9 December 2025

One of the primary objectives of investing is to gain a return on the investment. There are many ways to measure returns and compare performance. This article explains the different types of returns used by the super industry, regulators and AustralianSuper, and how you can use them to make informed investment choices.

Different types of returns

Your investment return is the amount that an investment earns over time. When looking at the performance of your super, knowing the different types of returns helps you to compare returns to a benchmark or to compare investment options.

A key difference between common return measurements is the treatment of fees and costs. Fees and costs are very important to understand when it comes to investing as they can reduce your return, as shown in the scenarios below.

Gross Investment Return

Gross Investment Return on an investment is the starting point. This is the return of an investment before investment fees and costs, administration fees and taxes are deducted.

Net Investment Return

This is the performance of the investment after investment fees and costs, transaction costs and taxes are deducted, but does not take into account administration fees.

Net Return

The Net Return, also known as Net Benefit, is the return after investment fees and costs, transaction costs, administration fees and taxes. This return can be used to compare investment options to peer funds after adjusting for all fees and costs. This method translates fixed administration fees into percentages for easier comparison across super funds based on a comparative account balance. For example, the $1.00 per week administration fee plus the 0.10% asset-based fee would equate to 0.20% of a $50,000 account balance. If your account balance doubled to $100,000, the same administration fee would equate to 0.15%, as it factors in your higher account balance.

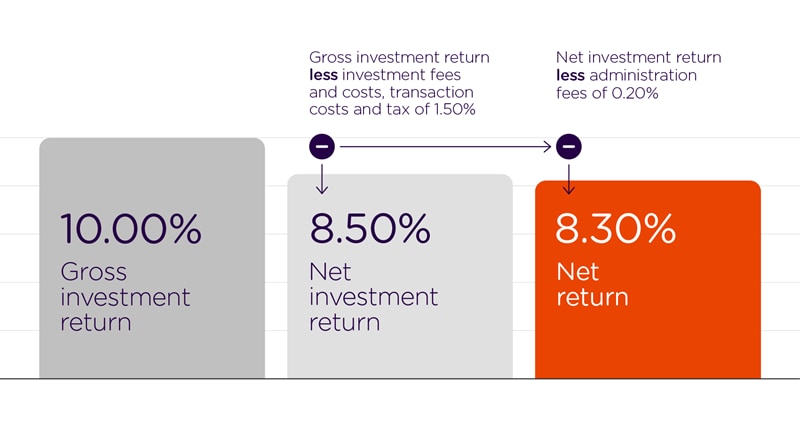

Consider the example below with the following assumptions:

- If a $50,000 super account had a 10% Gross Investment Return over one year,

- the Net Investment Return would be 8.50% after 1.50% of investment fees and costs, transaction costs and tax2,

- the Net Return would be 8.30% after administration fees of 0.20% were deducted3.

In dollar terms, this 8.30% return would result in an increase in the balance of a member’s $50,000 account to $54,150 at the end of the year.

Type of return - hypothetical example

2 Tax can vary each year based on the income and capital gains earned in an investment option.

3 From 1 April 2020 to 2 September 2022, the crediting rate for super (accumulation) options deducted a percentage-based administration fee of up to 0.04% per annum.

Comparing the performance of different investment options

To compare investment options, looking at returns after all fees (Net Return or Net Benefit), provides an equal comparison. To see how an investment option has performed, a look at the net returns over 3, 5 or 10 years highlights the investment management ability and the impact of fees over time.

Read more: Net benefit and your super

View the historical investment performance of our superannuation and account based pension investment options using the link below.

Read more: Investment Performance

How performance changes the balance of your account

Performance figures that are published for the investment options show the return for a period of time. These returns are compounded, which means the return is applied to your estimated balance each day. These returns can grow your super balance when investment markets are rising or lower your balance during market declines.

Each transaction in your account can also influence your return. Contributions, taxes, insurance payments, fees, switches or withdrawals adjust the balance of your account and your return.

Comparing performance to benchmarks

To see how your investment option is delivering returns for you over time, it’s important to compare performance to a benchmark. Similar to types of return measurement, there are different types of benchmarks to help you compare. These include peer, goal-based and market-based benchmarks. As part of the investment objectives for an investment option, a time horizon for benchmark comparison is also included. This could be over a short, medium or long-term period or a specific number of years.

Peer benchmarks look at the return of an investment compared to the return provided by similar investments. For example, you can compare the Balanced option to similar options from other funds. The peer benchmark for the Balanced option is the median balanced fund in the SuperRatings survey.

Goal-based benchmarks consider the objective of an investor. When saving for retirement, inflation reduces the value of money over time. Exceeding inflation is important to maintain the buying power of your savings. This is why super funds often use CPI benchmarks for their investment options. For example, the goal-based benchmark for the Balanced option is CPI + 4% pa.

Market-based benchmarks are indexes that track a segment of the investment markets. They help you to compare performance against a broad selection of securities where a portfolio manager could invest. These types of benchmarks often match the expected returns and risk profile of an investment option. They can also demonstrate a portfolio manager’s skill in selecting securities that outperform the return of a passive benchmark. For example, the market-based benchmark for the Australian Shares option is the S&P/ASX 200 Index (adjusted for tax).

Regulator assessments

One of the aims of Australia’s regulators is to improve member returns. To achieve this, APRA assesses performance using the Performance Test. AustralianSuper supports mandatory performance assessment. This helps to address poor fund performance in the industry.

The Performance Test was introduced under the Your Future, Your Super legislation, effective from 1 July 2021. The legislation is designed to ensure superannuation works in the best financial interests of members. The assessment compares investment performance relative to a benchmark portfolio, based on the product’s strategic asset allocation.

AustralianSuper's MySuper Balanced option and all the PreMixed options have “Passed” the performance test for the period ending 30 June 2025. For details on this, go to: apra.gov.au/annual-superannuation-performance-test.

Tags:

This may include general financial advice which doesn’t take into account your personal objectives, financial situation or needs. Before making a decision consider if the information is right for you and read the relevant Product Disclosure Statement, available at australiansuper.com/PDS or by calling 1300 300 273. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the TMDs at australiansuper.com/TMD. The Financial Services Guide is available at australiansuper.com/representatives

AustralianSuper Pty Ltd ABN 94 006 457 987, AFSL 233788, Trustee of AustralianSuper ABN 65 714 394 898.