29 July 2025

Negative news headlines make us all feel uneasy and it’s natural to question the impact these events may have on your super. In times of uncertainty, remember, super is a long-term investment. While it can be tempting to switch options, staying invested in a diversified portfolio may often be the best action you can take.

Market uncertainty is sometimes triggered by changes in economic outlook and global events. Significant events can restrict growth, but it’s important to think long term. Market ups and downs are a normal part of investing.

-

Show Transcript

When markets fall and you see your super balance going down, it's natural to want to do something, such as switching to a more conservative investment option like cash.

While it can feel like you're protecting your retirement savings by doing this, you could lock in your losses and miss the opportunity to grow if markets improve.

So it's important you understand the risk of switching when markets are falling and the benefit of staying calm.

I'm a financial planner with over 14 years experience helping people like you protect and grow their super.

Unfortunately, investment markets don't provide a signal of when a downturn will start, how long it may last, or how quickly markets will recover.

This makes it extremely hard to improve your returns by switching options.

As you might recall, the COVID-19 market downturn in 2020 lasted around eight weeks and then rebounded very quickly.

Our data shows that making decisions based on short-term market movements can often leave members worse off financially in the long term.

This scenario demonstrates the difference between staying in a diversified option compared with switching to the Cash option.

Fueled by what they had read in the media about market changes due to COVID-19, this member decided to switch from the Balanced option to the Cash option on the 23rd of March 2020.

Then the member stayed invested in the Cash option as shown on screen.

If this member had stayed invested in the Balanced option, their balance would not only have recovered all the losses during COVID-19, but would have grown even higher.

Instead, switching and staying in the Cash option locked in those losses, leaving them much worse off.

For more on the impact switching can have on your super balance, you can read our article ‘Understanding switching risks’ on the AustralianSuper website.

This also provides scenarios that show the potential impact of switching when you're in retirement.

Let's now take a long-term view that shows the substantial growth in value for members who stayed invested in a diversified portfolio, like the Balanced option through all the market ups and downs.

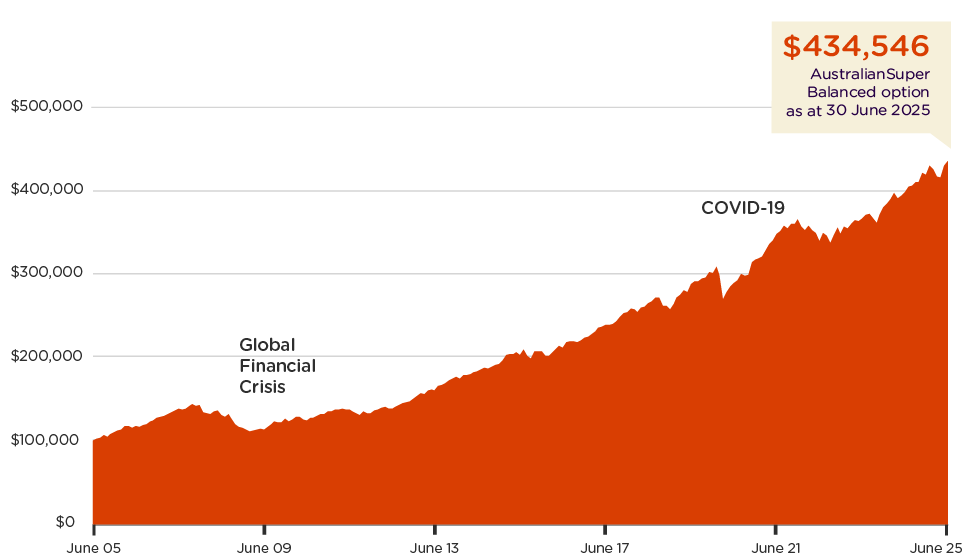

This chart shows the growth of $100,000 over 20 years with no additional contributions.

Despite different market events, including the Global Financial Crisis and the COVID-19 downturn, over the long term, markets have historically recovered and moved higher.

Another way to look at the long-term performance is the annual financial year performance.

This chart shows the annual returns since the inception of the Balanced option.

It demonstrates that even though members have had substantial growth since the inception of the option, there are years where the option lost value.

However, the number of negative years has been limited compared to the number of years where there has been positive performance.

It's normal for share markets to go up and down.

And as you've seen historically markets have recovered after downturns.

Importantly, your Investments team here at AustralianSuper have decades of experience managing your super through all market conditions.

So when markets are falling it's important to stay calm and stick to your long-term investment strategy.

Even in retirement.

If you have trouble doing this, or if you are unsure about which investment options are right for you, consider speaking to a qualified adviser.

As an AustralianSuper member, you have access to a number of advice options, including speaking with someone like me.

We are here to help so you can make the right decisions for your retirement.

For more details on the advice options available to you, visit australiansuper.com/advice.

End Transcript

Changing market conditions

When markets are rising, you may have concerns you are missing out. When markets are falling, you may feel anxious about potential losses. This is understandable and it can be hard to sit tight and not take immediate action.

When markets go down, we often speak to members who are considering switching from a diversified investment option, such as AustralianSuper’s Balanced option, to a cash option. Many members think this is a safer place to be, but you could be locking in investment losses that may be harder to recover from when markets bounce back. A short-term view can have a long-term negative impact on your final retirement balance.

Look past market turbulence

Looking past market turbulence can be challenging. But history shows that markets increase in value over the long term1. By staying invested in a diversified portfolio your super has more opportunity to benefit when markets recover.

Members who stay invested in diversified portfolios can end up in a better position in the long term, compared to those who switch investment options. The below examples highlight this.

Looking past market turbulence can be challenging. But history shows that markets increase in value over the long term1.

History shows that markets bounce back

Despite short-term ups and downs in the market, members' super has grown over the long term. Overall, staying invested has resulted in a good outcome.

AustralianSuper Balanced option (super) – long-term performance over 20 years

The chart below shows the performance of the Fund’s Balanced option over 20 years, to 30 June 2025. It uses a starting balance of $100,000 and shows how – over 20 years – that balance has grown to $434,546.

Investing for the long term

The Balanced option, where most members are invested, has generated a 10-year average annual return of 7.94% and a 20-year average annual return of 7.62% as at 30 June 20251. This performance result includes investing through economic downturns like the Global Financial Crisis and the COVID-19 pandemic, while continuing to provide long-term growth for members.

If a member had invested in AustralianSuper’s Balanced option (Super) over the 20 years to 30 June 2025, they would’ve more than quadrupled their investment1.

Case study: Members who switched investment options

Below are two hypothetical examples that demonstrate the difference between staying invested in a diversified option (the Balanced option), compared to switching to the Cash option. The time period covers the March 2020 market downturn, which was brought about in part due to the start of the COVID-19 pandemic.

In each scenario the member invested in the Balanced option from 31 December 2019.

Claire – switched to the Cash option from the Balanced super option

Claire is 56 and, on 31 December 2019, she had a balance of $350,000 invested in the Balanced option.

On 23 March 2020, Claire decided to switch from the Balanced option to the Cash option. Her concerns about the market sell-off fuelled this change. Claire stayed invested in the Cash option until 30 June 2025.

The chart below shows the growth of Claire’s super in the Cash option, compared to the Balanced option. If Claire stayed invested in the Balanced option, her balance at 30 June 2025 would’ve grown to $505,744. Instead, by switching to the Cash option, she ended up with a balance of $332,403.

Switching and staying in Cash left her $173,341 worse off than if she stayed invested in the Balanced option through this period.

Claire’s super savings in the Cash option compared to the Balanced option

Brent – switched to the Cash option in retirement with an account based pension (Choice Income)

Brent is a retiree aged 67. On 31 December 2019, he had $750,000 invested in the Choice Income Balanced option, AustralianSuper’s account based pension.

An account-based pension lets you access your super as needed. Brent took monthly withdrawals based on an annual amount of 5% of his financial year-end balance. Withdrawal amounts are identical in both scenarios, based on the investment in the Balanced option.

Brent also switched his investment option to Cash on 23 March 2020.

Before he switched, Brent’s account was earning returns from a diversified investment portfolio, the Balanced option. These returns meant he wasn’t dipping too far into his savings. He was living off the returns that were helping to grow his balance.

Investing in the Balanced option actually boosted his balance, despite him withdrawing cash regularly. By 30 June 2025, his balance would’ve grown to a total of $853,798, even after about $212,000 in withdrawals, if he remained invested in the Balanced option.

Brent’s decision to switch to the Cash option in 2020 meant his savings earned a lower return. As a result, his withdrawals reduced his balance to $481,852 on 30 June 2025. The difference between staying in the Balanced option or switching to the Cash option was $371,946.

Brent’s retirement (account-based pension) savings in the Cash option, compared to the Balanced option

These examples illustrate the potential negative impact that switching to cash can have on your retirement balance.

Investing for the long term – AustralianSuper’s investment approach

AustralianSuper has an in-house team of over 400 investment professionals as at 30 June 2025. These experts continually assess economic and investment data to help formulate and adjust the Fund’s investment strategies.

By investing in a mix of assets, the team aims to further reduce risk, maximise investment opportunities and grow members’ retirement savings over the long term.

Before switching investment options

If you’re considering making a change, talk to a financial adviser. They can help you make the right investment choices for your personal goals and risk appetite. A financial adviser can also guide you when investment markets are bumpy, providing reassurance. This could help you stay focused on the long term and ease any worry you may have.

When faced with uncertainty, sticking to a long-term investment plan may be the best course of action.

1Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

This may include general financial advice which doesn’t take into account your personal objectives, financial situation or needs. Before making a decision consider if the information is right for you and read the relevant Product Disclosure Statement, available at australiansuper.com/PDS or by calling 1300 300 273. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the TMDs at australiansuper.com/TMD.

AustralianSuper Pty Ltd ABN 94 006 457 987, AFSL 233788, Trustee of AustralianSuper ABN 65 714 394 898.