Are you eligible to claim a tax deduction

You can claim a tax deduction for your personal contributions if:

- You haven't opened an account-based pension using part or all of the contributions for which you intend to claim a tax deduction,

- You’re a member of AustralianSuper and your contributions are still in your super account,

- You haven’t lodged an application to split the contribution for which you intend to claim a deduction (this must be done after you give us your notice of intent to claim a deduction),

- The contributions have not been released under the First Home Super Saver (FHSS) scheme, and

- You meet the work test or work test exemption if you’re aged between 67 and 75 years2.

Potential benefits of claiming a tax deduction

Reduce your taxable income

Boost your retirement savings

How much you can claim

How to claim your tax deduction

-

1. Make a contribution

Start by logging into your account online and making an after-tax voluntary contribution1. You can make contributions using BPAY® or direct debit. If using BPAY, ensure your payment is made at least 10 business days before the end of the financial year.

® Registered to BPAY Pty Ltd ABN 69 079 137 518

-

2. Notify us of your intent and submit your claim online

Log into your account and go to Online forms. If you don’t have online access set up, register now.

Under 'Start an online form', select 'Claim a tax deduction' and complete the form. When you submit your form, you'll receive a confirmation that we've processed your request and notified the ATO. In some instances, requests may take up to 5 business days to process, including where you vary an existing claim.

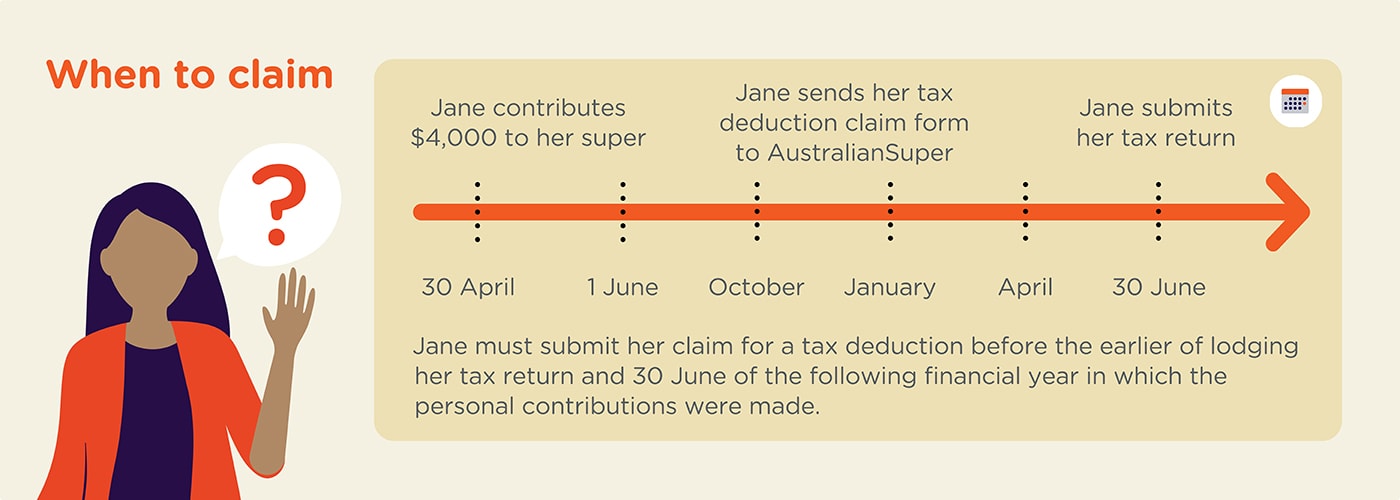

You’ll need to do this before you lodge your tax return or by 30 June of the following year, whichever comes first.

-

3. Add to your tax return

After receiving confirmation, submit your tax return. You'll need to state the amount you want to claim as a tax deduction in the supplementary section of your tax return. -

If you’re unable to claim online

Our online form is easy, quick, and secure. If you're unable to claim your tax deduction online, download the Notice of intent to claim a tax deduction for personal super contributions form. Complete the form and upload it online to send it back to us. Please allow up to 5 business days for processing.

Important considerations

Certain contributions cannot be claimed as tax deductions:

- concessional contributions like salary sacrifice,

- First Home Super Saver scheme contributions,

- COVID-19 withdrawals that you’ve recontributed,

- downsizer contributions,

- spouse contributions, and

- rolled over super benefit amounts.

If you’re claiming a deduction for an after-tax super contribution, the contribution will count towards your concessional contributions cap ($30,000 per year).

Note that you may be eligible to contribute more if you have unused concessional contributions from previous financial years.

For more information on eligibility criteria for contributions that can be claimed as tax deductions and the latest tax rates, visit ato.gov.au

-

Disclaimers

- Before adding to your super, consider your financial circumstances, eligibility, contribution caps that may apply, tax issues and when your super can be accessed. We recommend you consider seeking financial advice.

- If you’re 75 or older, you can’t claim a deduction for personal contributions you made more than 28 days after the month you turned 75.