Climate change will impact economies, industries, societies and the environment. As such, climate change presents risks and opportunities for the investments in our portfolio.

AustralianSuper has made a commitment to achieve net zero carbon emissions by 2050 in the investment portfolio (based on scope 1 and scope 2 emissions of portfolio investments).

The Intergovernmental Panel on Climate Change (IPCC) proposed that achieving net zero emissions by 2050 would be required to limit the average global temperature increase to 1.5 degrees by 2100 (which aligns with the more ambitious Paris Agreement temperature limit)1. Scenario modelling undertaken by the global central banks indicates that a net zero by 2050 scenario results in the lowest economic cost outcome in the long term2. This is consistent with our objective of helping members achieve their best financial position in retirement.

Governments, investors and companies around the world are working towards a net zero economic transition by 2050. More than 120 countries, including Australia, have now committed or proposed to achieve net zero emissions by 20503. The Australian Government has also set a 2035 climate change target at a range of 62% to 70% reduction on 2005 emissions4.About our net zero 2050 commitment

We focus our integration and stewardship activities on the measurement and management of scope 1 and scope 2 emissions of the investments in the portfolio. From an economy wide perspective, we expect that scope 3 emissions will reduce as scope 1 and scope 2 emissions are managed to net zero across the economy. We may engage with investments on their scope 3 emissions where:

- they have relevance to the expected risk and/or returns to the investment. This is based on the level of transition risk scope 3 emissions present to the company, and

- the company has the ability to influence scope 3 emissions.

Our ability to achieve the net zero commitment is dependent on policymakers and portfolio companies making and delivering on their own net zero commitments. Given the scale of policy, economic and societal change required, and given the inherent challenges associated with long-term forecasts, there is some unavoidable uncertainty as to whether the commitments of policymakers and portfolio companies will be met in a timely manner.

Monitoring our progress to net zero 2050

We monitor progress towards our net zero commitment through our internal carbon tracking activities. Our analysis at 30 June 2024 measures the current and estimated 2050 emissions (scope 1 and scope 2) of approximately 70% of our investment portfolio, including investments in the Australian shares, international shares, property, and infrastructure asset classes based on their commitments at the time of analysis5. We have commenced measuring emissions for our private equity investments, although coverage is currently low. This analysis seeks to identify the largest contributors to emissions in these asset classes and helps to inform our stewardship approach described below.

As an example, we have included insights from this analysis for our internally managed fundamental portfolios in the Australian shares asset class below. (These portfolios represented around 94% of the Australian shares asset class, with that asset class representing around 24% of the total portfolio as at 30 June 2024.)

The analysis6 found that:

- Investee companies responsible for almost 87% of emissions in these portfolios have made net zero by 2050 commitments.

- Emissions are concentrated in a small number of companies. Five companies in these portfolios are responsible for almost 75% of current emissions in those portfolios.

- The carbon intensity of these portfolios is estimated to reduce from their current 79.5 tonnes of CO2e emissions per million AUD invested in 2024 to 8.5 tonnes of CO2e emissions per million AUD invested in 2050, based on the emissions reduction commitments made by investee companies.

Our internally managed fundamental portfolios in the Australian shares asset class are actively managed by our in-house investment team. Our team uses research and insights, and applies their expertise and judgment to assess the quality and value of individual companies on a range of factors. These can include company financial information, management quality, market and industry outlooks and ESG considerations.

We focus our direct stewardship efforts on the major contributors to emissions within these portfolios. We are asking that they develop credible plans to achieve their net zero goals.

We also engage collectively with other investors through industry groups and investor networks such as the Australian Council of Superannuation Investors (ACSI) and Climate Action 100+.

Our climate change actions

We invest in Australian and international markets and have investments that touch many areas of the global economy. Our approach to managing climate change risks and opportunities and the net zero transition in the portfolio includes the way we invest and our actions as owners, as described below.

Through our ESG and Stewardship program we:

- Integrate climate change considerations into our investment process for certain asset classes and investments. Our approach is more developed in the Australian shares, international shares, infrastructure and property asset classes. Our approach also varies by the characteristics of our investment, including whether we’re investing directly or through external managers or whether our investment is actively or passively held.

- Engage with the larger contributors to emissions in our internally managed fundamental portfolios in the Australian shares asset class to understand their:

- Alignment to the Paris Agreement, net zero 2050 plans and progress on emissions reductions.

- Governance and management of climate change risks and opportunities.

- Climate change disclosures, such as the Taskforce on Climate-related Financial Disclosure frameworks (TCFD).

- Are a founding member of Climate Action 100+, an investor engagement initiative on climate change seeking emissions reductions from the world's largest carbon emitters.

- Engage collectively with other investors through industry groups and investor networks such as the Australian Council of Superannuation Investors (ACSI) and Climate Action 100+.

- Vote on climate change-related resolutions, supporting those we believe will create or enhance investment value and/or will result in improved disclosures on climate change.

Our carbon footprint over time

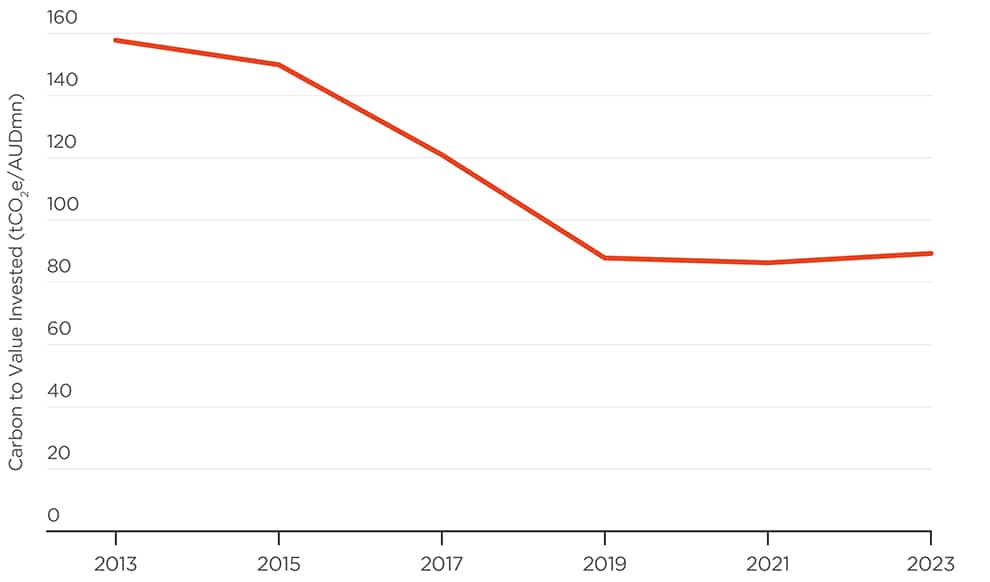

In addition to our internal carbon tracking analysis, we use external carbon footprinting to measure and report our historical emissions. We have been measuring the carbon intensity of the Australian shares and international shares asset classes portfolios using an external carbon consultancy since 2013.

This analysis6 tracks the GHG emissions in the Australian shares and international shares asset classes based on the value (AUD million) invested on a market capitalisation basis, and includes scope 1, scope 2 and non-electricity first tier supply chain emissions. The analysis covers approximately 49% of our total portfolio as at 30 June 2023.

The graph below shows the historical carbon emissions in the Australian shares and international shares asset classes as calculated by an external data provider. It shows that the carbon intensity in these asset classes reduced by 43% between 2013-20237.

The change in carbon intensity can be impacted by a range of factors including changes in portfolio structure and holdings, share prices, and exchange rates. It therefore does not necessarily provide an indication of actual emissions reductions in investee companies, or actions that we are taking to reduce emissions in the portfolio.

AustralianSuper portfolio carbon footprint

GHG emissions in the Australian and international shares asset classes

Emissions data on this page is based on company reported or estimated emissions, as sourced from our research provider/s and/or publicly available information from investee companies. AustralianSuper has not taken steps to independently verify this information (or their underlying assumptions) and we acknowledge that the data can vary and be impacted by changes in methodologies and other factors over time. We believe the development of consistent Australian climate reporting standards will assist in the improvement and reliability of data.

- IPCC, 2018: Summary for Policymakers. In: Global Warming of 1.5°C, an IPCC special report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. www.ipcc.ch/sr15

- Network for Greening Financial System: NGFS Scenarios for central banks and supervisors, September 2022. Scenarios show the transition and physical risk impacts on GDP deviation at 2050 and 2100. https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_for_central_banks_and_supervisors_.pdf.pdf

- Net Zero Tracker, zerotracker.net (sourced 26 June 2025). Includes countries which have net zero, climate neutral, carbon/net negative targets which are proposed/in discussion, in policy documents, in law, declared/pledged or achieved (self-declared) on or before 2050.

- Joint media release: Setting Australia's 2035 climate change target | Ministers

- Asset classes AustralianSuper has measured as at 30 June 2024. Coverage rates for each asset class vary subject to data availability and investment characteristics. Asset classes we have not measured at this date include credit, fixed interest and cash.

- This data is based on holdings as at 30 June 2024. AustralianSuper has calculated the portfolio emissions based on the proportion that we own of the market capitalisation of each company and their reported or estimated scope 1 and 2 emissions for 2024 or 2023 based on data available, from our research provider or in select cases from company disclosures. Emissions data covers approximately 96% of the value of our internally managed fundamental portfolios in the Australian shares asset class. The projected future carbon intensity of the portfolio represents our estimation of what 2050 portfolio emissions would be if investee companies met their emissions reduction commitments as reported in publicly available information. This modelling assumes all commitments will be met and does not assess the likelihood of these commitments being achieved. Modelling does not consider changes in portfolio holdings or value between 2024 and 2050. By its nature, the underlying data is uncertain and may be subject to revision.

- This is the latest available data at the time of publication. This analysis covers approximately 97% of the value of holdings in the Australian shares and International shares asset classes as at 30 June 2023.

- Source: S&P Global Sustainable1 Analysis, Portfolio data for Australian shares and International shares asset classes at 30 June 2013, 30 September 2015, 2017, 2019, 2021 and 30 June 2023. Carbon to value invested: CO2e emissions per AUD million invested. Includes scope 1, 2 and non-electricity first tier supply chain emissions.