677 3240 for international callers, weekdays from 9am-5pm (AEST).

Please note that we cannot accept email as a method of updating a mobile number.

-

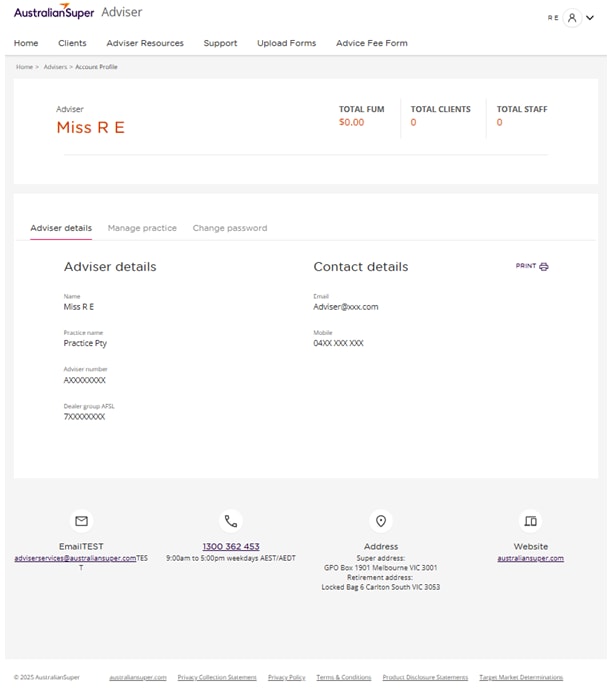

Check your recorded mobile number

To ensure you are prepared, log in to the Adviser Portal to check your mobile number.

You can do this by:

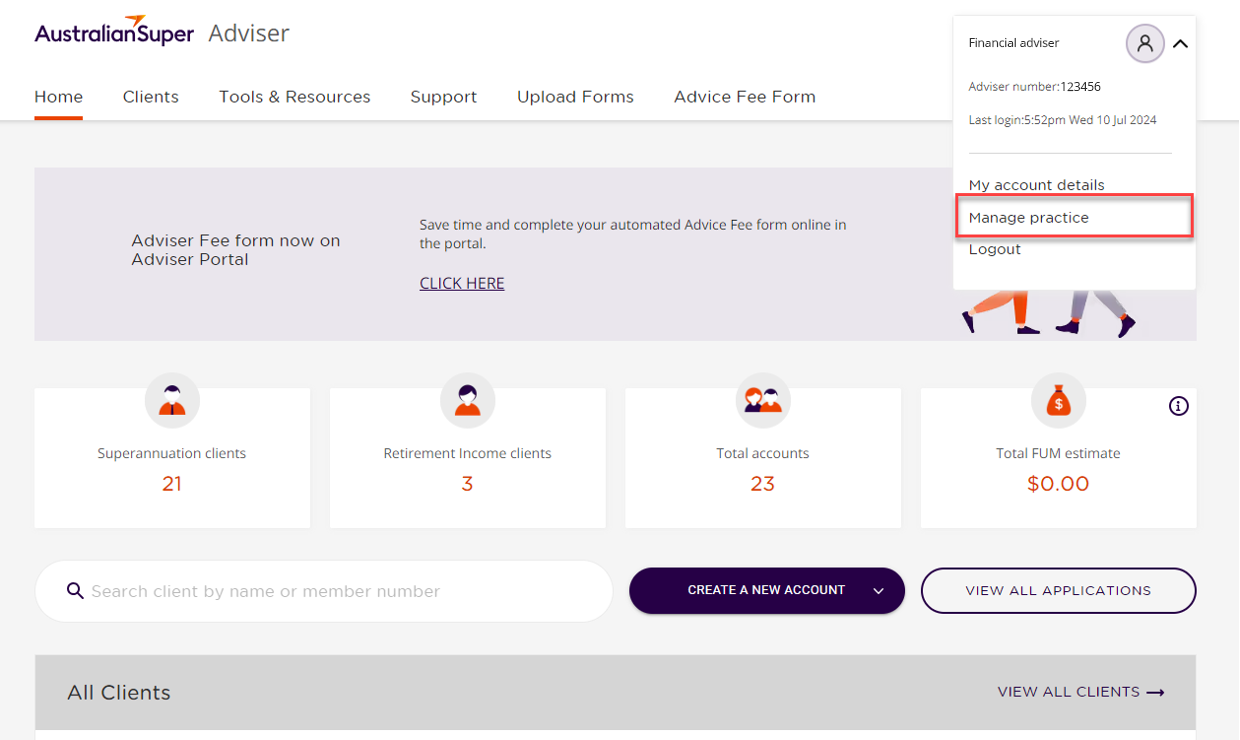

- Navigating to the top right corner of the Adviser Portal home screen and clicking on the drop-down arrow next to your name.

- Select 'My account details' to view your recorded mobile phone number under Contact details.

If your mobile number is correct, you don’t need to do anything.

-

Update your mobile number

If your mobile number is incorrect, please call us on 1300 362 453 weekdays from 9am-5pm (AEST). For privacy and security reasons, we'll need to verify your identity before changing any details.

Please note that we cannot accept email as a method of updating a mobile number.

We’re here to help.

If you have any questions or would like to know more, please email us at adviserenquiries@australiansuper.com.

This article is accurate as at the date of publishing: 7 January 2026.Improved accumulation join process in the Adviser Portal

We’ve listened to your feedback and improved the way your clients apply to join AustralianSuper when it’s done through the Adviser Portal.

These changes will increase client engagement, reduce your workload, and enhance compliance throughout the (accumulation account) application process.

-

What’s changed for your clients?

- Easier to review and validate their application details, reducing the risk of errors

- Improved messaging at key points throughout the application process

- Clearer timeframes around completion dates

- The PDS and TMD will be presented directly to them

- They’ll directly approve the ‘Declaration and acknowledgement’ section, reducing reliance on the Adviser

- Before reviewing their application, clients will need to verify their identity using a one-time-password (mobile number will be a mandatory field).

-

What’s changed for Advisers and Support staff

- Data quality in the applications will improve, reducing the need for follow ups

- A wider range of ‘Status’ types in the Adviser Portal, for a clearer overview of all join applications at any point in time

- A new ‘Action’ column in the Adviser Portal, making it easier to understand the next steps in the process

- Improved messaging during the process, enabling you to assist your client if required.

-

We’re here to help

- If you’d like a walk-through of the improved accumulation join process, email adviserservices@australiansuper.com

- For general troubleshooting, email Advice Operations at adviserenquiries@australiansuper.com

- To set up Adviser Portal access, scroll to the top of this page and select the dropdown option from the ‘Login’ button.

And remember, if your client needs support during the application process (e.g. they didn’t receive a one-time-password for verification) we’ll communicate with both you and your client, to make it easy for you to provide them with assistance.

This article is accurate as at the date of publishing: 29 January 2026

Important updates to the Member Direct investment option

From 28 March 2026, there will be several important updates to the Member Direct (MD) investment option.

-

If your clients have this option, they’ll be informed that we’re

- changing the research provider from UBS Securities Australia Limited (‘UBS’) to Morningstar Australasia Pty Ltd (‘Morningstar’) to expand research coverage of ASX listed securities

- reducing Portfolio administration fees for ‘Term Deposits’ and ‘Shares, ETFs & LICs’ levels of access

- reducing Brokerage fees when buying and selling shares, ETFs or LICs

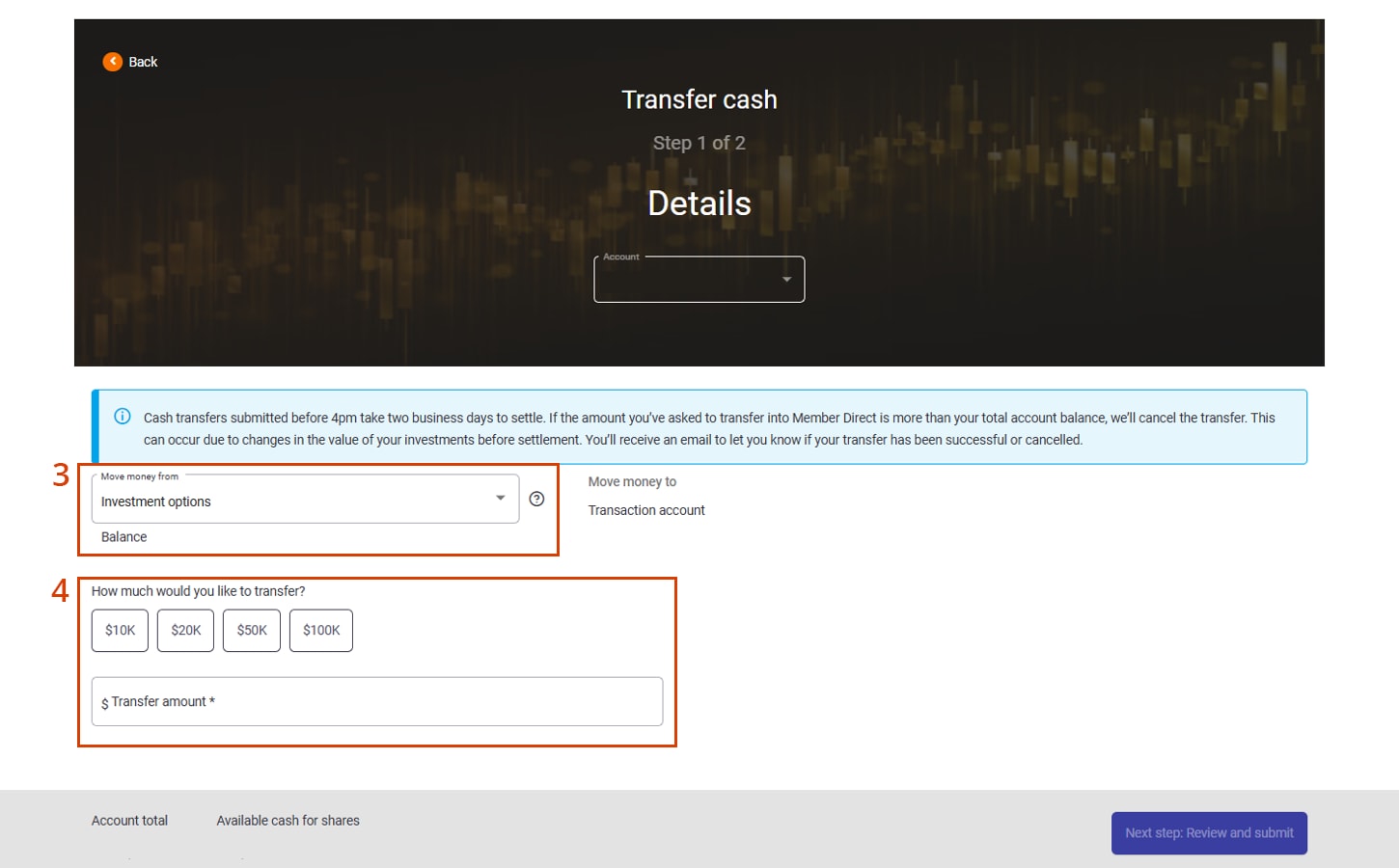

- enhancing the cash transfer process to allow members, and their advisers, to specify dollar amounts to be transferred into or out of AustralianSuper’s other investment options when actioning a cash transfer from or to the MD Cash account

- specifying the order in which we’ll action the early redemption of Term Deposits when we dispose of or rebalance their MD investments

- updating the Terms and Conditions for using the AustralianSuper Member Direct online platform.

-

What this means for your clients with MD

MD online platform

You or your clients won’t be able to access the MD online platform between 11pm AEDT on Friday 27 March 2026 and 1pm AEDT on Saturday 28 March 2026 while we update the system. We encourage members to log in once the system is back online to familiarise themselves with the changes, including reading all explanatory notes and disclaimers.

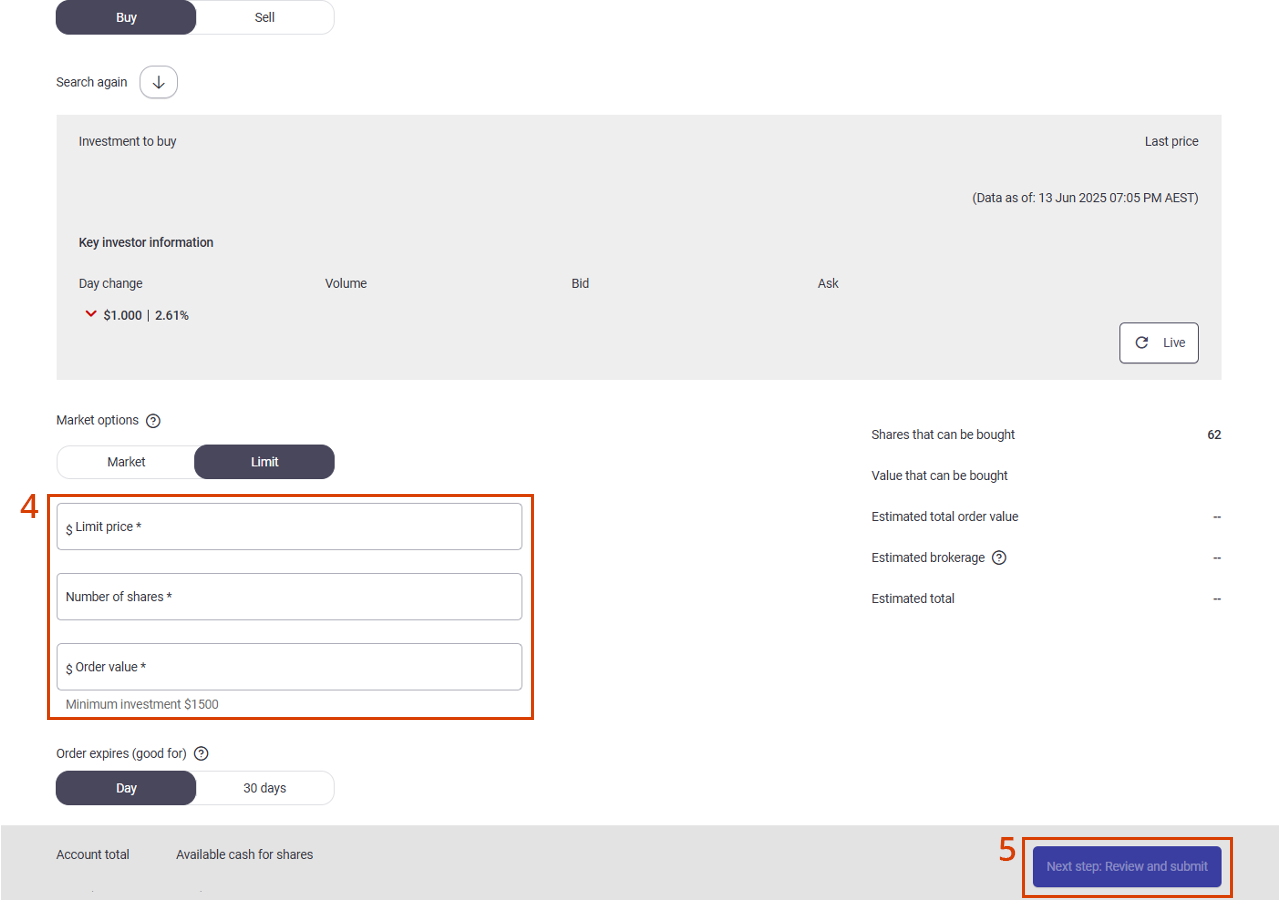

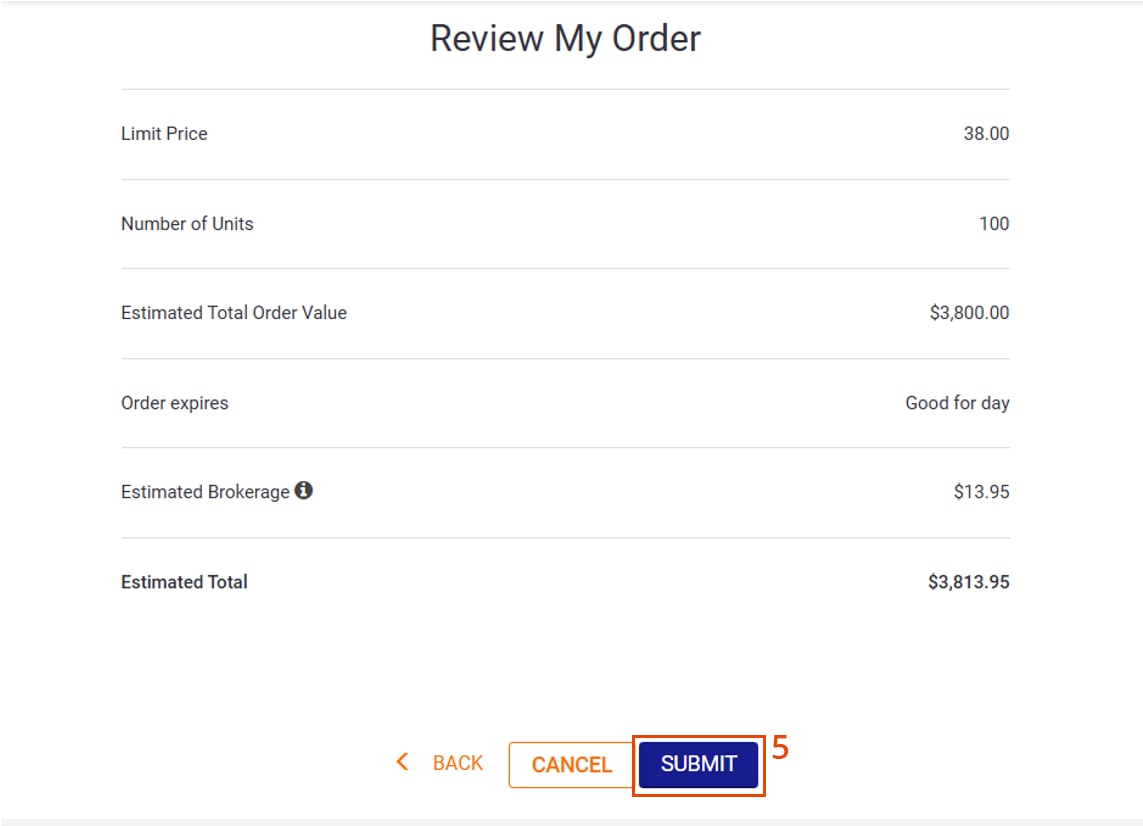

Re-submission of orders

To help us manage the change, any remaining open orders as at 11pm AEDT on Friday 27 March 2026 will be cancelled. This includes open or unfilled 30-day limit orders, and open part-filled at market orders.

Accordingly, members will be advised not to set up any limit orders after market close (4pm AEDT) on Friday 27 March 2026 as these will be automatically cancelled at 11pm AEDT. If required, they can set up new limit order requests once the platform is back online on Saturday 28 March 2026.

Fee changes

If members have selected the Cash Account level of access their fees won’t change. In all other cases, their Portfolio administration fee and any Brokerage fees will reduce from Saturday 28 March 2026.

-

What advisers need to do

When you first access the MD online platform from 28 March 2026, you’ll need to read and accept the updated Terms and Conditions for using the AustralianSuper Member Direct online platform available on our Member Direct page.

In addition we’ll also be updating the:

- MD investment option guide, Fees and Costs IBR and the Choice Income PDS,

- MD investment menu on, or around 1 April 2026 with additions and deletions as part of the annual review,

- TTR Income PDS, as the associated join form is being refreshed and the Binding death nomination form is being updated.

As distributors of our products, it’s important that you:

- dispose of all previous versions of the documents mentioned above (including any join forms) to ensure your clients receive the most current versions, and

- use the updated documents (including any join forms) from 28 March 2026.

-

What your clients with MD need to do

When your clients first access the MD online platform from 28 March 2026, they’ll need to read and accept the updated Terms and Conditions for using the AustralianSuper Member Direct online platform, available on our Member Direct page.

If they wish to change their level of access to take advantage of the reduced fees, they can log into MD and make the change in their account settings once the platform is back online on Saturday 28 March 2026.

If your client is not comfortable with the changes and they wish to cancel their MD account, they can log into MD and make the change in their account settings before 4pm AEDT on Friday 27 March 2026.

-

We’re here to help

For more information, including details of fee reductions , please refer to the SEN titled Important updates to the Member Direct investment option February 2026.

If you have any questions, email adviserservices@australiansuper.com or call 1300 362 453 weekdays from 9am – 5pm AEST/AEDT.

Important changes for Advisers from 23 October 2025

We’re releasing new Choice Income and Transition to Retirement (TTR) Income Product Disclosure Statements (PDSs), join forms, Target Market Determinations (TMDs) and Investment Guide effective 23 October 2025.

-

Updated PDS documents, join forms and TMDs

As distributors of our products, it’s important that you:

-

Minimum balance to open new Retirement accounts

Please note that the minimum balance to open a:

- Choice Income account has changed from $50,000 to $10,000,

- TTR Income account has changed from $25,000 to $10,000.

-

Making it easy for your clients to refresh their income account and top-up their savings

AustralianSuper has introduced a simplified account recycling service, enabling advisers to help clients boost their retirement savings with ease.

To learn more, download the form and read our FAQs, please visit our Refresh your income account and top-up your savings page

-

Updated SuperRatings benchmarks

In July 2025, the SuperRatings benchmarks used in the investment objectives of some PreMixed investment options, to compare performance to other funds, were changed. The change removed the number of providers in each benchmark, e.g. ‘50’ was removed from the SR50 Balanced (60-76) Index.

Investment option Super and TTR From To Stable SR50 Capital Stable (20–40) Index SR Capital Stable (20–40) Index Conservative Balanced SR25 Conservative Balanced (41–59) Index SR Conservative Balanced (41–59) Index Balanced SR50 Balanced (60-76) Index SR Balanced (60-76) Index High Growth SR50 Growth (77–90) Index SR Growth (77–90) Index Choice Income From To Stable SRP50 Capital Stable (20–40) Index SRP Capital Stable (20–40) Index Conservative Balanced SRP25 Conservative Balanced (41–59) Index SRP Conservative Balanced (41–59) Index Balanced SRP50 Balanced (60-76) Index SRP Balanced (60-76) Index High Growth SRP50 Growth (77–90) Index SRP Growth (77–90) Index This article is accurate as at the date of publishing: 23 October 2025

Support staff can now create super accounts online

Previously, we announced that advisers and public trustee officers (PTOs) can open super (accumulation) accounts for their clients directly in the Adviser Portal.

To make things even easier for advisers, we’ve enhanced the portal to allow adviser support staff to pre-fill new account applications using their own login details.

-

More information

Main benefits

- Saves time for advisers who delegate this task to their support staff.

- More secure than sharing login details with others.

- Will help to open super accounts faster for clients.

How does it work?

When creating an application, the support staff will select the adviser/PTO who will review and approve (or reject) the application.

On the last page of the application, the option to ‘submit’ is replaced with ‘send for review’. The application will be sent to the selected adviser/PTO to review and approve (or reject).

Help and support

To learn more about the Adviser Portal and support staff access, please read the FAQs on our Adviser Resources page. And if you need further help, please refer to the related article, “Open super accounts online” or contact us.

Important notice about Annual Statements

AustralianSuper will send annual statements to members from September 2025. Advisers should be aware that while the closing balance shown on these statements is correct, it may not match the closing balance members see in the member portal and app.

This is due to a known issue, and AustralianSuper is actively working on a fix. We’re also adding messages to both the member portal and app to alert members about this discrepancy.

If you receive any enquiries from your clients, please explain the situation and reassure them that AustralianSuper is resolving the issue. Then direct them to refer to their annual statement to see the correct closing balance.

If you have any further questions, please contact the Adviser Services team.

This article is accurate as at the date of publishing: 11 September 2025.Important changes for Advisers effective 1 August 2025

We're releasing new Accumulation, Choice Income and Transition to Retirement (TTR) Product Disclosure Statements (PDS) effective 1 August 2025.

-

Updated PDS documents and join forms

As distributors of our products, it’s important that you dispose of all previous versions of our PDSs to ensure your clients receive the most current PDS and join form. Please begin using the updated join forms included in the new PDS.

-

Fees and costs

The confirmed fees and investment costs have been included in the August 1 Accumulation, TTR and Choice Income PDSs, and are also available on our website. -

Changes to our Socially Aware option

AustralianSuper has recently reviewed the investment exclusions (or ‘screens’) that apply to the Socially Aware investment option to better meet member expectations, specifically in relation to the areas of concern subject to screening, and to ensure as far as practical that screens apply to all assets held by the option.

Effective from 1 August 2025, the review has resulted in changes to the strategic asset allocation, investment objectives, risk levels and screens that apply.

For full details of the Socially Aware investment option, including updated details on the implementation and monitoring of screens, refer to:

- For super accounts: australiansuper.com/InvestmentGuide

- For Choice Income or TTR Income accounts: the relevant product disclosure statement at australiansuper.com/pds

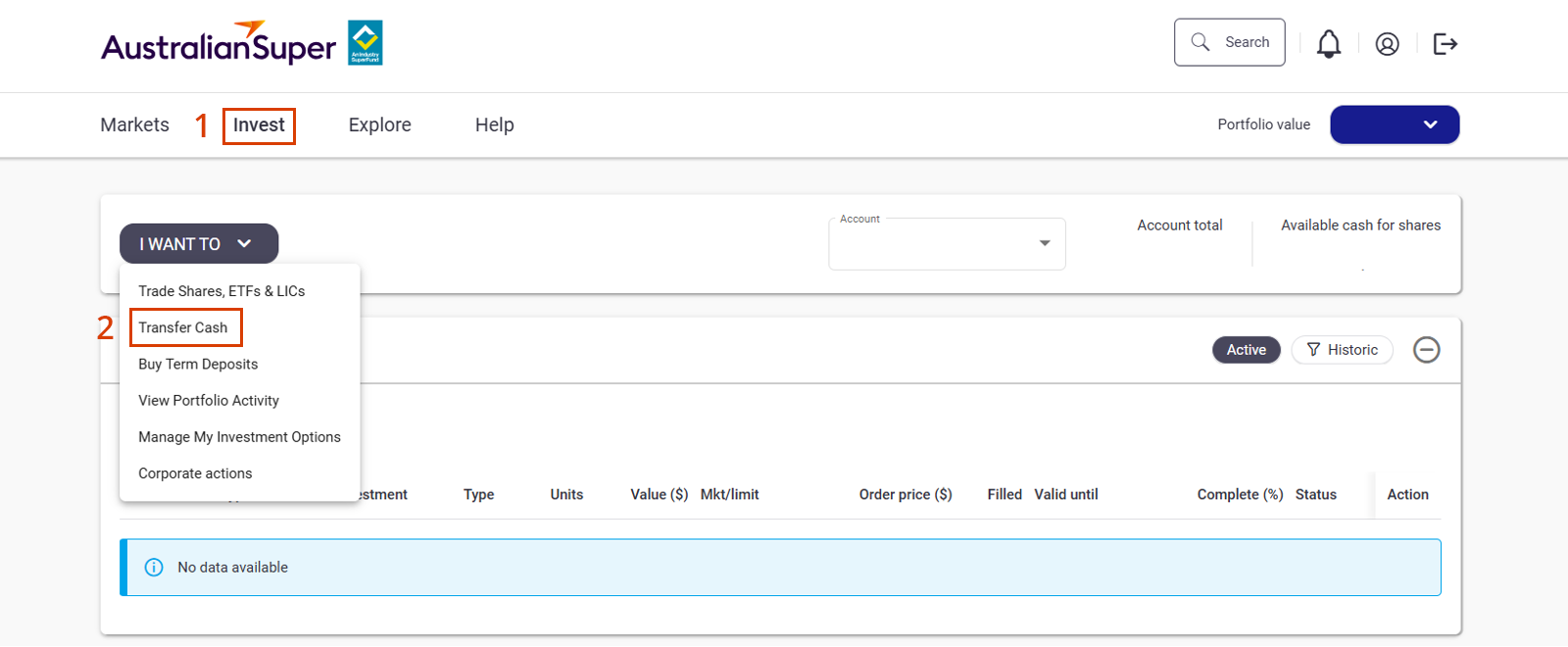

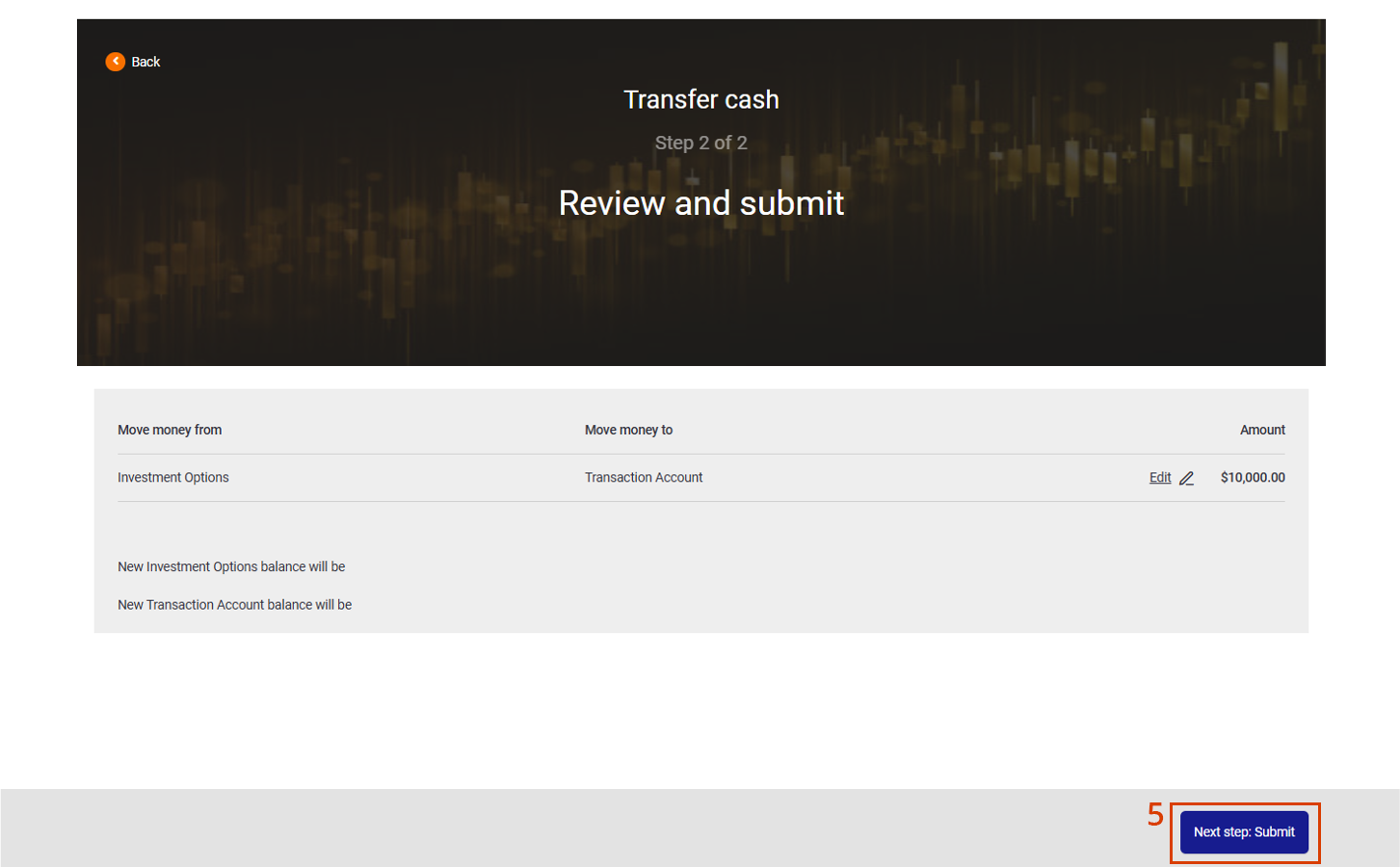

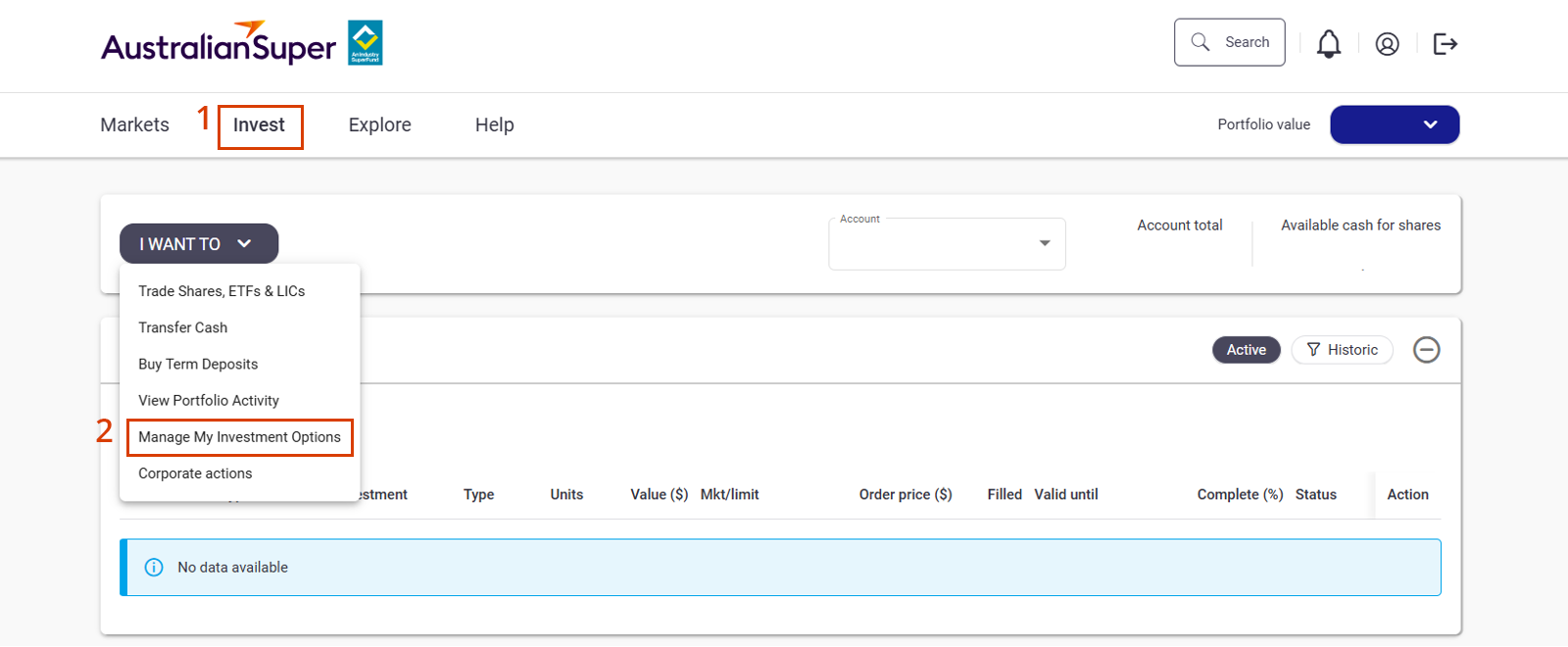

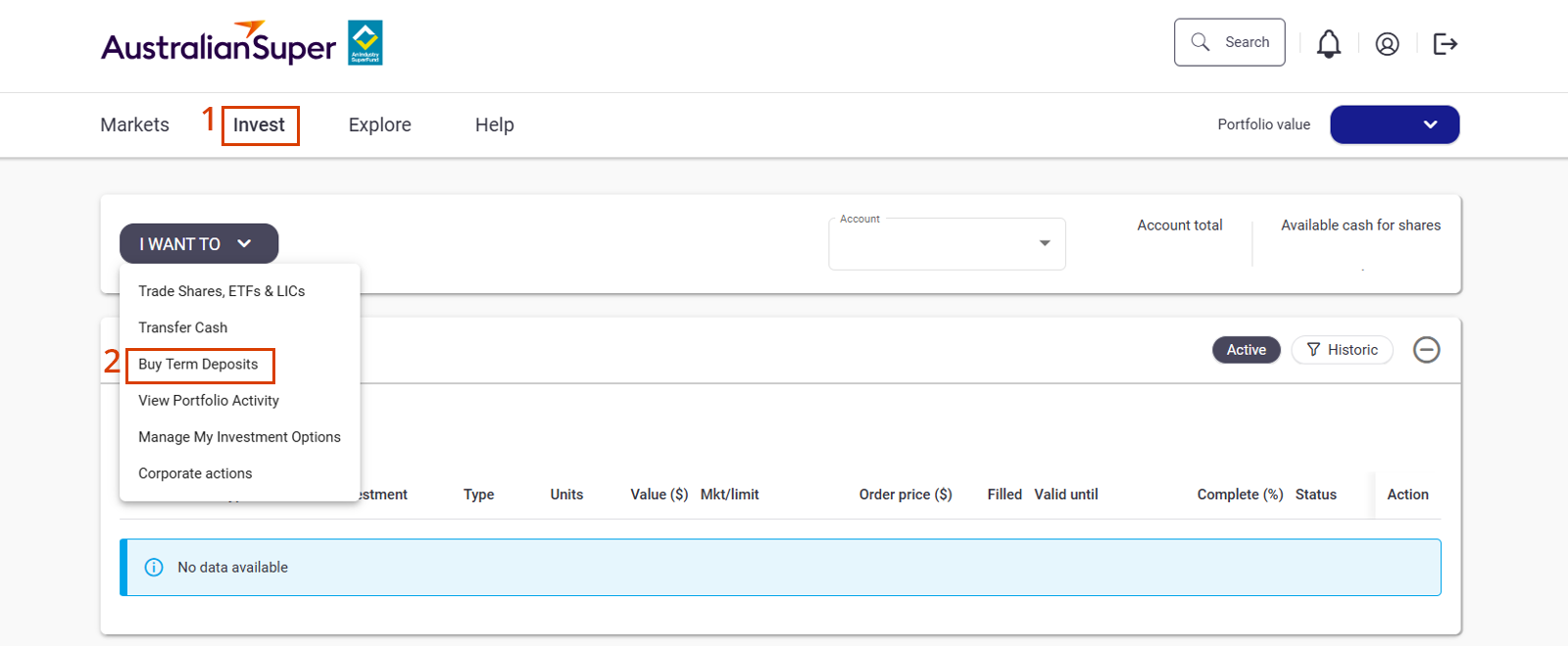

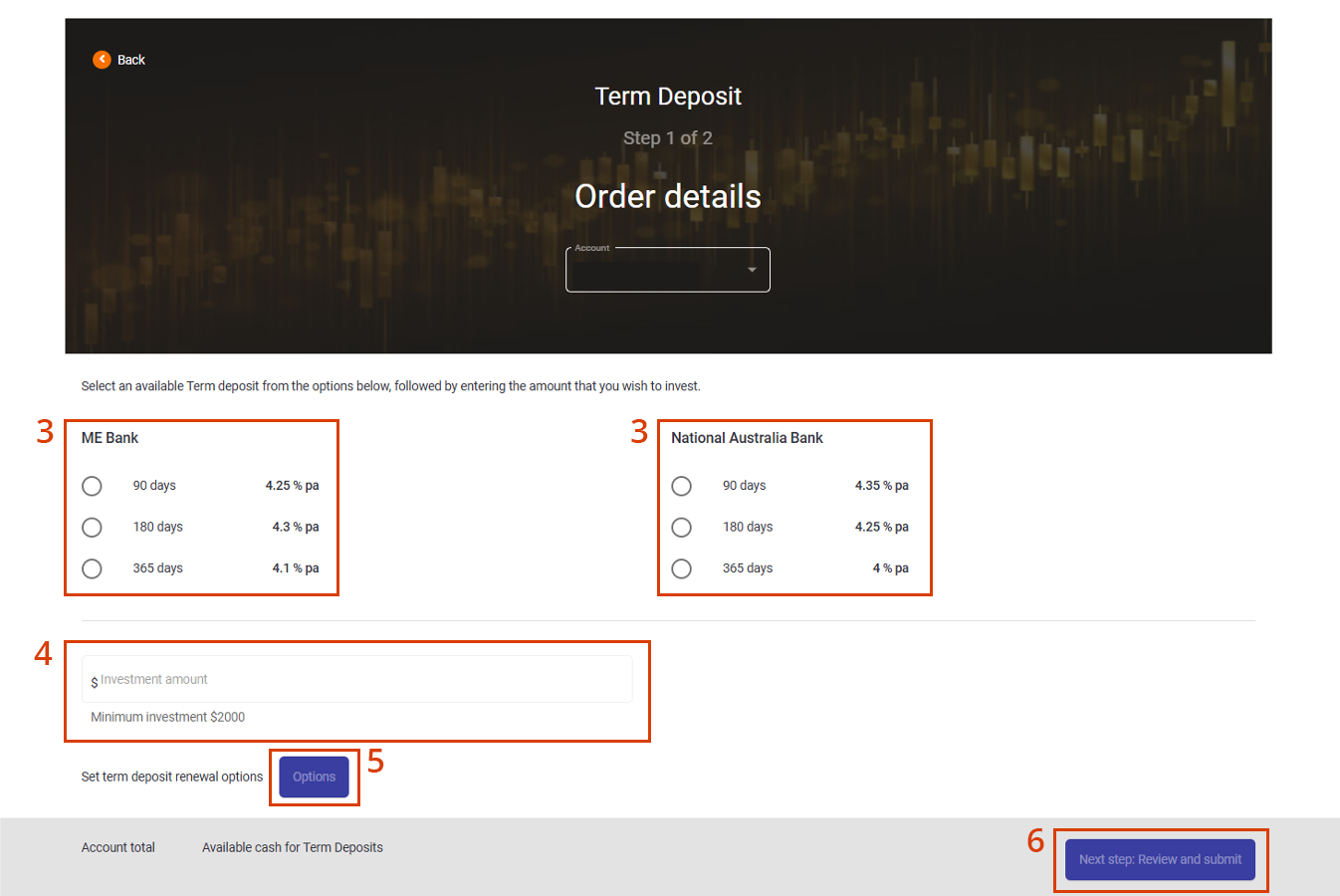

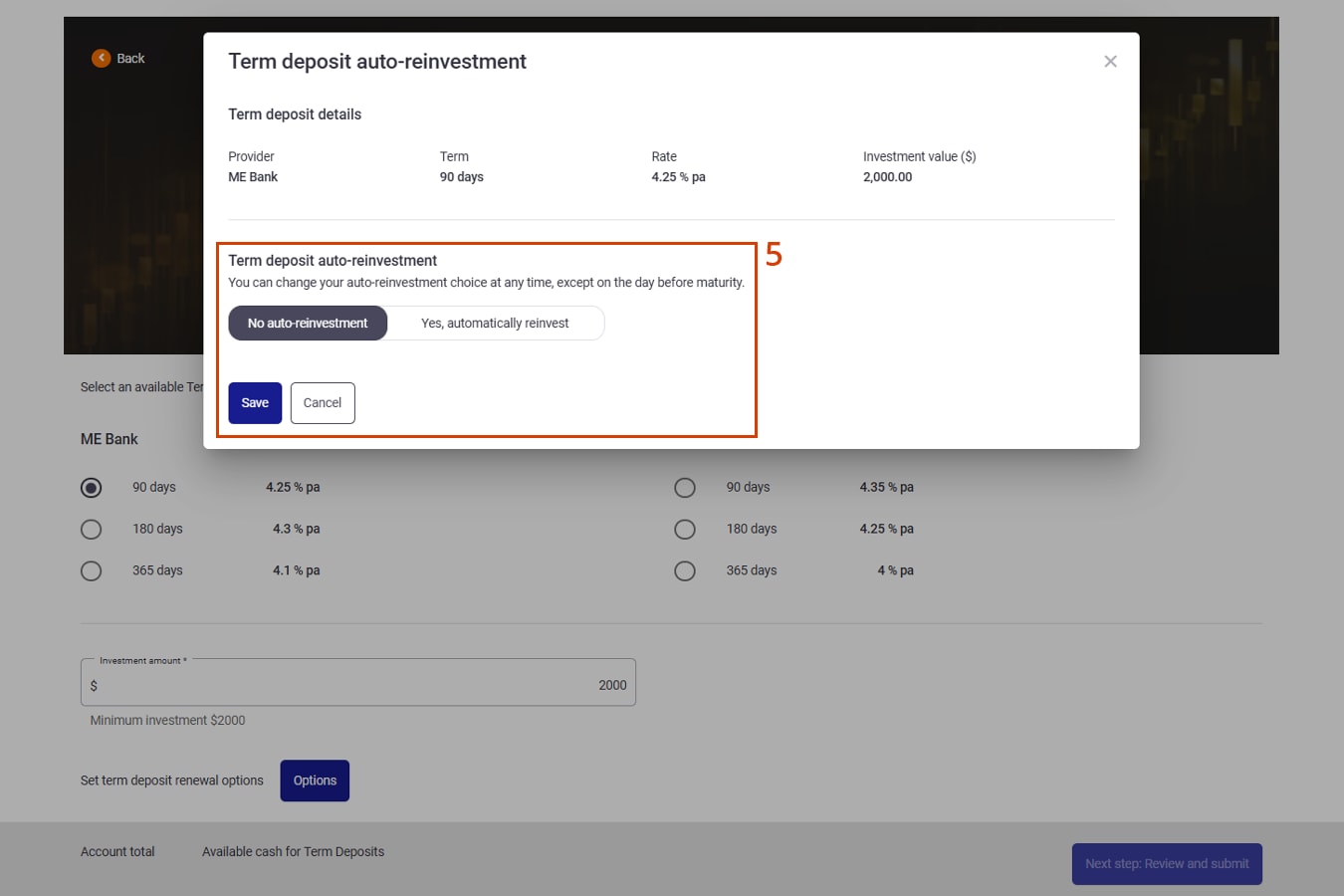

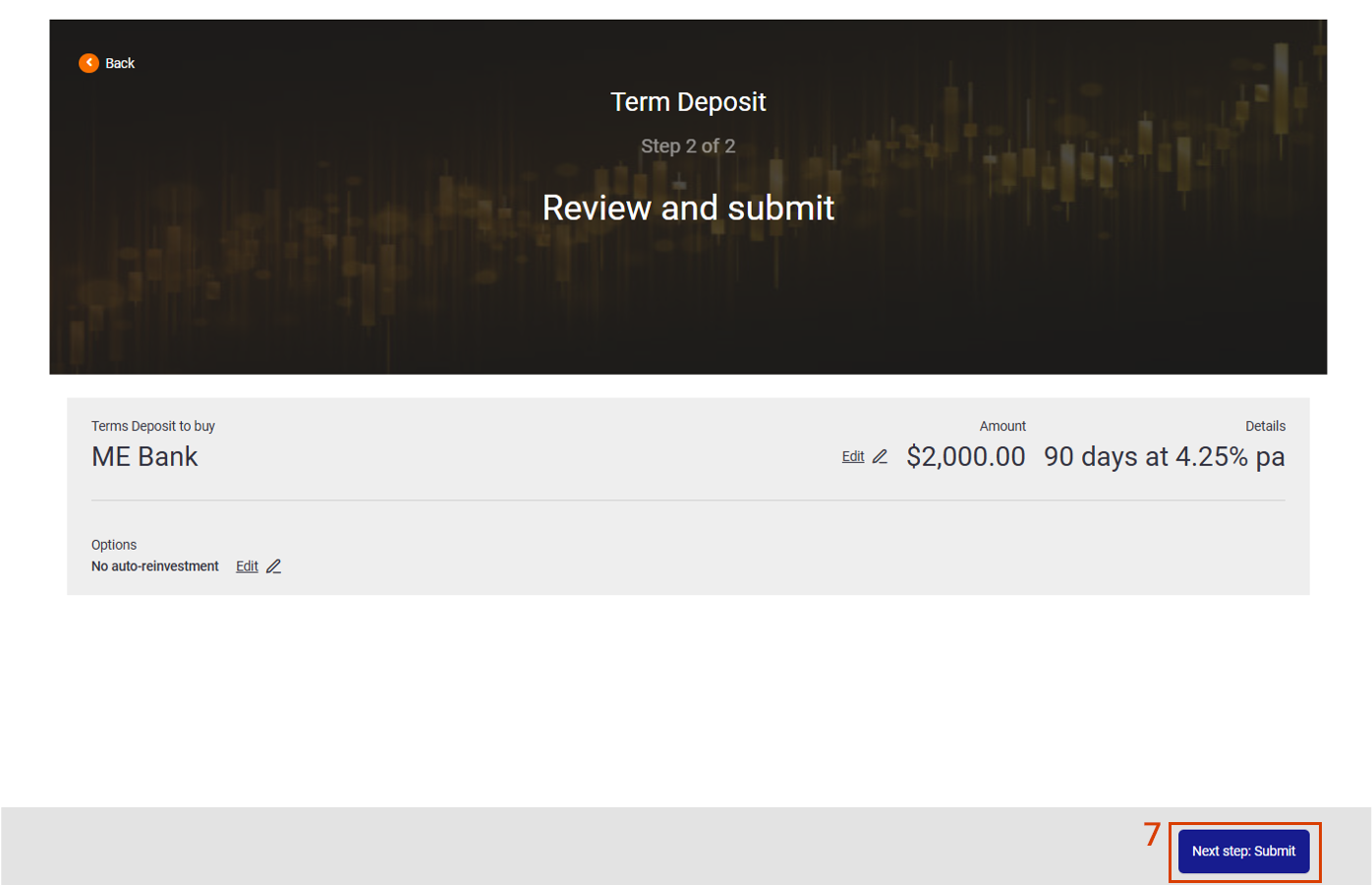

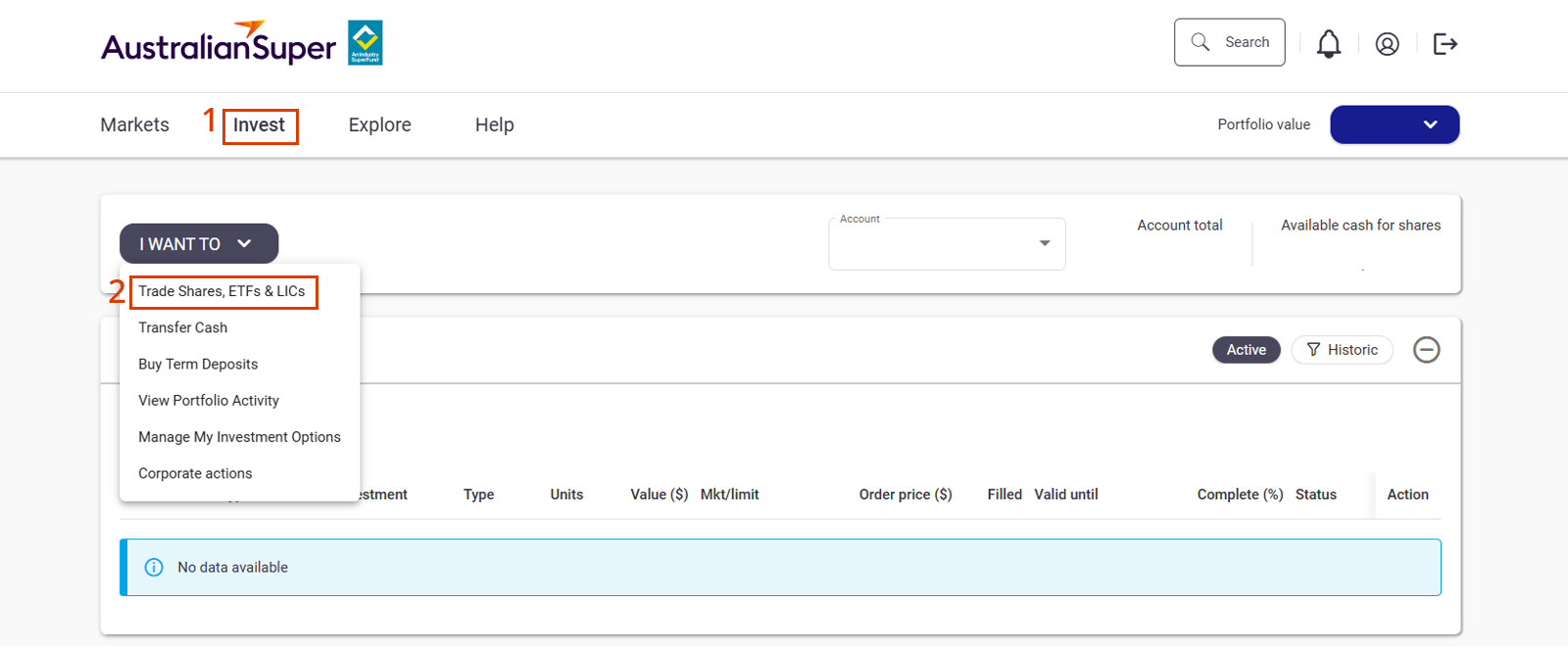

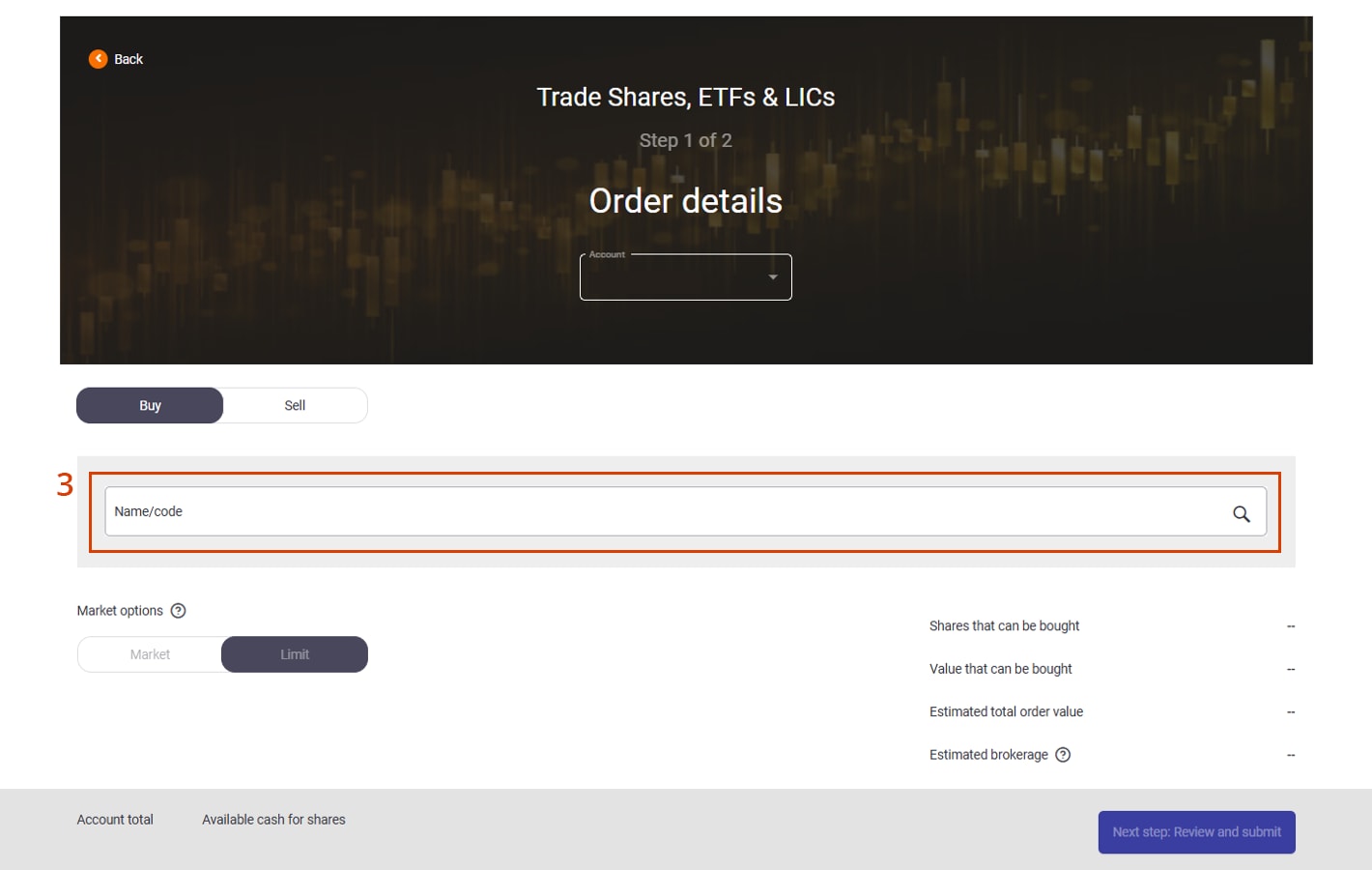

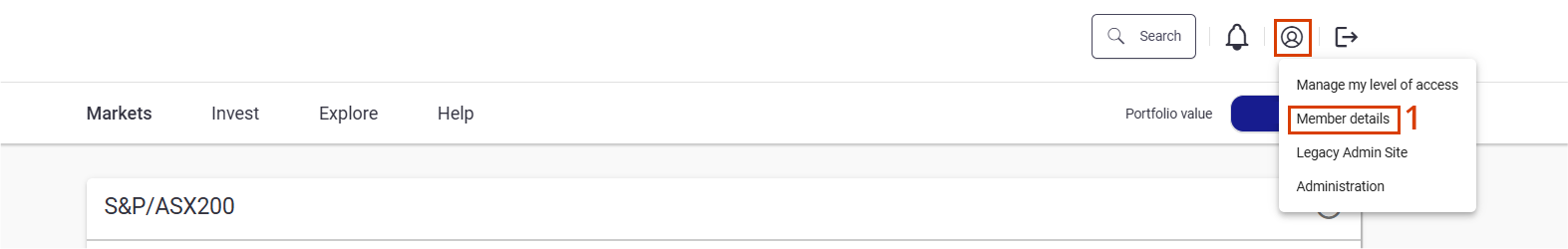

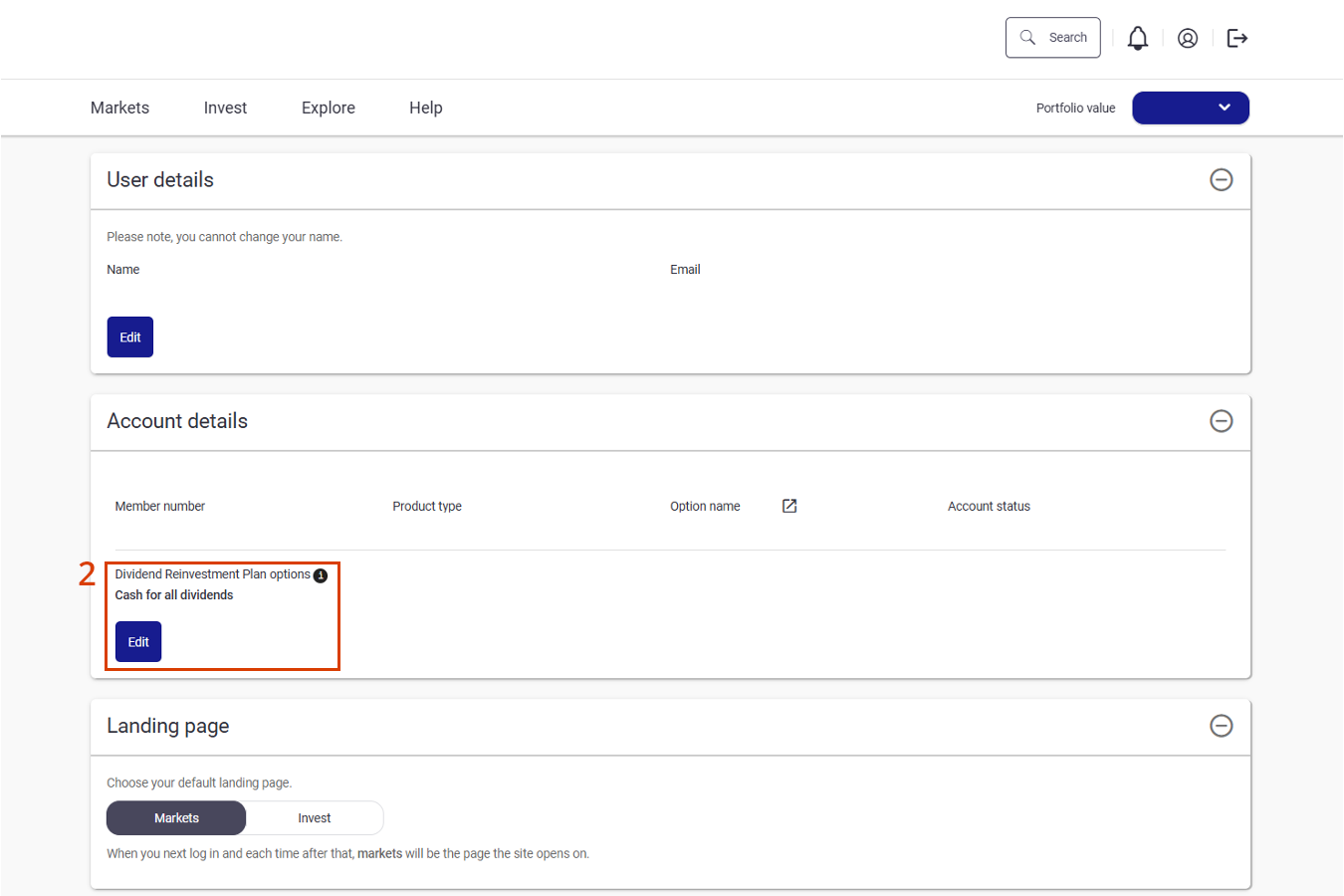

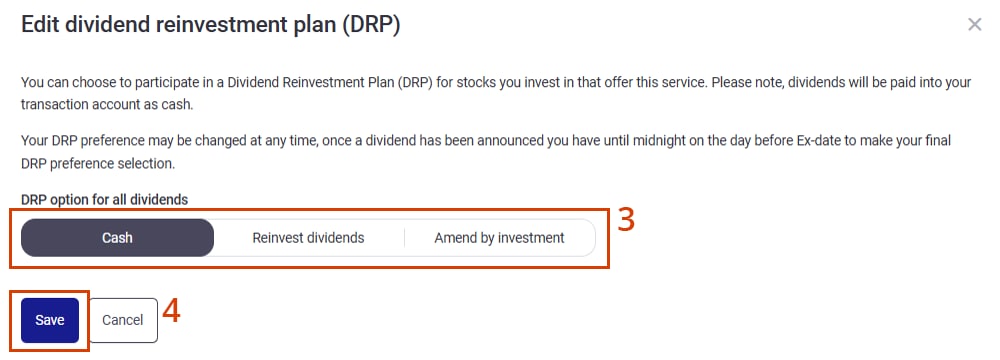

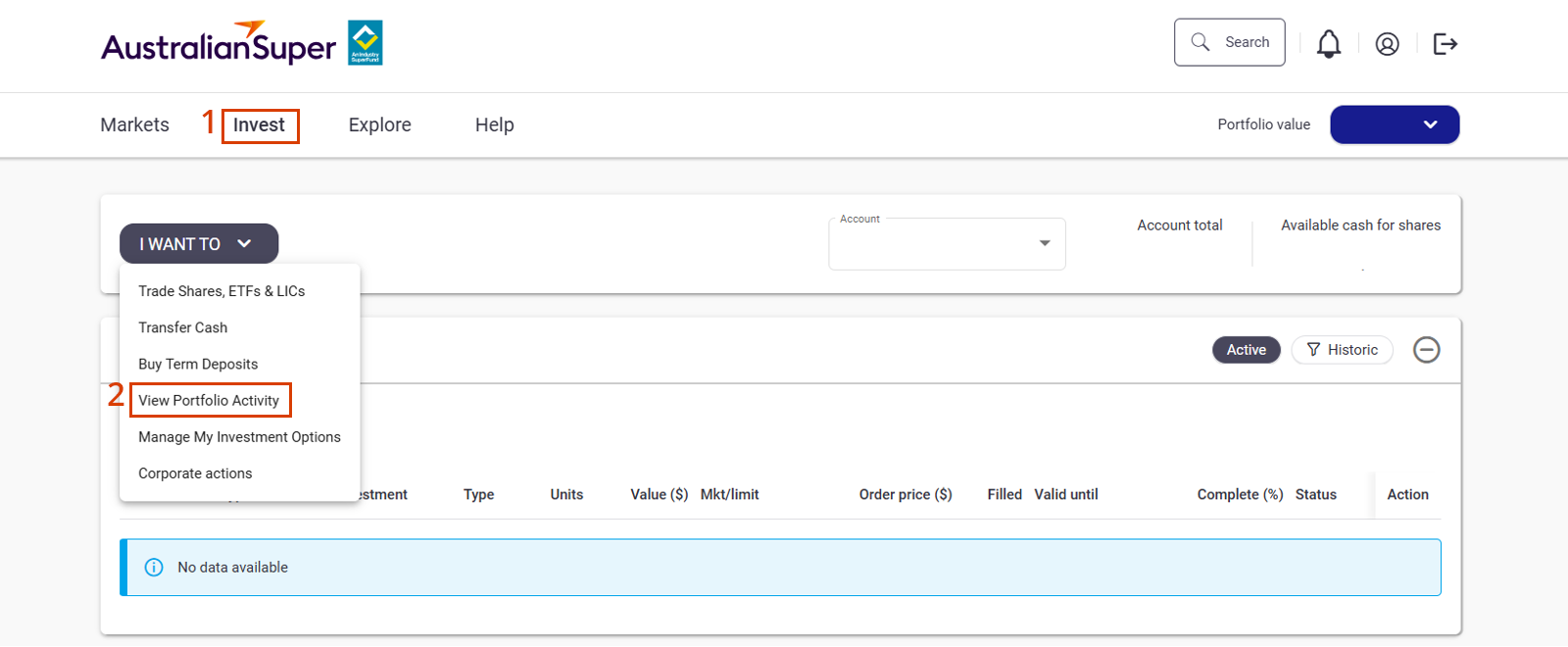

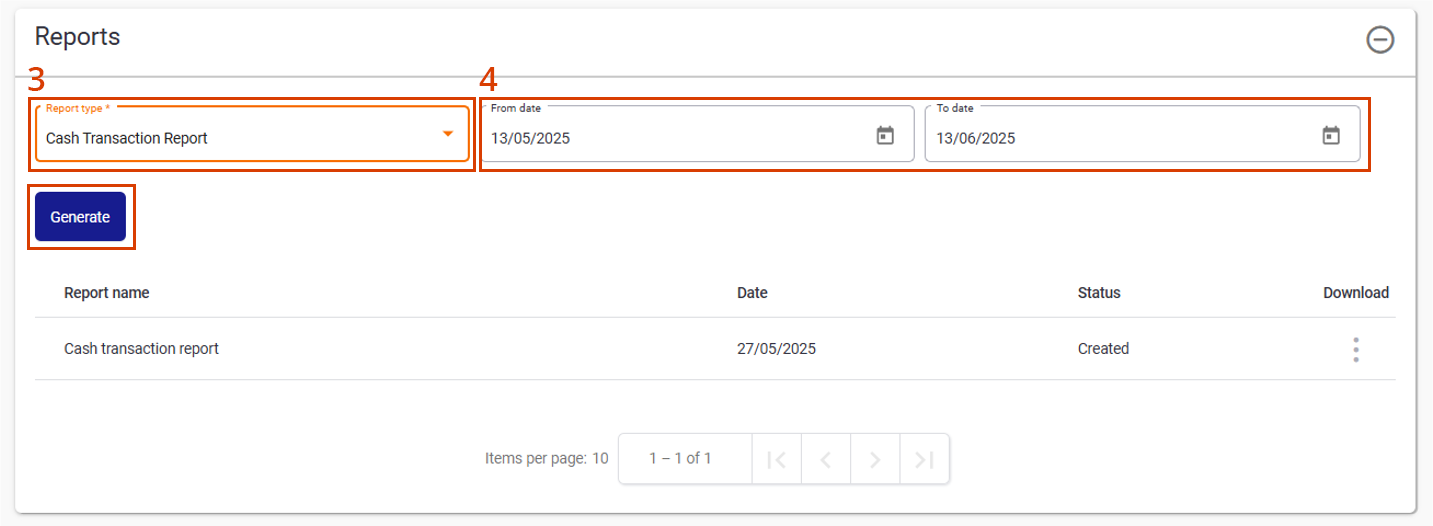

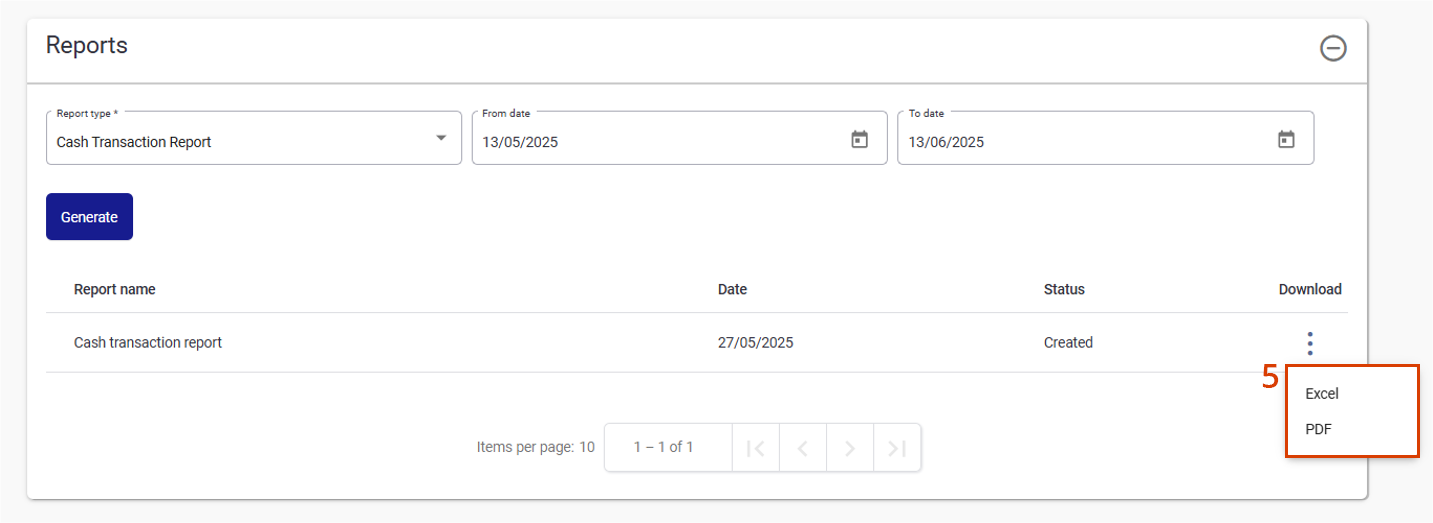

New Member Direct FAQs

We’ve recently refreshed the Member Direct FAQs with screenshots to better guide you how to perform key tasks.

Notice of Intent (NOI) and rollover/withdrawal timing - Best practice

To support smooth processing and protect your client’s ability to claim a tax deduction, check the Adviser Portal to confirm the client’s NOI has been processed, before submitting any rollover or withdrawal requests.

This approach ensures contributions are eligible for deduction and avoids delays or unintended tax outcomes.

To find this information, go to your client’s ‘Transactions’ screen on the portal. By choosing the financial year, the description of the transaction will display as ‘Notice of Intention (NOI) tax deduction’ – see below for example:

Insurance enhancements through TAL Connect

As part of our ongoing commitment to improving member experience, we’ve introduced more efficient and user-friendly ways to lodge insurance claims and underwriting applications through our insurance provider TAL Life Limited.

-

Online claims

Members can now lodge claims for Total & Permanent Disablement (TPD), Income Protection or terminal illness through the AustralianSuper Member Portal, Member App, or by speaking with a TAL claims consultant via tele-claim.

These options provide numerous benefits, including:

- Reduced waiting time for claim forms via mail

- Intuitive forms based on member claim type and condition, and

- Direct claim lodgement to the TAL claim team.

Members can also complete a greenID check in TAL Connect for Income Protection payments. For TPD and terminal illness, additional ID checks will be required.

Paper-based claims remain available and are required for Third Party Authorities (TPAs) and restricted members.

-

Start your basic cover - new

New members can now apply online to start their basic cover before they turn 25 and their super balance reaches $6,000 (age limits and eligibility conditions apply). Members can continue to submit paper Start your basic cover application forms included in their Welcome pack.

-

Life events

Eligible members can apply for new or additional cover following certain life events, if their insurance needs have changed. Members now have 120 days to apply. A child starting primary school and a child starting secondary school have been added as life events.

-

Salary increase

Eligible members now have 90 days to apply for an increase to their Income Protection cover amount following a salary increase. Evidence requirements have also been simplified.

-

Transfer of cover

Eligible members can transfer their existing insurance cover from another super fund to AustralianSuper - up to $2m for Death and TPD, and $20,000 a month for Income Protection (subject to maximum cover limits). We can now also match long-term Income Protection benefit payment periods (certain occupations can’t have a long-term benefit payment period).

For more information about any of these insurance changes, download the Insurance in your super guide.

AustralianSuper insurance is provided by TAL Life Limited (the Insurer) ABN 70 050 109 450, AFSL 237848.

Uploading forms in the Adviser Portal

You can now upload all your forms directly through the Adviser Portal. If you haven’t already, we encourage you to start using the 'Upload forms' page in the portal for all form and client request submissions. It’s a quicker and more efficient way to get things processed.

Open super accounts online

Advisers and public trustee officers can now open super accounts for their clients directly in the Adviser Portal.

Simply select ‘Create a new account > Superannuation’ from the main dashboard page and follow the on-screen prompts.

Once submitted online, the account will automatically be set up. There are no identity verification requirements for super accounts, so this doesn’t apply for the online process like it does for our Choice Income or Transition to Retirement products.

Please note, the process requires downloading a prefilled application form. This doesn’t need to be submitted to AustralianSuper however you’ll need to obtain the client’s signature and keep the signed form on file. Like our other application forms, you may be asked to produce this in future and are expected to do so within five business days.

We’re planning to extend this enhancement to authorised support staff in the future.

Choice Income online join via Adviser Portal

There are a few ways to submit a Choice Income application to Adviser Services. The fastest way to open an account is online via the Adviser Portal.

- Online forms will only proceed with all the required information, reducing the need for unnecessary re-work.

- Applications are received quicker, so they’re processed promptly by our admin team.

- Any issues with Electronic ID are identified at lodgement stage and if certified ID is required, this can be sent directly with the application to Adviser Services to avoid delay.

If you need help with lodging an online application, please contact our Adviser Services team.

Submitting third party authorities

To ensure a smooth process when submitting your own third-party authority form to AustralianSuper, please follow these guidelines:

- Adviser’s email: include email address of the adviser requesting authorisation.

- Support staff authorisation: if you’d like your team to assist with client matters, please include a line on your form authorising ‘all support staff’.

Our Adviser Services team

Our Adviser Services team includes our Adviser Services Managers, a dedicated group of experienced financial services professionals. They can support you with administrative, product or process queries you may have while working with us.

Our Adviser Partnerships team

Our Adviser Partnerships team are Fund and product experts, who are dedicated to developing and maintaining strong, long-term relationships with external licensees and financial advisers. They’ll work with you to ensure you have the right information, tools and support to grow your clients’ savings for a better future.

-

Meet our Adviser Partnerships team

Tim Berkman

Tim Berkman

Manager, Adviser Partnerships (QLD & NT)Phone: 0402 929 972

Email: tberkman@australiansuper.comJoining AustralianSuper in 2010, Tim previously spent eight years with BT and Rothschild. Tim’s role at the Fund involves building adviser and licensee relationships across Queensland and the Northern Territory. His focus is on growing the adviser channel and supporting licensees and advisers in their work with AustralianSuper.

Nikki Spiers

Nikki Spiers

Adviser Partnerships Manager (VIC & WA)Phone: 0429 203 789

Email: NSpiers@australiansuper.comNikki joined AustralianSuper in 2017 after working for 18 years at a major dealer group as Practice and Recruitment Manager. Prior to this, she worked as a Certified Financial Planner and is a member of CPA Australia. She’s responsible for providing support on our products and services to our external advisers and licensees throughout Victoria and Western Australia.

Claire Phillips

Claire Phillips

Adviser Partnerships Manager (NSW)Phone: 0424 970 353

Email: cphillips@australiansuper.comClaire joined AustralianSuper in February 2020 and is the key contact for external advisers and licensees in the NSW North Shore, Far North Coast, Central Coast and Newcastle regions, providing support on our products and services.

Claire has worked in financial services for 15 years in Australia and overseas and spent the past nine years working with financial planners. Prior to joining the Fund, Claire held previous Business Development roles at a number of Australia’s largest financial institutions. Ile Petroski

Ile Petroski

Adviser Partnerships Manager (NSW & ACT)Phone: 0416 278 746

Email: IPetroski@australiansuper.comIle joined AustralianSuper in 2018 and is a contact for external advisers and licensees, providing support on our products and services. He is the key contact within the Sydney CBD and metropolitan areas including East, West and South Sydney regions, as well as Central West, Southern Highlands, Riverina and ACT. He was previously at Vanguard Investments working in their Adviser Distribution team, and prior to that, at Colonial First State working across a number of adviser facing roles.

Ben Thompson

Ben Thompson

Adviser Partnerships Manager (QLD)Phone: 0439 021 385

Email: bthompson@australiansuper.comBen has over 21 years of experience in the financial services sector, working across banking, financial advice and superannuation. He has been with AustralianSuper since 2016 working initially as a comprehensive financial planner, then Education Manager and now in his current role as an Adviser Partnerships Manager.

Peter Bekavac

Peter Bekavac

Adviser Partnerships Manager (VIC, SA & TAS)Phone: 0417 573 112

Email: pbekavac@australiansuper.comPeter has over 20 years’ experience in financial services. He has been with AustralianSuper since 2011 and was a foundation member of the Fund’s external advice channel. Prior to joining AustralianSuper he worked for one of Australia’s largest superannuation administrators, Link Group. With his broad skill set, Peter’s focus is to provide quality training and support on AustralianSuper’s products and services to advisers and support staff.